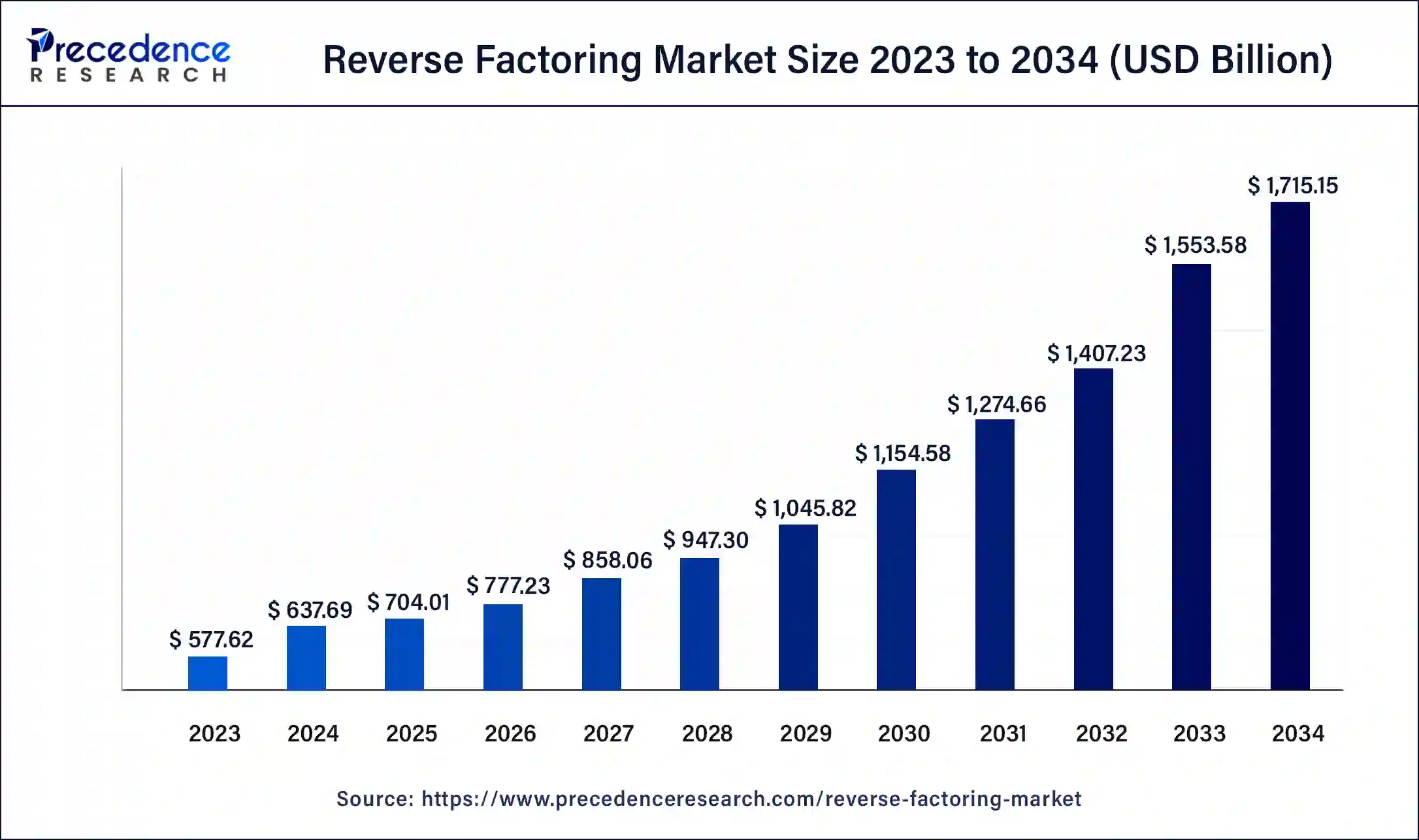

The global reverse factoring market size reached USD 577.62 billion in 2023 and is anticipated to hit around USD 1,527.05 billion by 2033, expanding at a CAGR of 10.21% from 2024 to 2033.

Key Points

- Europe has contributed more than 50% of market share in 2023.

- By category, the domestic segment held the largest market share in 2023.

- By category, the international segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By financial institution, the bank segment has generated the biggest market share in 2023.

- By financial institution, the non-banking financial institutions segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the manufacturing segment has led the significant market share in 2023.

- By end-use, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

Reverse factoring, also known as supply chain finance, is a financial technique that allows businesses to optimize their working capital by extending payment terms to their suppliers while providing them with early payment options facilitated by a third-party financial institution. In the reverse factoring market, these financial institutions play a crucial role in bridging the gap between buyers and suppliers, offering financing solutions that benefit both parties.

Get a Sample: https://www.precedenceresearch.com/sample/3985

One of the key drivers behind the growth of the reverse factoring market is the increasing demand for efficient working capital management solutions among businesses. As companies strive to improve their liquidity and cash flow positions, reverse factoring provides an attractive option to optimize their balance sheets without negatively impacting supplier relationships. By leveraging the creditworthiness of large buyers, suppliers can access financing at favorable rates, enabling them to improve their own cash flow and reduce reliance on costly short-term financing options.

The reverse factoring market is also influenced by broader trends in supply chain management and globalization. As supply chains become more complex and globalized, with suppliers located across different regions and countries, there is a growing need for financial solutions that address the challenges of managing working capital across disparate networks. Reverse factoring offers a scalable and flexible solution that can be tailored to the specific needs of different industries and supply chain structures, making it an attractive option for businesses operating in diverse markets.

Furthermore, regulatory changes and advancements in technology are shaping the evolution of the reverse factoring market. Regulatory initiatives aimed at increasing transparency and improving the stability of financial markets are driving greater adoption of supply chain finance solutions, including reverse factoring. Additionally, advancements in fintech and digital platforms are making it easier for businesses to access and deploy reverse factoring programs, streamlining the process and reducing administrative burdens.

In terms of regional insights, the reverse factoring market is experiencing significant growth across various geographies. In developed economies such as North America and Europe, mature financial markets and established supply chain practices have paved the way for widespread adoption of reverse factoring solutions among large corporations. Meanwhile, emerging markets in Asia-Pacific, Latin America, and Africa are witnessing increasing demand for supply chain finance as businesses seek to optimize their working capital and improve cash flow management in rapidly evolving business environments.

Despite its many benefits, the reverse factoring market also faces challenges and risks that could impact its growth trajectory. One such challenge is the potential for supply chain disruptions and credit risks associated with the financial health of suppliers. In times of economic uncertainty or market volatility, suppliers may face difficulties accessing financing through reverse factoring programs, leading to liquidity issues and disruptions in the supply chain. Additionally, concerns around ethical sourcing practices and supplier sustainability are increasingly shaping the way businesses approach supply chain finance, with stakeholders placing greater emphasis on responsible lending practices and environmental, social, and governance (ESG) considerations.

Recent Developments

- In October 2022, HSBC Hong Kong, a wholly-owned subsidiary of the HSBC Group, unveiled Trade Platform, a comprehensive e-platform designed to offer flexibility, safety, and security in managing global trade transactions. It caters to trade loans for sellers and buyers, guarantees, import bills, and import documents for credit.

- In December 2022, Endesa, in collaboration with Banco Bilbao Vizcaya Argentaria, Caixabank, and Santander, introduced a circular reverse factoring solution. This innovative initiative includes incentives and rewards for sustainable practices, thereby enhancing their competitiveness within the economy.

Reverse Factoring Market Companies

- Citibank

- HSBC

- Santander

- Banco Bilbao Vizcaya Argentaria (BBVA)

- Caixabank

- JPMorgan Chase

- Bank of America

- BNP Paribas

- Deutsche Bank

- Barclays

- Société Générale

- Credit Suisse

- ING Group

- Wells Fargo

- Standard Chartered

Segments Covered in the Report

By Category

- Domestic

- International

By Financial Institution

- Banks

- Non-banking Financial Institutions

By End-use

- Manufacturing

- Transport & Logistics

- Information Technology

- Healthcare

- Construction

- Others (Retail, Food & Beverages, Among Others)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments