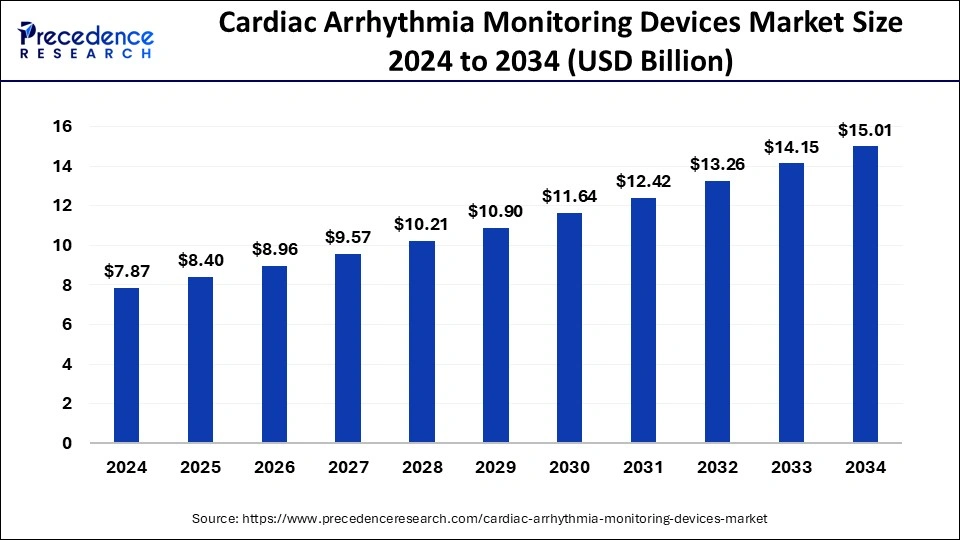

The global cardiac arrhythmia monitoring devices market size was valued at USD 7.37 billion in 2023 and is estimated to hit around USD 14.15 billion by 2033, growing at a CAGR of 6.74% from 2024 to 2033.

Key Takeaways

- North America dominated the market with the largest market share of 37% in 2023.

- By device, the holter monitor segment has held the major market share of 43% in 2023.

- By application, the tachycardia segment dominated the market largest market share in 2023.

- By end-use, the hospitals and clinics segment has accounted more than 46% market share in 2023.

The cardiac arrhythmia monitoring devices market encompasses a range of medical devices designed to detect and monitor irregular heart rhythms, also known as arrhythmias. These devices play a crucial role in diagnosing and managing various cardiac conditions, including atrial fibrillation, ventricular tachycardia, and bradycardia. With the rising prevalence of cardiovascular diseases globally, the demand for cardiac arrhythmia monitoring devices has been steadily increasing. These devices are instrumental in providing continuous monitoring of patients' heart rhythms, enabling timely intervention and improving patient outcomes.

Get a Sample: https://www.precedenceresearch.com/sample/3948

Growth Factors:

Several factors contribute to the growth of the cardiac arrhythmia monitoring devices market. Firstly, the increasing incidence of cardiovascular diseases, coupled with the aging population worldwide, has led to a greater need for effective cardiac monitoring solutions. Additionally, advancements in technology have resulted in the development of more sophisticated and user-friendly monitoring devices, driving adoption rates among healthcare providers and patients alike. Moreover, the growing emphasis on preventive healthcare and the rising awareness about the importance of early detection and management of cardiac arrhythmias have further propelled market growth.

Region Insights:

The cardiac arrhythmia monitoring devices market exhibits regional variations in terms of demand, adoption rates, and regulatory landscapes. North America holds a significant share of the market, driven by the presence of well-established healthcare infrastructure, increasing prevalence of cardiovascular diseases, and a proactive approach towards adopting advanced medical technologies. Europe follows closely, with countries like Germany, the UK, and France being key contributors to market growth. In the Asia-Pacific region, rapid urbanization, changing lifestyles, and improving healthcare infrastructure are driving the demand for cardiac monitoring devices, particularly in countries like China, India, and Japan.

Cardiac Arrhythmia Monitoring Devices Market Dynamics

Drivers:

Several factors act as drivers for the cardiac arrhythmia monitoring devices market. One of the primary drivers is the increasing prevalence of cardiovascular diseases globally, fueled by factors such as sedentary lifestyles, unhealthy dietary habits, and aging populations. Additionally, advancements in wearable technology have made it easier for patients to monitor their heart rhythms outside clinical settings, leading to greater acceptance and adoption of cardiac monitoring devices. Moreover, the growing emphasis on personalized medicine and the integration of artificial intelligence (AI) and machine learning (ML) algorithms into monitoring devices have enhanced their diagnostic accuracy and predictive capabilities, further driving market growth.

Opportunities:

The cardiac arrhythmia monitoring devices market presents several opportunities for growth and innovation. With the increasing focus on remote patient monitoring and telemedicine, there is a growing demand for wireless and mobile-enabled monitoring devices that allow for real-time transmission of data to healthcare providers. Furthermore, the integration of cloud computing and data analytics technologies opens up avenues for the development of advanced analytics platforms that can provide actionable insights into patients' cardiac health. Additionally, partnerships and collaborations between medical device companies and technology firms can facilitate the development of more integrated and comprehensive monitoring solutions.

Challenges:

Despite the promising growth prospects, the cardiac arrhythmia monitoring devices market faces certain challenges. One of the key challenges is the high cost associated with advanced monitoring devices, which can limit their accessibility, particularly in emerging economies with constrained healthcare budgets. Moreover, ensuring the accuracy and reliability of monitoring devices, especially in real-world settings, poses technical challenges related to signal processing and noise reduction. Additionally, regulatory hurdles and compliance requirements vary across different regions, posing challenges for market entry and product commercialization. Lastly, privacy and security concerns surrounding the collection and transmission of sensitive patient data present ongoing challenges for manufacturers and healthcare providers alike.

Recent Developments

- In October 2023, The LUX-Dx II+ Insertable Cardiac Monitor (ICM) System, developed by Boston Scientific, is a next-generation insertable monitor intended for long-term arrhythmia monitoring related to disorders like syncope, cryptogenic stroke, and atrial fibrillation (AF).

- In July 2022, Xplore Lifestyle introduced a smartwatch with medical-grade features for continuous cardiac health monitoring. This watch, created in collaboration with the Israeli company Cardiac Sense, is billed as the world's first medical-grade continuous monitoring gadget in the shape of a watch. This medical gadget may distinguish between an arrhythmia, an abnormal or irregular heartbeat, and a normal heart rhythm, particularly atrial fibrillation (AFib).

Cardiac Arrhythmia Monitoring Devices Market Companies

- Applied Cardiac Systems

- AliveCor

- Biotronik

- Biotricity

- GE Healthcare

- iRhythm Technologies

- Koninklijke Philips N.V

- Medtronic plc

- Nihon Kohden Corporation

- St. Jude Medical (Abbott Laboratories)

- Spacelabs Healthcare (OSI Systems, Inc.)

- Welch Allyn (Hillrom Services, Inc.)

Segments Covered in the Report

By Device

- Holter Monitor

- Event Recorder

- Mobile Cardiac Telemetry

- Implantable Cardiac Monitor

- Electrocardiogram (ECG) Monitor

- Others

By Application

- Tachycardia

- Atrial Tachycardia

- Ventricular Tachycardia

- Bradycardia

- Premature Contraction

- Others

By End-use

- Hospitals and Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

- Homecare Settings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments