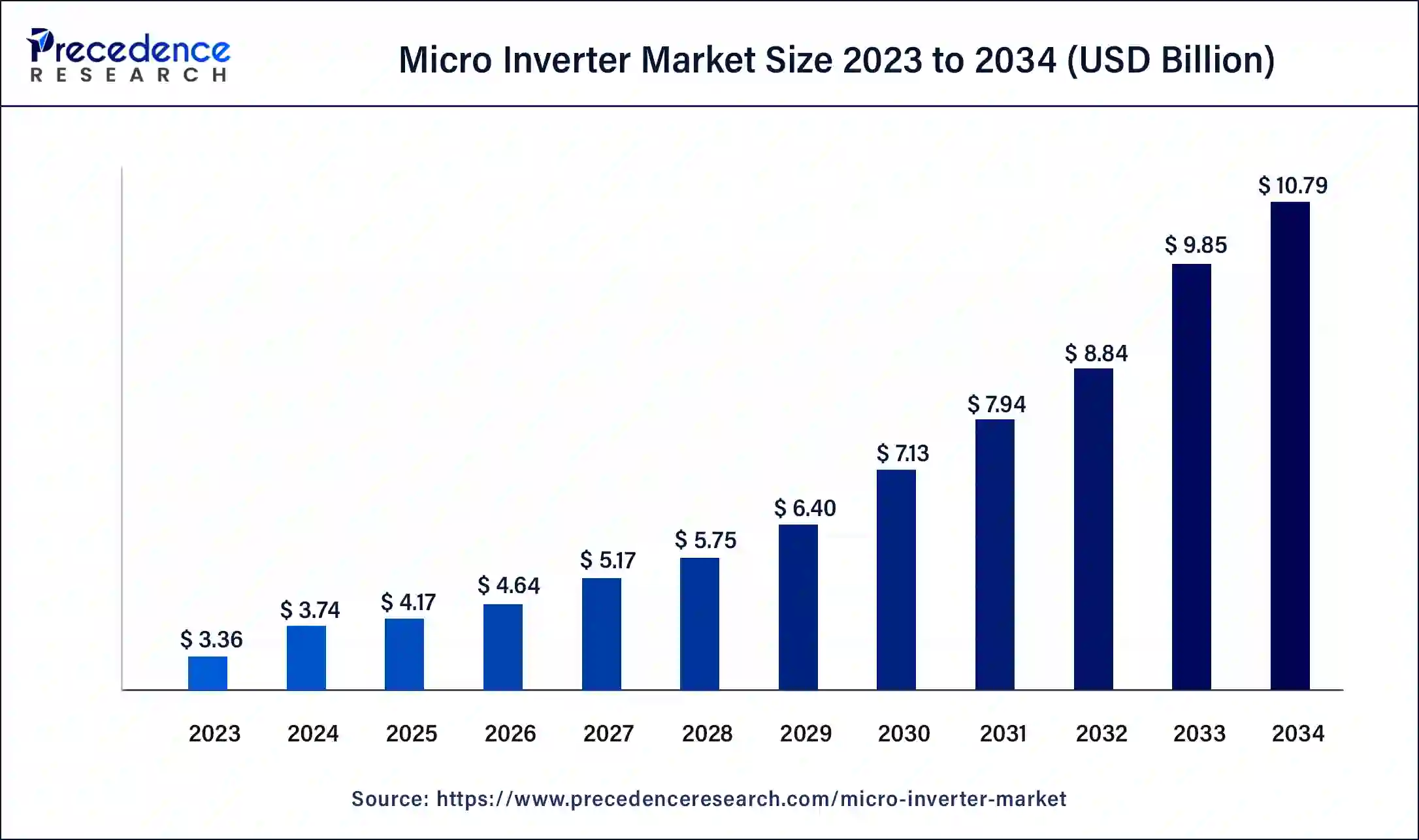

The global micro inverter market size reached USD 3.36 billion in 2023 and is anticipated to grow around USD 9.85 billion by 2033, growing at a CAGR of 11.35% from 2024 to 2033.

Key Takeaways

- North America dominated micro inverter market in 2023.

- By phase, the single-phase segment holds the largest market share in 2023.

- By connectivity, the on-grid segment dominated the market in 2023.

- By application, the residential segment dominated the micro inverter market in 2023.

The micro inverter market is witnessing significant growth driven by advancements in renewable energy technologies and the increasing adoption of solar photovoltaic (PV) systems worldwide. Micro inverters play a crucial role in solar energy systems by converting direct current (DC) generated by solar panels into alternating current (AC) suitable for household or commercial use. Unlike traditional string inverters, micro inverters are installed directly on each solar panel, offering benefits such as enhanced energy production, improved reliability, and monitoring capabilities at the individual panel level.

Get a Sample: https://www.precedenceresearch.com/sample/4026

Growth Factors:

Several factors contribute to the growth of the micro inverter market. Firstly, the rising demand for clean and sustainable energy solutions, coupled with government initiatives and incentives to promote renewable energy adoption, drives the deployment of solar PV systems. Micro inverters enable higher energy yields by mitigating the effects of shading, soiling, and panel mismatch, thus increasing the overall efficiency of solar installations. Additionally, technological advancements, such as improved power electronics and communication systems, enhance the performance and reliability of micro inverters, further fueling market growth.

Region Insights:

The micro inverter market exhibits substantial regional variation in terms of adoption and growth opportunities. North America, particularly the United States, holds a dominant position in the market, driven by the increasing installation of residential and commercial solar PV systems. Europe follows closely, with countries like Germany, the United Kingdom, and the Netherlands leading the adoption of micro inverter technology. The Asia-Pacific region is also experiencing significant growth, propelled by the expanding solar energy market in countries like China, India, and Australia.

Micro Inverter Market Dynamics

Drivers:

Several drivers contribute to the expansion of the micro inverter market. The declining cost of solar panels and associated components, coupled with favorable government policies promoting renewable energy deployment, stimulate the adoption of micro inverters. Moreover, the growing awareness of environmental issues and the need to reduce carbon emissions drive individuals and businesses to invest in solar energy solutions. Technological advancements leading to higher efficiency and reliability of micro inverters further accelerate market growth.

Opportunities:

The micro inverter market presents numerous opportunities for manufacturers, suppliers, and service providers. Expansion into emerging markets with favorable regulatory frameworks and increasing investments in renewable energy infrastructure can unlock new growth prospects. Additionally, innovations in micro inverter design, such as integrated energy storage solutions and smart grid compatibility, offer opportunities for differentiation and market penetration. Collaborations and partnerships between industry players to develop comprehensive solar energy solutions could also enhance market opportunities.

Challenges:

Despite the promising growth prospects, the micro inverter market faces several challenges that warrant attention. One key challenge is the competition from alternative solar energy technologies, such as string inverters and power optimizers, which offer similar functionalities at lower costs. Moreover, the intermittent nature of solar energy generation and grid integration issues pose challenges for micro inverter deployment, particularly in regions with unstable grid infrastructure. Additionally, concerns regarding product reliability, maintenance costs, and warranty support may hinder widespread adoption, requiring continuous innovation and improvement in micro inverter technology.

Recent Developments

- In October 2023, Indian inverter manufacturer FIMER plans to introduce a 5 MVA bidirectional converter (BDC) for massive grid-connected energy storage applications within the next two months. The product will go on sale in early 2019 and will be the biggest BDC produced in India.

- In March 2023, the renowned PV inverter maker SolaX Power had a notable New Product Launch in India. With an eye toward the rapidly expanding solar sector in the nation, it unveiled the X1-MINI G4 and X1-BOOST G4, its newest residential grid-tied inverters.

Micro Inverter Market Companies

- Darfon Electronics Corp.

- Enphase Energy

- SMA Solar Technology AG

- Alternate Power System, Inc.

- Fimer Group

- Chilicon Power LLC

- AEconversion GmbH & Co.

- Sensata Technologies, Inc.

- Northern Electric Power Technology Inc.

- Sparq System

- Yotta Energy

- Growatt New Energy

Segments Covered in the Report

By Phase

- Single-phase

- Three-phase

By Connectivity

- Stand Alone

- On-grid

By Application

- Residential

- Commercial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments