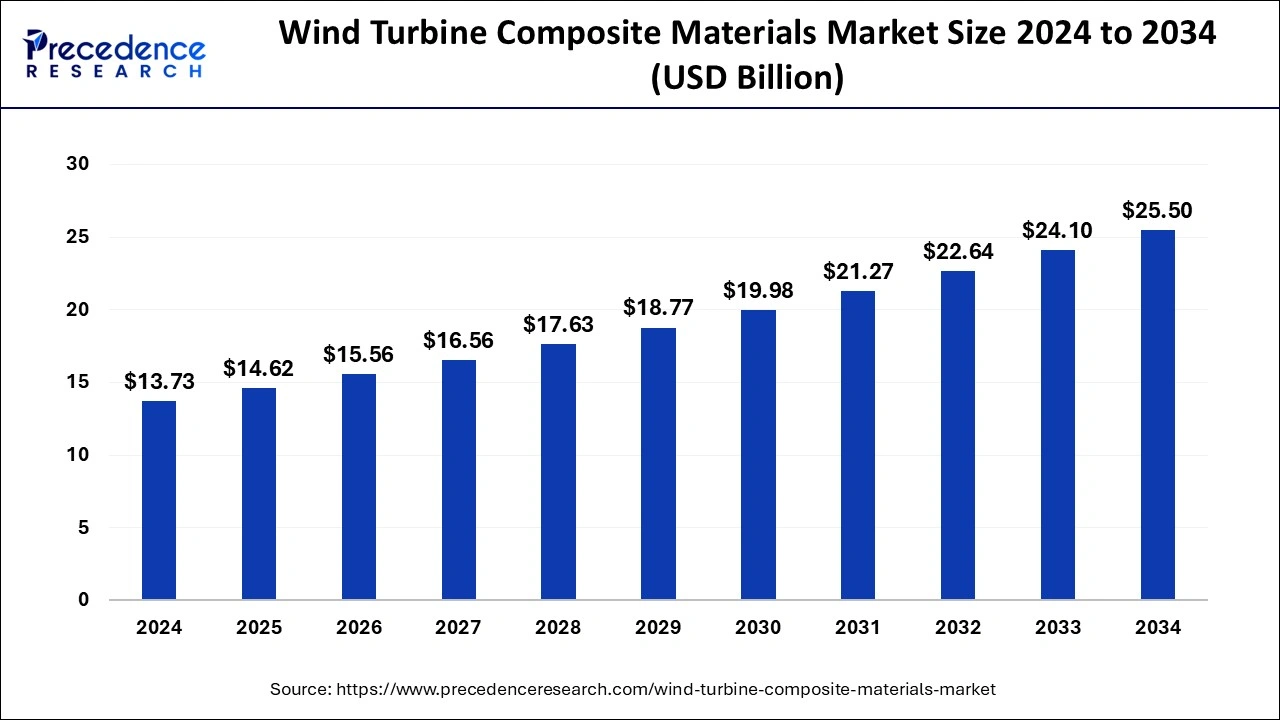

The global wind turbine composite materials market size reached USD 12.90 billion in 2023 and is predicted to cross around USD 24.10 billion by 2033, growing at a CAGR of 6.44% from 2024 to 2033.

Key Takeaways

- Asia Pacific dominated the market in 2023 with the largest share 35%.

- North America is anticipated to grow at a notable growth rate in the wind turbine composite materials market during the forecast period.

- By fiber type, the glass fiber segment held the largest share of around 65% in 2023.

- By fiber type, the carbon fiber segment is expected to grow significantly during the forecast period.

- By technology, the vacuum injection molding segment accounted for the dominating share of 45% in 2023.

- By technology, the prepreg segment is observed to witness a considerable growth rate in the global wind turbine composite materials market over the forecast period.

- By application, the wind blades segment held the dominating share of 75% in 2023.

Wind turbine composite materials play a crucial role in the construction and operation of wind turbines, which are essential for harnessing wind energy and generating electricity. These composite materials are specifically designed to withstand the harsh environmental conditions and mechanical stresses experienced by wind turbine components, such as blades, nacelles, and towers.

One of the primary advantages of using composite materials in wind turbines is their lightweight nature combined with high strength and durability. This enables manufacturers to design longer and more aerodynamically efficient blades, maximizing energy capture and improving overall turbine performance.

Get a Sample: https://www.precedenceresearch.com/sample/4067

The most common composite materials used in wind turbine blades are fiberglass and carbon fiber reinforced polymers (CFRP). Fiberglass composites consist of glass fibers embedded in a polymer matrix, typically epoxy resin, while CFRP composites utilize carbon fibers for enhanced strength and stiffness. These materials offer excellent fatigue resistance, corrosion resistance, and structural integrity, making them well-suited for prolonged exposure to harsh weather conditions and cyclic loading.

Additionally, the manufacturing process for wind turbine composite materials allows for greater design flexibility and scalability compared to traditional materials such as steel or aluminum. Advanced manufacturing techniques, such as vacuum infusion, resin transfer molding, and automated fiber placement, enable precise control over material properties and geometries, resulting in optimized turbine performance and reduced manufacturing costs.

Furthermore, wind turbine composite materials contribute to environmental sustainability by reducing the environmental impact of wind energy production. Compared to conventional materials like steel, composites require less energy and produce fewer greenhouse gas emissions during manufacturing and transportation. Additionally, the lightweight nature of composite materials reduces the structural load on support structures, leading to lower material consumption and decreased environmental footprint over the lifecycle of the turbine.

However, despite their numerous advantages, wind turbine composite materials also face challenges and limitations. One of the primary challenges is the cost of materials and manufacturing processes, which can be higher than traditional materials in some cases. Although advancements in material science and manufacturing technology have led to cost reductions over time, further innovation and economies of scale are needed to make composite materials more cost-competitive with conventional alternatives.

Moreover, the recycling and disposal of wind turbine composite materials present environmental concerns and logistical challenges. Unlike metals, which can be easily recycled, composite materials are more difficult to recycle due to their complex composition and the need to separate fibers from the polymer matrix. Developing efficient recycling methods and establishing end-of-life strategies for decommissioned wind turbine components are critical for minimizing environmental impact and promoting the circular economy.

Recent Developments

- According to a BSE filing, in June 2023, SJVN Green Energy, a subsidiary of SJVN Ltd, secured a 200 MW wind power project through a tariff-based competitive bidding process conducted by the Solar Energy Corporation of India. This project requires an investment of Rs 1,400 crore. SJVN Green Energy will undertake the development of this wind power project anywhere in India through an EPC (engineering procurement construction) contract.

- Amazon now has more than 500 wind and solar projects globally, and once operational, they are expected to generate more than 77,000 gigawatt-hours (GWh) of clean energy each year, or enough to power 7.2 million U.S. homes.

Wind Turbine Composite Materials Market Companies

- TPI Composites Inc.

- Huntsman International LLC

- Teijin Limited

- TPI Composites Inc.

- LM Wind Power

- Suzlon Energy Limited

- Gurmit Holding AG

- LM Wind Power

- Molded Fiber Glass Companies

- Toray Industries, Inc.

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy, S.A.U.

- Hexcel Corporation

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- Others

Segments Covered in the Report:

By Fiber Type

- Glass Fiber

- Carbon Fiber

- Others

By Technology

- Vacuum Injection Molding

- Prepreg

- Hand Lay-Up

- Others

By Application

- Wind blades

- Nacelles

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

0 Comments