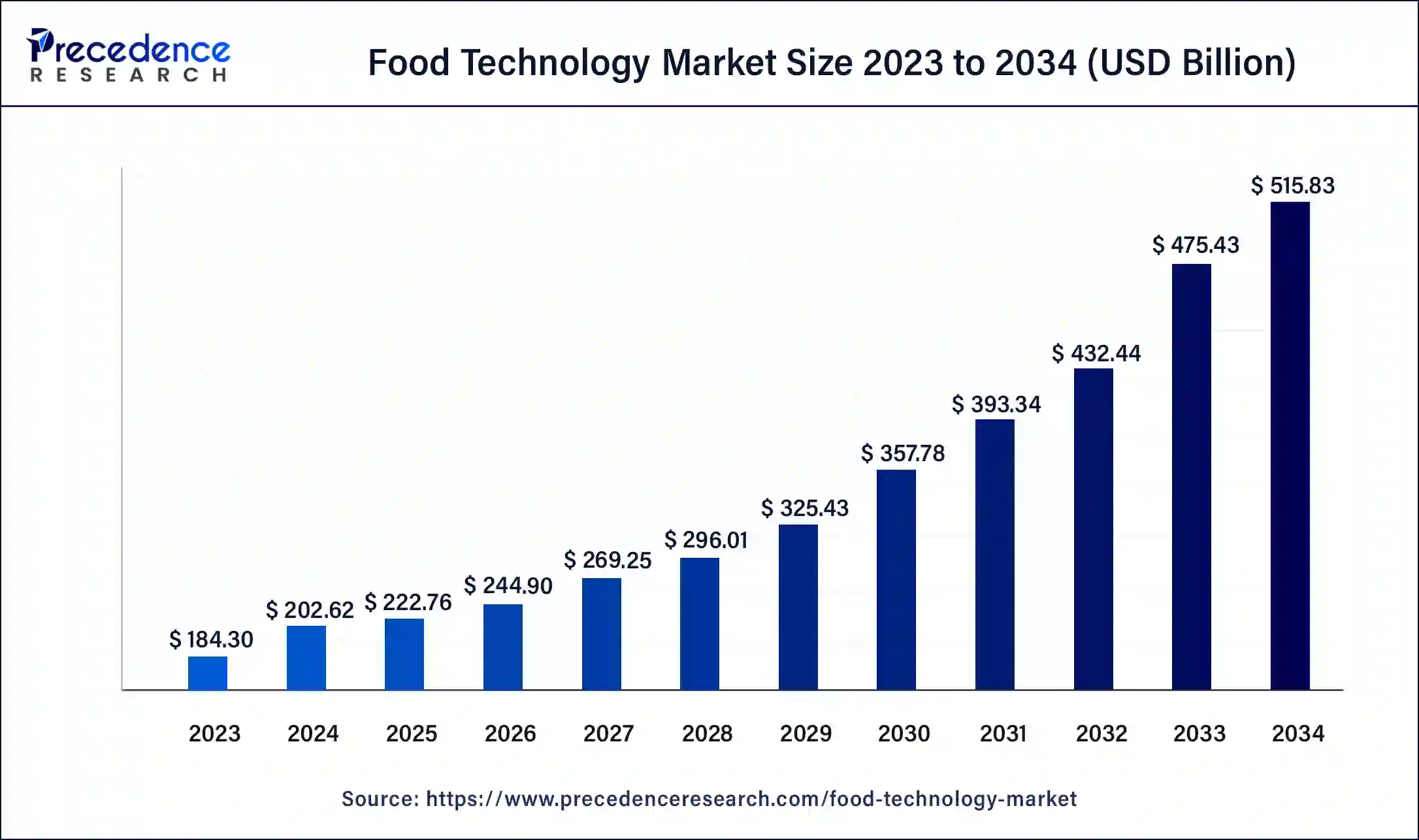

The global food technology market size was estimated at USD 184.30 billion in 2023 and is anticipated to attain around USD 475.43 billion by 2033, growing at a CAGR of 9.94% from 2024 to 2033.

Key Takeaways

- Asia-Pacific has contributed more than 33% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By component, the hardware segment held the largest market share of 43% in 2023.

- By component, the software segment is anticipated to grow at a remarkable CAGR of 11.13% between 2024 and 2033.

- By industry, the fish, meat, and seafood segment has accounted over 20% of market share in 2023.

- By industry, the dairy products segment is expected to expand at the fastest CAGR over the projected period.

- By application, the food science management segment has recorded over 27% of market share in 2023.

- By application, the delivery segment is expected to expand at the fastest CAGR over the projected period.

The food technology market is a dynamic sector that encompasses a wide range of innovations aimed at enhancing the production, processing, packaging, and distribution of food products. With the global population on the rise and changing consumer preferences towards healthier, sustainable, and convenient food options, the demand for innovative food technology solutions is increasing rapidly. This market is driven by a multitude of factors, including technological advancements, changing dietary habits, growing awareness about food safety and security, and increasing investments in research and development.

Food Technology Market Data and Statistics

- In April 2023, Aniai, Inc., a South Korea-based company specializing in robotic kitchen technology, unveiled the Alpha Grill, an innovative cooking robot tailored specifically for preparing burgers, leveraging automation and AI capabilities.

- The Good Food Institute reported that investments in plant-based meat, egg, and dairy companies reached a total of USD 2.1 billion in 2020, with Impossible Foods, a prominent player in the plant-based meat sector, securing over USD 1.9 billion in funding to date.

- According to McKinsey & Company's data as of May 2021, DoorDash held a dominant position in various markets, including San Jose with 77% market share, Houston with 56%, Philadelphia with 51%, and San Antonio with 51%. Meanwhile, Uber Eats and Postmates jointly led in Los Angeles with a 50% market share and in New York City with 41%.

- In 2021, the USDA's Economic Research Service (ERS) found that 10.2% of the entire U.S. population, equating to approximately 13.5 billion households, faced food insecurity.

- The World Bank noted that the United States has been among the pioneering nations in industrialization, experiencing significant urbanization rates over the past two centuries.

- The Food Safety Modernization Act (FSMA) in the United States and similar regulations worldwide have prompted companies to invest in technologies like blockchain and IoT for traceability and transparency.

- With approximately 1.3 billion tons of food wasted globally each year, according to the Food and Agriculture Organization (FAO), technologies like predictive analytics and cold chain management are being increasingly adopted to minimize waste along the supply chain.

Get a Sample: https://www.precedenceresearch.com/sample/4025

Growth Factors: Several factors contribute to the growth of the food technology market. Technological advancements such as automation, artificial intelligence, and machine learning have revolutionized food processing, leading to increased efficiency, reduced waste, and improved product quality. Additionally, the rising demand for plant-based and alternative protein sources, driven by health and environmental concerns, has spurred innovation in areas such as plant-based meat substitutes and cultured meat production. Furthermore, the increasing adoption of Internet of Things (IoT) devices and blockchain technology in the food supply chain is enhancing transparency, traceability, and safety, thus driving market growth.

Region Insights: The food technology market exhibits regional variations driven by factors such as economic development, regulatory environment, and cultural preferences. Developed regions like North America and Europe lead the market due to high disposable incomes, strong technological infrastructure, and a well-established food industry. These regions also witness significant investments in research and development, fostering innovation in areas such as food processing, packaging, and preservation. Emerging economies in Asia Pacific, Latin America, and Africa are experiencing rapid growth in the food technology market, fueled by urbanization, rising disposable incomes, and changing dietary patterns.

Food Technology Market Dynamics

Drivers: Several key drivers propel the growth of the food technology market. Changing consumer preferences towards healthier, sustainable, and ethically produced food products drive innovation in areas such as plant-based proteins, functional foods, and organic farming practices. Additionally, increasing concerns about food safety, foodborne illnesses, and supply chain transparency are driving the adoption of technologies such as blockchain, RFID, and sensors to ensure traceability and quality control. Furthermore, the COVID-19 pandemic has accelerated the adoption of e-commerce and digital solutions in the food industry, leading to increased demand for online food delivery platforms, meal kits, and contactless payment systems.

Opportunities: The food technology market presents numerous opportunities for growth and innovation. One significant opportunity lies in the development of sustainable and environmentally friendly food production methods, such as vertical farming, aquaponics, and precision agriculture, to meet the growing demand for food while minimizing environmental impact. Moreover, the rise of personalized nutrition and dietary supplements opens up avenues for the development of tailored food products and services to address individual health needs and preferences. Additionally, partnerships and collaborations between food technology companies, research institutions, and government agencies can facilitate knowledge sharing, resource pooling, and the development of holistic solutions to address global food challenges.

Challenges: Despite its immense potential, the food technology market faces several challenges that hinder its growth and adoption. One major challenge is regulatory compliance and food safety standards, which vary across regions and can impede the introduction of new technologies and products. Additionally, the high initial investment costs associated with implementing food technology solutions, such as automation systems and advanced equipment, can be prohibitive for small and medium-sized enterprises (SMEs). Moreover, consumer acceptance and perception of novel food technologies, such as genetically modified organisms (GMOs) and lab-grown meat, pose significant challenges to market penetration and adoption. Furthermore, issues related to food waste, supply chain inefficiencies, and sustainability concerns necessitate comprehensive solutions that address the entire food ecosystem.

Recent Developments

- In July 2023, FarMart, an advanced food supply network, introduced Saudabook, India's inaugural technological solution for the food processing industry. This groundbreaking platform extended its ERP system, FarMartOS, to all food processors across India, to modernize the nation's food sector and streamline supply chain processes intelligently.

- In March 2023, CUBIQ FOODS and Cargill, Incorporated, a U.S.-based company, revealed a collaboration to supply innovative fats for plant-based foods. Through this partnership, the companies sought to address the growing demand for healthier ingredients in the market.

Food Technology Market Companies

- Beyond Meat

- Impossible Foods

- Cargill, Incorporated

- Tyson Foods

- Nestlé

- ADM (Archer Daniels Midland Company)

- Kerry Group

- Ingredion

- Tyson Foods

- Danone

- Kraft Heinz

- Givaudan

- Conagra Brands

- The Kellogg Company

- Ingredion Incorporated

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Industry

- Fish, Meat, and Seafood

- Fruits and Vegetables

- Grain and Oil

- Dairy Products

- Beverages

- Bakery and Confectionery

- Others

By Application

- Food Science

- Kitchen & Restaurant Tech

- Delivery

- Supply Chain

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments