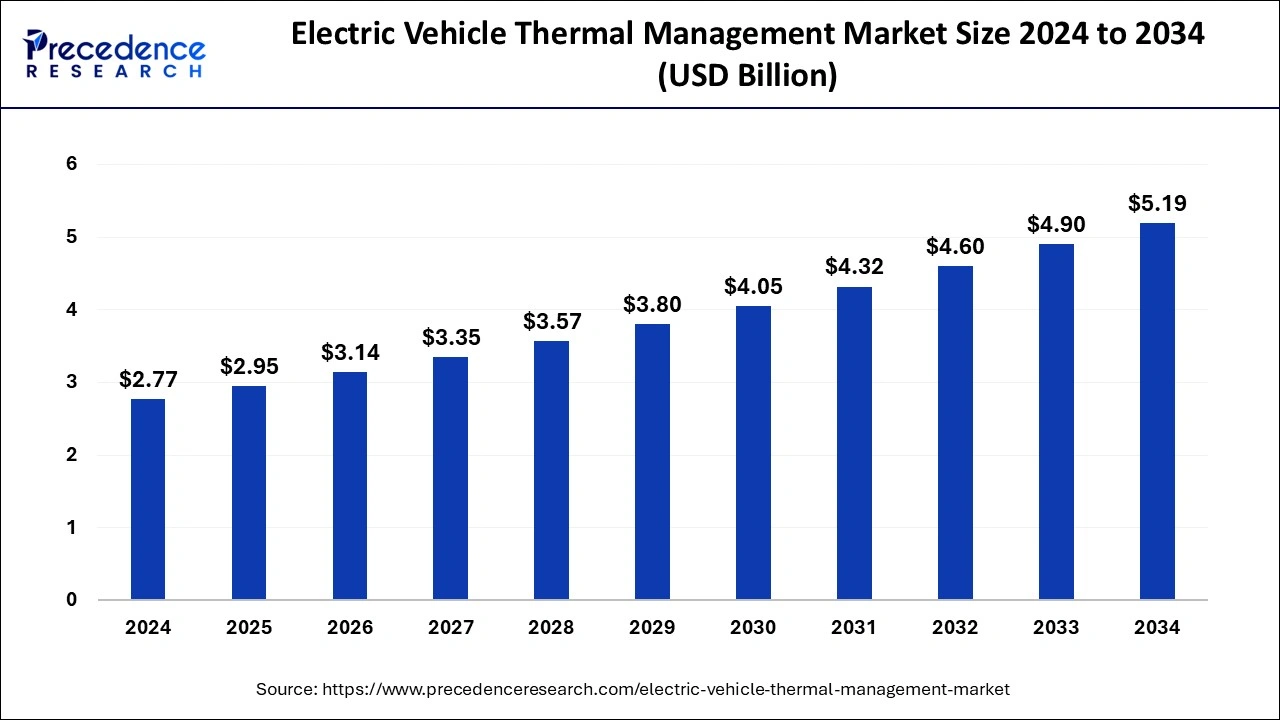

The global electric vehicle thermal management market size accounted for USD 2.60 billion in 2023 and is predicted to cross around USD 4.90 billion by 2033, growing at a CAGR of 6.54% from 2024 to 2033.

Key Takeaways

- North America dominated the global electric vehicle thermal management market in 2023 with market share of 39%.

- Europe is expected to witness notable growth in the market over the forecast period.

- By system, the heating, ventilation, and air conditioning (HVAC) segment dominated the market in 2023.

- By system, the powertrain cooling segment is expected to grow at the highest CAGR in the market during the forecast period.

- By component, the motor segment has accounted market share of 47% in 2023.

- By component, the battery segment is expected to grow at a significant rate during the forecast period.

- By technology, the reduced HVAC system loading segment dominated the market in 2023.

- By technology, the active transmission warmup segment is expected to grow at the highest CAGR in the market during the forecast period.

- By application, the air condition segment dominated the market in 2023.

- By application, the engine cooling segment is expected to grow at the highest CAGR in the market during the forecast period.

- By vehicle type, the hybrid EV (HEV) segment dominated the market in 2023.

- By vehicle type, the plug-in hybrid EV (PHEV) segment is expected to grow at the highest CAGR in the market during the forecast period.

The electric vehicle (EV) thermal management market plays a crucial role in ensuring the efficient operation and longevity of electric vehicles. Thermal management systems regulate the temperature of critical components such as batteries, motors, and power electronics, optimizing performance, enhancing safety, and extending battery life. As the adoption of electric vehicles continues to rise globally, driven by factors such as environmental concerns, government incentives, and technological advancements, the demand for effective thermal management solutions is expected to grow significantly.

Get a Sample: https://www.precedenceresearch.com/sample/4069

Growth Factors:

Several factors are driving the growth of the electric vehicle thermal management market. Firstly, the increasing focus on reducing greenhouse gas emissions and combating climate change has led to a growing preference for electric vehicles over traditional internal combustion engine vehicles. This shift towards electrification has created a substantial market opportunity for thermal management solutions that improve the efficiency and reliability of electric vehicle systems.

Additionally, advancements in battery technology have resulted in the development of high-performance lithium-ion batteries with greater energy density and faster charging capabilities. However, these batteries are sensitive to temperature fluctuations and require effective thermal management to maintain optimal operating conditions. Consequently, the demand for thermal management systems capable of efficiently cooling or heating battery packs has surged, driving market growth.

Furthermore, stringent government regulations and emission standards aimed at promoting the adoption of electric vehicles have incentivized automakers to invest in thermal management technologies. Compliance with regulatory requirements necessitates the implementation of efficient thermal management solutions to ensure vehicle performance, safety, and reliability, thereby stimulating market demand.

Region Insights:

The electric vehicle thermal management market exhibits regional variations influenced by factors such as market maturity, government policies, infrastructure development, and consumer preferences.

In North America, the United States and Canada are at the forefront of electric vehicle adoption, driven by environmental regulations, consumer awareness, and government incentives. The region boasts a robust automotive industry and a well-established ecosystem of technology providers, fostering innovation and investment in thermal management solutions for electric vehicles.

In Europe, countries like Germany, Norway, and the Netherlands are leading the transition towards electric mobility through ambitious targets for vehicle electrification and renewable energy adoption. The European Union's regulatory framework, including CO2 emission standards and electric vehicle mandates, has spurred investment in thermal management technologies to support the growing fleet of electric vehicles.

In Asia-Pacific, China has emerged as the largest market for electric vehicles, supported by government subsidies, infrastructure development, and industrial policies promoting electric mobility. The region's rapid urbanization, expanding middle class, and growing environmental concerns have fueled demand for electric vehicles and associated thermal management solutions, driving market growth.

Electric Vehicle Thermal Management Market Dynamics

Drivers:

Several drivers are propelling the growth of the electric vehicle thermal management market. Firstly, the increasing adoption of electric vehicles worldwide, fueled by environmental consciousness, government incentives, and technological advancements, is a primary driver of market growth. Electric vehicles require sophisticated thermal management systems to ensure the efficient operation and longevity of critical components such as batteries, motors, and power electronics.

Additionally, advancements in battery technology, including higher energy density and faster charging capabilities, have expanded the application of electric vehicles in various segments such as passenger cars, commercial vehicles, and two-wheelers. However, these advancements have also heightened the importance of effective thermal management to mitigate heat generation and maintain battery performance and safety.

Furthermore, the growing emphasis on vehicle electrification and the transition towards sustainable transportation solutions have prompted automakers to invest in thermal management technologies. Compliance with regulatory requirements for emissions reduction and vehicle efficiency necessitates the integration of advanced thermal management systems to enhance the performance, range, and reliability of electric vehicles.

Opportunities:

The electric vehicle thermal management market presents significant opportunities for technology providers, automotive manufacturers, and suppliers to innovate and capitalize on the growing demand for thermal management solutions. One of the key opportunities lies in developing integrated thermal management systems that offer comprehensive cooling, heating, and temperature control functionalities for electric vehicle components.

Moreover, advancements in materials science and thermal engineering present opportunities to enhance the efficiency and performance of thermal management systems. Innovations such as phase change materials, thermal interface materials, and advanced cooling technologies can optimize heat dissipation, reduce energy consumption, and improve the reliability of electric vehicle systems.

Furthermore, partnerships and collaborations between automotive OEMs, technology providers, and research institutions can accelerate the development and commercialization of next-generation thermal management solutions. Collaborative efforts to address common challenges such as thermal runaway, battery degradation, and thermal stress can drive innovation and differentiation in the market.

Challenges:

Despite the opportunities presented by the growing demand for electric vehicle thermal management solutions, the market faces several challenges that must be addressed to realize its full potential. One of the primary challenges is the complexity and integration of thermal management systems within electric vehicles. Designing and implementing effective thermal management solutions that meet performance requirements while minimizing cost, weight, and space constraints pose significant engineering challenges for automotive manufacturers and suppliers.

Moreover, the rapid pace of technological innovation and the evolving regulatory landscape require continuous investment in research and development to stay competitive in the market. Keeping pace with advancements in battery technology, vehicle electrification trends, and regulatory requirements necessitates agility, flexibility, and collaboration across the value chain.

Furthermore, cost considerations remain a barrier to the widespread adoption of electric vehicle thermal management systems, particularly in price-sensitive market segments such as entry-level passenger cars and commercial vehicles. Balancing the performance, reliability, and affordability of thermal management solutions is essential to drive market penetration and achieve economies of scale.

Recent Developments

- In March 2024, Ford Motor Company launched an exploration of EVs with a wider range of varieties and refinements. The battery delivers up to 374 miles (600 km) range, topping the 311 miles Ford initially expected. Ford’s single-motor extended range explorer starts at £45,875 ($58,000) with a 77 kWh battery. The dual-motor version is equipped with VW’s 335 hp powertrain for its sporty GTX EVs.

- In February 2024, Nouveau Monde Graphite Inc. announced a parallel offtake agreement with Panasonic Energy, which, combined with GM’s Supply Agreement, covers approximately 85% of NMG’s planned active anode material production at its Phase-2 Bécancour Battery Material Plant.

- In January 2024, Melexis in Belgium launched its first MEMS pressure sensor using a new patented architecture called Triphibian. The triphibian MEMS pressure sensor, developed by Melexis, handles gas and liquid media measurements from 2 to 70 bar in a 16-pin SO16 package.

- In September 2023, Marelli launched new smart actuators for transmission and thermal management in EVs. These actuators are designed to simplify the actuation of complex vehicle functions. As future cars are expected to have over 100 actuators with different missions and purposes, this solution will help carmakers reduce complexity and ease the integration of vehicles’ mechanic and electronic environments.

- In September 2023, Informa Markets announced The Battery Show India, which was scheduled from 4th October to 6th October 2023. The Battery Show India was estimated to attract over 200 brands, 8000 trade visitors, and 50 speakers, including an impressive array of policymakers, decision-makers, influencers, technical experts, and professionals.

Electric Vehicle Thermal Management Market Companies

- Denso Corporation

- Valeo

- Dana Limited

- BorgWarner Inc.

- MAHLE GmbH

- Gentherm

- Informa Markets

- Robert Bosch GmbH

- LG Chem

- VOSS Automotive GmbH

- Modine Manufacturing Company

Segment Covered in Reports

By System

- Heating, Ventilation, and Air Conditioning (HVAC)

- Powertrain Cooling

- Fluid Transport

- Others

By Component

- Motor

- Battery

- Cabin Area

By Technology

- Active Transmission Warm-up

- Exhaust Gas Recirculation (EGR)

- Reduced HVAC System Loading

- Others

By Application

- Engine Cooling

- Air Condition

- Heated Steering

- Waste Geat Recovery

- Transmission System

- Heated/Ventilated Seats

- Others

By Vehicle Type

- Battery EV

- Hybrid EV (HEV)

- Plug-in Hybrid EV (PHEV)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments