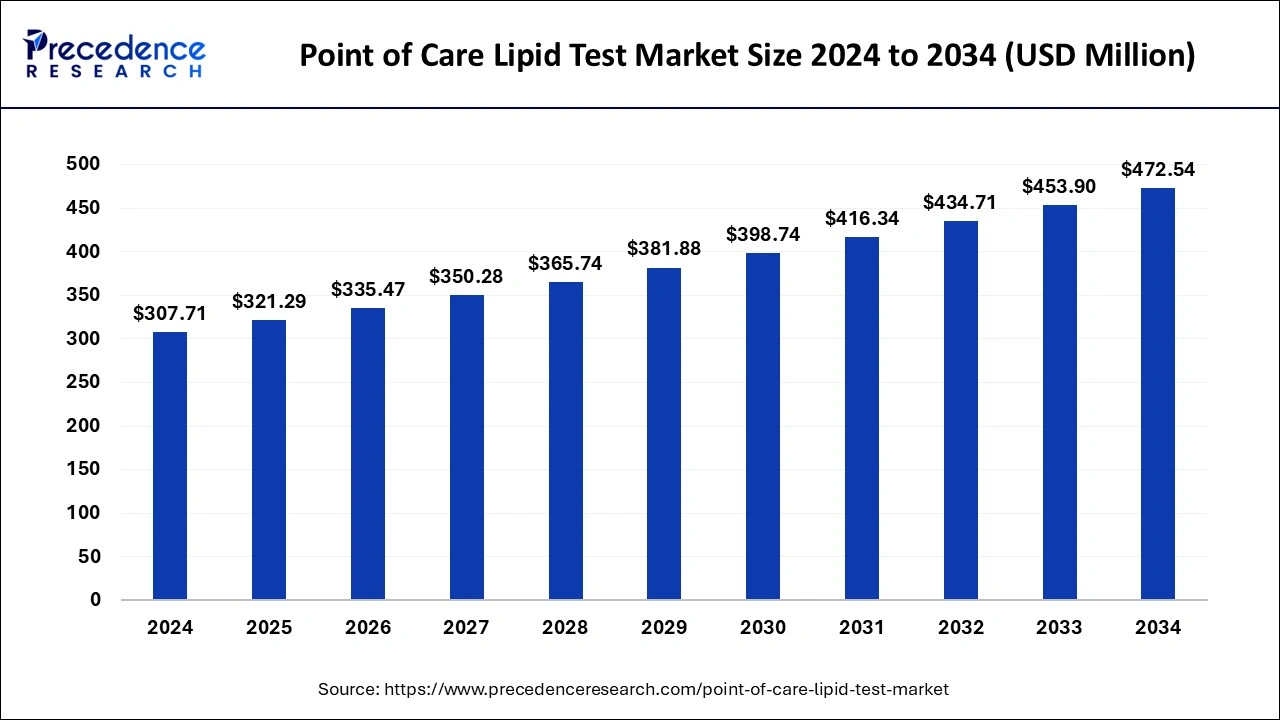

The global point of care lipid test market size reached USD 294.70 million in 2023 and is expected to grow around USD 453.90 million by 2033, growing at a CAGR of 4.41% from 2024 to 2033.

The Point of Care (POC) Lipid Test Market refers to the market for diagnostic tests used to assess lipid levels in patients in various healthcare settings, such as clinics, pharmacies, and other outpatient facilities. These tests are designed to provide quick and convenient assessments of lipid profiles, which include levels of cholesterol (total, LDL, HDL) and triglycerides. The results of these tests help healthcare providers make timely decisions regarding patient care, such as prescribing medication or recommending lifestyle changes to manage lipid levels and reduce the risk of cardiovascular diseases.

Overview: The Point of Care Lipid Test Market is experiencing significant growth due to an increase in cardiovascular diseases, growing health awareness among the population, and the convenience of having tests performed at the point of care. These tests offer rapid results and immediate medical decision-making, reducing the time taken for diagnosis and treatment. The market includes various test types, including handheld devices and strips, which are used for measuring lipid levels.

Growth Factors:

-

Rising Prevalence of Cardiovascular Diseases: Cardiovascular diseases, including heart attacks and strokes, are the leading cause of death worldwide. Regular monitoring of lipid levels is crucial for early detection and management of these conditions.

-

Growing Geriatric Population: An aging population is more susceptible to cardiovascular diseases, leading to increased demand for lipid testing.

-

Technological Advancements: Continuous improvements in POC testing technology have led to more accurate, efficient, and user-friendly tests, encouraging their adoption.

-

Increasing Awareness and Health Consciousness: Growing awareness of the importance of monitoring cholesterol and lipid levels for overall health is driving demand for point of care testing.

Region Insights:

-

North America: This region dominates the market due to a high prevalence of cardiovascular diseases, a large geriatric population, and advanced healthcare infrastructure. The presence of key market players and favorable reimbursement policies also contribute to market growth.

-

Europe: Europe holds a significant share of the market due to increasing health awareness, a rise in chronic diseases, and government initiatives promoting preventive healthcare.

-

Asia Pacific: This region is anticipated to witness the fastest growth due to a large population base, rising disposable incomes, and increasing healthcare expenditure. The growing prevalence of lifestyle diseases also fuels demand for POC lipid tests.

-

Latin America and Middle East & Africa: These regions are expected to experience moderate growth due to improving healthcare infrastructure and increasing awareness of preventive healthcare.

Drivers:

-

Convenience and Accessibility: POC lipid tests offer patients the convenience of undergoing testing close to home, and healthcare providers can quickly make treatment decisions based on the immediate results.

-

Cost-effectiveness: These tests are often more cost-effective than traditional laboratory testing, making them accessible to a larger population.

-

Regulatory Support: Governments and healthcare organizations are encouraging the use of POC tests to improve health outcomes and reduce healthcare costs.

-

Rising Demand for Preventive Healthcare: As people become more health-conscious, there is a growing demand for regular monitoring of cholesterol and lipid levels.

Opportunities:

-

Expansion in Emerging Markets: Emerging markets offer significant opportunities for growth due to rising health awareness and an expanding middle class.

-

Development of New Technologies: Continuous research and development efforts to improve POC lipid testing, such as integrating advanced sensors and digital technologies, provide growth opportunities.

-

Integration with Telemedicine: POC lipid tests can be integrated with telemedicine services, enabling healthcare providers to offer remote consultations and continuous monitoring.

-

Collaborations and Partnerships: Partnerships between POC test manufacturers and healthcare providers can lead to expanded distribution and adoption of these tests.

Challenges:

-

Regulatory Hurdles: Stringent regulations regarding the approval and use of POC tests can slow down market growth.

-

Quality and Accuracy Concerns: Ensuring consistent accuracy and reliability of POC lipid tests across different settings can be challenging.

-

Cost of Equipment and Maintenance: While the tests themselves may be affordable, the initial investment in equipment and ongoing maintenance costs can be barriers to adoption.

-

Competition from Traditional Testing: Although POC tests offer quick results, traditional laboratory tests are often considered the gold standard for accuracy, creating competition for the market.

Recent Developments

- In October 2022 Genes2Me Pvt. Ltd launched Rapi-Q- Point of Care RT PCR solution for human papillomavirus (HPV) and tuberculosis. The device is easy to use and gives faster results in less than 45 minutes. This CE-IVD-marked POC solution delivers superior performance, high sensitivity, and stable detection.

- In March 2022, Visby Medical announced that it received funding of USD 25.5 million from the U.S. Biomedical Advanced Research and Development Authority to develop a rapid flu-COVID-19 PCR test for home use. At present, the test is in the under-developing phase, and the design is ready as a PCR device that can detect COVID-19, influenza A, and B from a single sample.

- In March 2022, Canada-based Company BioLytical Laboratories Inc. received a CE marking for the iStatis COVID-19 Antigen Home Test.

- In May 2022, Qiagen Inc. launched the NeuMoDxHSV 1/2 Quant Assay for the quantification and differentiation of herpes simplex virus type 1 (HSV-1) DNA and herpes simplex virus type 2 (HSV-2) with approval from the European Commission. The emergence of this assay is allowing the company to expand its product portfolio in laboratory testing, which ultimately helps the market grow owing to the innovative tests.

- In March 2022, Mindray launched the BC-700 Series, a hematology analyzer series that assists in both blood count and erythrocyte sedimentation rate tests.

Point of Care Lipid Test Market Com[panies

- Callegari Sinocare Inc.

- Abbott Laboratories

- Mico Bio Med

- Nova Biomedical Corporation

- VivaChek Biotech (Hangzhou) Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Zoetis Inc.

- Menarini Group

- SD Biosensor, Inc.

Segments Covered in the Report

By Product Type

- Devices

- Consumables

By Application

- Endogenous Hyperlipemia

- Combined Hyperlipidemia

- Familial Hypercholesterolemia

- Others

By End-user

- Hospitals And Clinics

- Diagnostic Laboratories

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments