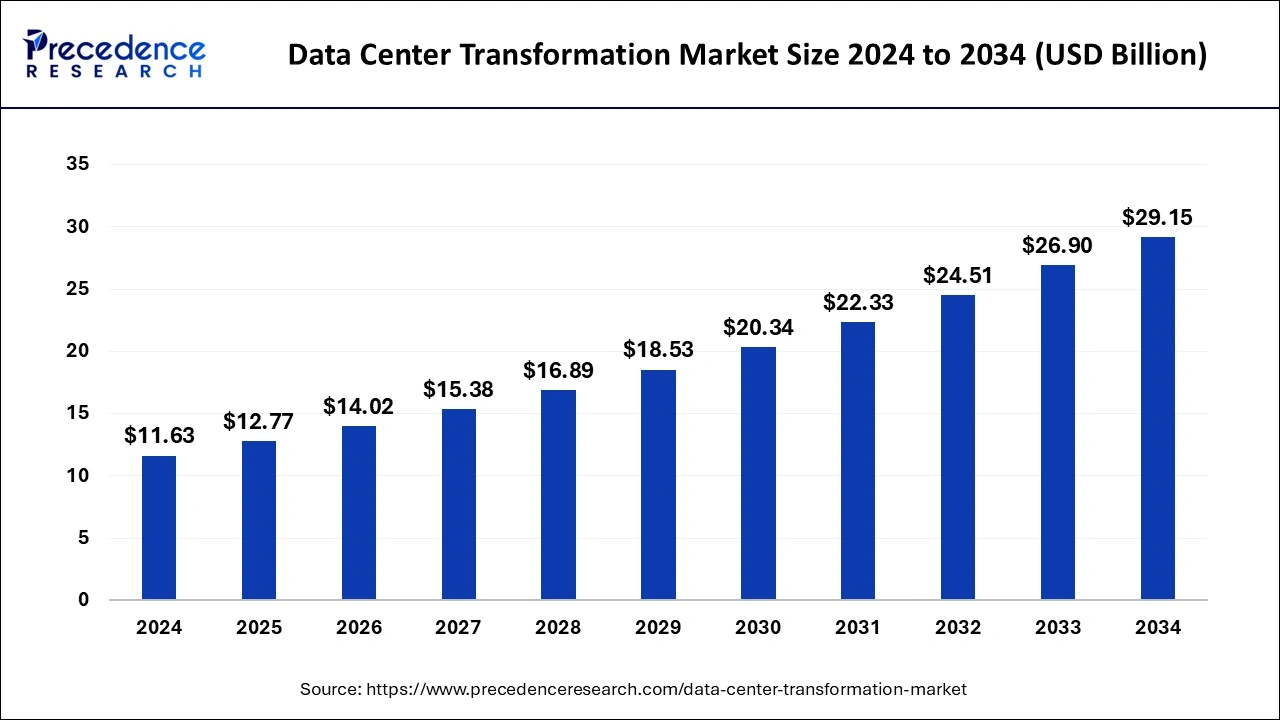

The global data center transformation market size was estimated at USD 10.60 billion in 2023 and is predicted to cross around USD 26.90 billion by 2033, growing at a CAGR of 9.76% from 2024 to 2033.

Key Takeaways

- North America dominated data center transformation market with revenue share of 51% in 2023.

- By service, the consolidation segment has dominated the market in 2023 with revenue share of 36.5%.

- By end-user, the cloud service providers services segment dominated the data center transformation market in 2023 with revenue share of around 48%.

- By vertical, the IT & telecommunications segment dominated the market in 2023.

The Data Center Transformation Market refers to the industry segment focused on modernizing and upgrading data center infrastructure to meet evolving business needs, technological advancements, and regulatory requirements. As organizations increasingly rely on digital operations and data-driven processes, the demand for efficient, scalable, and resilient data center solutions has surged, driving growth in the data center transformation market.

Get a Sample: https://www.precedenceresearch.com/sample/4066

Several factors contribute to the growth of the data center transformation market. Firstly, the exponential growth of data generated by businesses, coupled with the proliferation of digital technologies such as cloud computing, big data analytics, and the Internet of Things (IoT), has necessitated the expansion and optimization of data center infrastructure. Organizations are seeking to enhance data storage, processing, and management capabilities to extract actionable insights, improve decision-making, and gain a competitive edge in the market.

Moreover, the need for improved energy efficiency, sustainability, and environmental responsibility has prompted organizations to invest in data center transformation initiatives. Modern data center solutions incorporate energy-efficient technologies, such as virtualization, consolidation, and advanced cooling systems, to reduce power consumption, minimize carbon footprint, and lower operating costs. Additionally, regulatory mandates and industry standards regarding energy efficiency and environmental impact have incentivized organizations to adopt sustainable data center practices.

Geographically, the data center transformation market exhibits significant variation across regions. Developed economies such as North America and Europe lead the market due to high adoption rates of digital technologies, robust IT infrastructure, and stringent regulatory requirements. In these regions, businesses are increasingly investing in data center modernization to enhance agility, scalability, and security while reducing operational complexities and costs.

In contrast, emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rapid growth in the data center transformation market driven by increasing digitalization, urbanization, and economic development. Rising demand for cloud services, mobile connectivity, and e-commerce platforms has spurred investments in data center infrastructure to support burgeoning digital ecosystems and cater to the needs of expanding populations and industries.

Several drivers propel the growth of the data center transformation market globally. Technological advancements, including the adoption of software-defined networking (SDN), hyper-converged infrastructure (HCI), and edge computing, enable organizations to build agile, scalable, and resilient data center environments capable of meeting evolving business requirements. Additionally, the growing popularity of hybrid and multi-cloud architectures allows organizations to leverage a combination of on-premises, private cloud, and public cloud resources to optimize performance, flexibility, and cost-effectiveness.

Furthermore, the COVID-19 pandemic has accelerated the digital transformation initiatives of businesses worldwide, leading to increased demand for data center infrastructure to support remote work, online collaboration, and digital commerce. The shift towards remote operations, digital services, and cloud-based applications has underscored the importance of robust, secure, and reliable data center solutions in ensuring business continuity and resilience in the face of disruptions.

Despite the opportunities presented by the data center transformation market, several challenges must be addressed to unlock its full potential. These challenges include legacy infrastructure constraints, budgetary limitations, skilled labor shortages, and cybersecurity risks. Organizations must navigate complex migration strategies, legacy system integration issues, and interoperability concerns when modernizing data center environments to minimize disruptions and maximize returns on investment.

Recent Developments

- In January 2024, the first data center of Digital Realty, the leading worldwide provider of colocation, interconnection, cloud, and carrier-neutral data center solutions, has opened its doors in India. Situated in the center of Chennai's industrial and manufacturing district, the 10-acre facility has the capacity to accommodate up to 100 megawatts of essential IT load. As the business grows to fulfill the demands of digital transformation in important international markets, this is a major addition to its global data center platform.

- In April 2023, Microsoft has announced the official launch of its latest trusted cloud region, which is situated in Poland and is its debut in Central and Eastern Europe. The three separate physical locations that make up Microsoft's Polish cloud area are situated in and around Warsaw, and each one has one or more data centers. It promises the greatest levels of privacy, security, and compatible data storage with national regulations.

Data Center Transformation Market Companies

- IBM Corporation

- Cisco Systems, Inc.

- Dell EMC

- HCL Technologies

- Cognizant

- Accenture

- Atos

- Wipro

- Microsoft Corporation

- Schneider Electric SE

Segments Covered in the Report

By Service

- Consolidation Services

- Optimization Services

- Automation Services

- Infrastructure Management Services

By End-user

- Cloud Service Providers

- Colocation Providers

- Enterprises

By Vertical

- BFSI

- IT & Telecommunications

- Government & Defense

- Energy

- Manufacturing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments