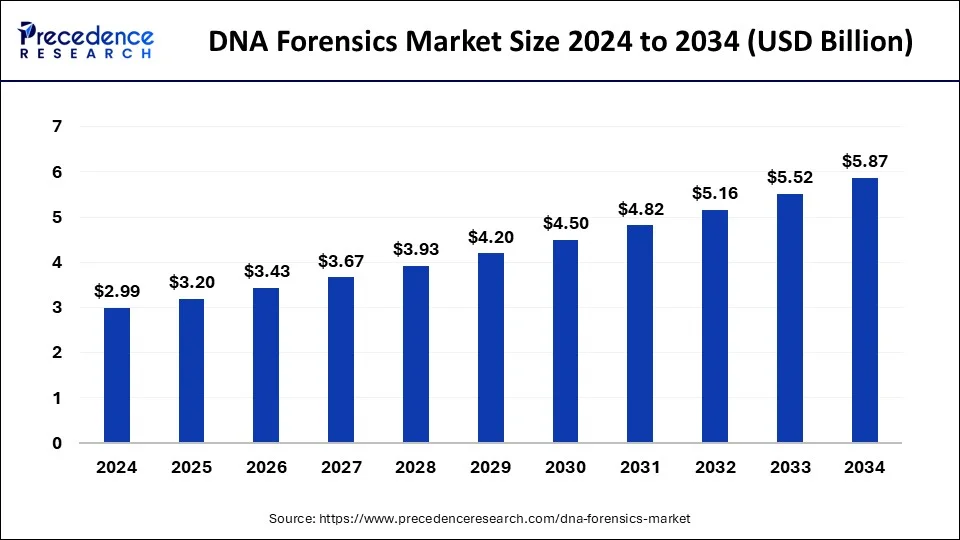

The global DNA forensics market size reached USD 2.79 billion in 2023 and is anticipated to hit around USD 5.52 billion by 2033, growing at a CAGR of 7.05% from 2024 to 2033.

Key Takeaways

- North America led the largest market share of 42% in 2023.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2024-2033.

- By solutions, the analyzers and sequencers segment is observed to grow at a notable rate during the forecast period.

- By method, the PCR amplification segment held the largest share of the market in 2023.

- By method, the capillary electrophoresis segment is expected to show substantial growth during the forecast period.

- By application type, the paternity and familial testing segment held the dominating share of the market in 2023.

- By application type, the criminal testing segment represents another highly influential segment for the forecast period.

The DNA forensics market is a critical component of modern law enforcement, providing tools and techniques to analyze DNA evidence for investigative purposes. It encompasses a range of technologies and services aimed at identifying individuals based on their genetic profiles. The market has witnessed significant growth in recent years, driven by advancements in DNA analysis techniques, increasing awareness of forensic DNA applications, and rising demand for accurate and reliable forensic solutions.

Get a Sample: https://www.precedenceresearch.com/sample/3986

Growth Factors:

Several key factors contribute to the growth of the DNA forensics market. Technological advancements, particularly in next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies, have enhanced the speed, accuracy, and sensitivity of DNA analysis, expanding the scope of forensic applications. Moreover, the growing prevalence of DNA databases and the digitization of forensic processes have streamlined data management and analysis, driving efficiency and scalability in forensic investigations. Additionally, increasing investments in research and development, along with collaborations between academia, industry, and government agencies, are fostering innovation and driving the development of novel forensic technologies and solutions.

Region Insights

The DNA forensics market exhibits regional variations driven by factors such as regulatory frameworks, infrastructure development, and law enforcement practices. North America and Europe dominate the market, fueled by well-established forensic infrastructure, robust regulatory frameworks, and significant investments in research and development. These regions are characterized by extensive DNA databases, sophisticated forensic laboratories, and widespread adoption of DNA analysis techniques in law enforcement and criminal justice systems. In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid growth in the DNA forensics market, driven by increasing awareness of forensic DNA applications, improving healthcare infrastructure, and rising government initiatives to combat crime and enhance forensic capabilities.

Drivers

Several drivers propel the growth of the DNA forensics market. The increasing incidence of crime, including violent crimes, sexual assaults, and property crimes, has heightened the demand for forensic DNA analysis to identify perpetrators and exonerate the innocent. Moreover, the expansion of forensic DNA databases and the adoption of DNA profiling in forensic investigations and criminal justice systems worldwide have bolstered market growth. Additionally, advancements in forensic technologies, such as rapid DNA analysis systems and portable DNA sequencers, are enabling on-site DNA testing and enhancing forensic capabilities in field settings, driving market expansion.

Opportunities

The DNA forensics market presents numerous opportunities for stakeholders across the forensic ecosystem. The growing adoption of DNA analysis in non-traditional applications, such as mass disaster victim identification, missing persons cases, and wildlife forensics, opens up new avenues for market growth. Furthermore, collaborations between forensic laboratories, law enforcement agencies, and academic institutions facilitate knowledge sharing, technology transfer, and capacity building, driving innovation and enhancing forensic capabilities. Additionally, the integration of artificial intelligence (AI) and machine learning algorithms into DNA analysis workflows offers opportunities to automate data interpretation, improve forensic efficiency, and accelerate investigative processes.

Challenges

Despite its growth prospects, the DNA forensics market faces several challenges that may impede its expansion. Concerns regarding privacy, data security, and ethical considerations surrounding the use of DNA databases and genetic information pose challenges to the widespread adoption of forensic DNA analysis. Moreover, the backlog of DNA samples awaiting analysis in forensic laboratories, coupled with resource constraints and budgetary limitations, hinders the timely processing of forensic evidence and delays investigative outcomes. Additionally, the evolving landscape of forensic science, including the emergence of novel DNA editing technologies such as CRISPR, presents regulatory and ethical challenges that require careful consideration to ensure the integrity and reliability of forensic DNA analysis.

Recent Developments

- In April 2023, StarMed Healthcare introduced a private forensic DNA lab, aiding in the expedited resolution of sexual assault cases. Arin Piramzadian, Starmed’s Chief Medical Officer, announces collaboration with local and state agencies nationwide. The lab’s launch marks a pivotal step towards enhancing efficiency and cooperation in forensic investigations.

- In November 2023, The STRmix team unveiled the latest iteration of their revolutionary software, STRmix™ version 2.11. Boasting improvements in memory usage and model enhancements, the highlight is the integration of Amelogenin into deconvolution and likelihood ratio calculations. This update enhances the software’s ability to resolve complex DNA samples, aiding forensic investigations.

DNA Forensics Market Companies

- Thermo Fisher Scientific

- Abbott

- Beckman Coulter Inc

- Promega Corporation

- VERISIS, Bode Cellmark Foresics Inc

- Bio-Rad Laboratories

- Qiagen

- Illumina Inc

- GORDIZ

- LabWare

- LabVantage Solution Inc.

Segments Covered in the Report

By Solutions

- Kits

- Analyzers and Sequencers

- Software

- Laboratory Information Management Systems

- Others

- Consumables

By Method

- Capillary Electrophoresis

- Next Generation Sequencing

- PCR Amplification

By Application

- Criminal Testing

- Paternity and Familial Testing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments