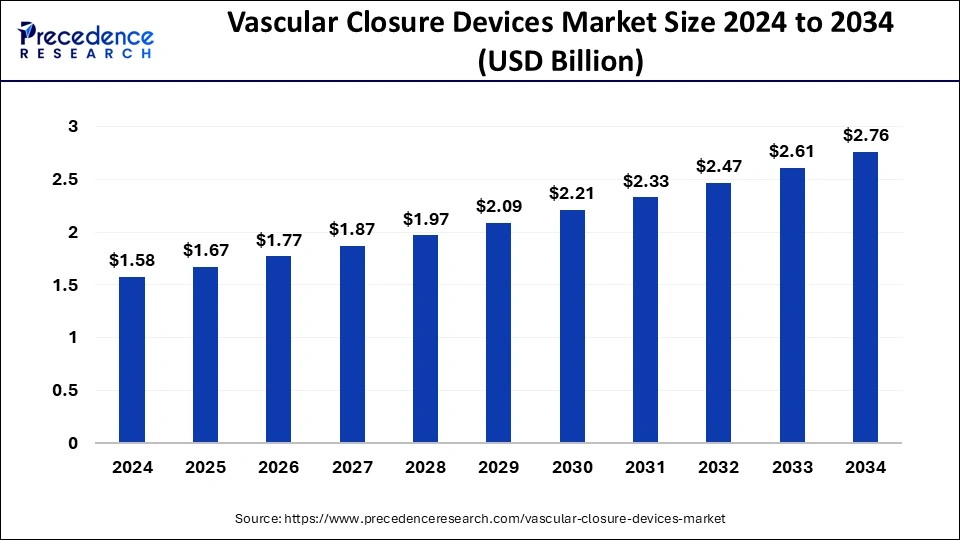

The global vascular closure devices market size was valued at USD 1.75 billion in 2023 and is projected to hit around USD 3.30 billion by 2033, growing at a CAGR of 6.55% from 2024 to 2033.

The vascular closure devices market is witnessing significant growth globally due to the rising prevalence of cardiovascular diseases and the increasing adoption of minimally invasive surgical procedures. Vascular closure devices are medical devices used to achieve hemostasis of the arterial puncture site following catheterization procedures. These devices help in reducing post-procedural complications such as bleeding and hematoma formation, thereby facilitating quicker patient recovery. The market for vascular closure devices comprises various types such as passive closure devices, active closure devices, and external compression devices. These devices play a crucial role in enhancing patient comfort and safety during vascular interventions, thereby driving the demand for such products.

Growth Factors:

Several factors contribute to the growth of the vascular closure devices market. One of the primary drivers is the increasing prevalence of cardiovascular diseases worldwide. With the growing burden of conditions such as coronary artery disease and peripheral artery disease, there is a rising demand for interventional cardiology procedures, including catheterization, angioplasty, and stenting. Vascular closure devices offer a reliable and efficient method for achieving hemostasis post-procedure, thereby reducing the risk of complications and improving patient outcomes. Additionally, advancements in technology have led to the development of innovative closure devices with enhanced safety and efficacy profiles, further propelling market growth.

Drivers:

The adoption of minimally invasive surgical techniques is another significant driver fueling the demand for vascular closure devices. Minimally invasive procedures offer several advantages over traditional open surgeries, including reduced hospital stays, faster recovery times, and lower risk of complications. Vascular closure devices play a crucial role in facilitating these procedures by providing reliable and efficient closure of arterial puncture sites, thus enabling physicians to perform complex interventions with greater precision and safety. Moreover, the growing geriatric population, coupled with increasing healthcare expenditure, is expected to drive market growth, as elderly individuals are more prone to cardiovascular diseases and may require interventional procedures.

Restraints:

Despite the numerous growth drivers, the vascular closure devices market faces certain challenges that may hinder its expansion. One of the primary restraints is the high cost associated with these devices, which limits their accessibility, particularly in developing regions with constrained healthcare budgets. Additionally, concerns regarding the risk of complications such as vascular complications, pseudoaneurysm formation, and infection associated with the use of closure devices may impede market growth. Moreover, the lack of skilled healthcare professionals proficient in using these devices and the stringent regulatory requirements for their approval pose challenges to market players, thereby restraining market growth to some extent.

Opportunities:

Despite the challenges, the vascular closure devices market presents several opportunities for growth and expansion. The increasing focus on patient safety and procedural efficiency is driving the demand for advanced closure devices with improved safety profiles and enhanced ease of use. Market players are investing in research and development activities to introduce innovative products that address unmet clinical needs and offer superior outcomes. Furthermore, the rising adoption of outpatient and ambulatory care settings for cardiovascular procedures presents lucrative opportunities for market players to expand their product offerings and penetrate emerging markets. Moreover, strategic collaborations and partnerships between medical device companies and healthcare providers can facilitate market growth by enhancing product distribution and market reach.

Region Insights:

The vascular closure devices market is segmented into various regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market, owing to the high prevalence of cardiovascular diseases, well-established healthcare infrastructure, and favorable reimbursement policies. The presence of key market players and ongoing technological advancements further contribute to the region's market dominance. Europe is also a significant market for vascular closure devices, driven by increasing healthcare expenditure, rising adoption of minimally invasive procedures, and growing awareness regarding the benefits of these devices. The Asia Pacific region is witnessing rapid market growth due to the expanding patient population, rising healthcare expenditure, and increasing focus on improving healthcare infrastructure. Additionally, government initiatives to promote access to advanced medical technologies are further propelling market growth in the region. Latin America and the Middle East and Africa are also emerging markets for vascular closure devices, driven by improving healthcare facilities, rising disposable income, and increasing investment by market players to expand their presence in these regions.

Recent Developments

- In February 2023, the LockeT product was introduced to the market by Catheter Precision, Inc., a wholly-owned subsidiary of Ra Medical Systems, Inc. The first shipments of the product to its distributors will start right away. When a catheter is inserted through the skin into a blood artery and subsequently removed after an operation, LockeT can be utilized in combination with the closure of the percutaneous wound site. LockeT is used to keep the sutures in place after the doctor has sutured the vessel and the location. The lockeT can be utilized in place of or in addition to closing devices. These devices are Angioseal, marketed by Terumo, Vascade, marketed by Cardiva, a division of Haemonetics, and Perclose, marketed by Abbott.

Vascular Closure Devices Market Companies

- Medtronic

- Abbott Vascular

- Biotronik GMBH & CO. KG

- COOK

- Merit Medical Systems, Inc.

- C. R. Bard, Inc.

- Boston Scientific Corporation

- ESSENTIAL MEDICAL, Inc.

- Cardinal Health

- W L. Gore & Associates

Segments Covered in the Report

By Type

- Active Vascular Closure Device

- Passive Vascular Closure Device

By Access

- Radial

- Femoral

By End-use

- Ambulatory Surgical Centers

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments