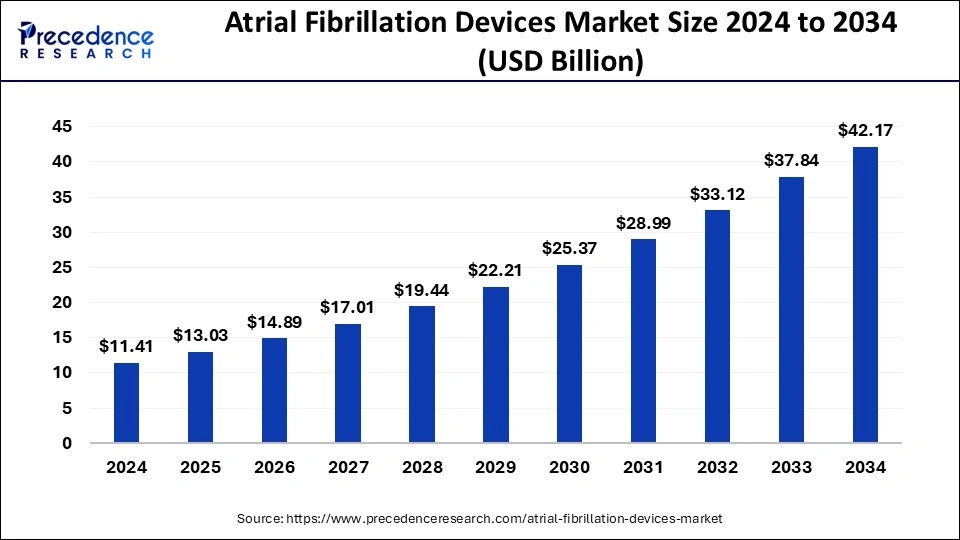

The global atrial fibrillation devices market size reached USD 9.99 billion in 2023 and is estimated to surpass around USD 37.84 billion by 2033, growing at a CAGR of 14.25% from 2024 to 2033.

Key Takeaways

- North America dominated the market share of 40% in 2023.

- By product, the EP ablation catheters segment dominated the atrial fibrillation devices market in 2023.

- By end-use, the hospitals segment dominated the market in 2023.

The Atrial Fibrillation (AF) Devices Market refers to the medical devices and technologies utilized in the treatment and management of atrial fibrillation, a common type of irregular heartbeat. Atrial fibrillation is a condition characterized by rapid and irregular electrical impulses in the atria of the heart, leading to an irregular and often rapid heartbeat. The market for AF devices encompasses a wide range of products, including catheter ablation systems, implantable cardioverter defibrillators (ICDs), pacemakers, cardiac monitors, and surgical devices.

The prevalence of atrial fibrillation is increasing globally due to factors such as an aging population, rising incidence of lifestyle-related risk factors such as obesity and hypertension, and improved detection methods. As a result, the demand for AF devices continues to grow, driven by the need for effective treatment options to manage the symptoms of atrial fibrillation and reduce the risk of complications such as stroke and heart failure.

Get a Sample: https://www.precedenceresearch.com/sample/3950

Growth Factors:

Several factors contribute to the growth of the atrial fibrillation devices market. Firstly, technological advancements in AF devices have led to the development of more effective and minimally invasive treatment options. For example, catheter ablation systems equipped with advanced mapping and navigation technologies enable precise targeting of abnormal heart tissue, improving treatment outcomes and reducing procedural complications.

Additionally, increasing awareness about atrial fibrillation and its associated risks among both patients and healthcare providers has led to greater diagnosis and treatment rates. Public health initiatives and educational campaigns aimed at raising awareness about atrial fibrillation and promoting early detection have contributed to the expansion of the market.

Furthermore, the growing adoption of implantable devices such as ICDs and pacemakers for the management of atrial fibrillation-related complications such as heart failure and sudden cardiac arrest is driving market growth. These devices help regulate the heart's rhythm and prevent life-threatening arrhythmias, thereby improving patient outcomes and quality of life.

Region Insights:

The atrial fibrillation devices market exhibits regional variations in terms of market size, growth rate, and adoption of advanced technologies. North America dominates the market, accounting for a significant share of the global revenue. This can be attributed to factors such as the high prevalence of atrial fibrillation in the region, favorable reimbursement policies, and the presence of well-established healthcare infrastructure and research facilities.

Europe is also a major market for AF devices, fueled by increasing healthcare expenditure, rising awareness about atrial fibrillation, and the presence of key market players. The Asia Pacific region is witnessing rapid growth in the atrial fibrillation devices market, driven by factors such as a large patient population, improving healthcare infrastructure, and increasing investments in healthcare technology.

Atrial Fibrillation Devices Market Dynamics

Drivers:

Several drivers are propelling the growth of the atrial fibrillation devices market. One key driver is the increasing prevalence of atrial fibrillation worldwide, particularly among the elderly population. As the population ages, the incidence of age-related risk factors such as hypertension and cardiovascular diseases increases, leading to a higher prevalence of atrial fibrillation.

Additionally, advancements in medical technology, such as the development of novel catheter ablation techniques and the miniaturization of implantable devices, have expanded the treatment options available for atrial fibrillation. These technological innovations have improved treatment efficacy, reduced procedural complications, and expanded the eligible patient population for AF device therapy.

Moreover, favorable reimbursement policies for AF devices in many countries have facilitated patient access to these advanced therapies. Reimbursement support from government healthcare programs and private insurance providers has encouraged healthcare providers to adopt AF devices and offer them to eligible patients, further driving market growth.

Opportunities:

The atrial fibrillation devices market presents several opportunities for growth and innovation. One such opportunity lies in the development of novel therapeutic approaches for atrial fibrillation, including non-invasive and pharmacological interventions. Emerging technologies such as radiofrequency ablation, cryoablation, and ultrasound-based therapies hold promise for improving treatment outcomes and expanding the market reach.

Furthermore, there is a growing emphasis on personalized medicine in the management of atrial fibrillation, driven by advancements in genetic testing and precision medicine technologies. Tailoring treatment approaches based on individual patient characteristics such as genetic predisposition, comorbidities, and lifestyle factors could lead to better treatment outcomes and patient satisfaction.

Additionally, expanding into emerging markets with high unmet medical needs presents lucrative opportunities for AF device manufacturers. Countries in Latin America, the Middle East, and Africa represent untapped markets with growing healthcare infrastructure and increasing healthcare expenditure, creating opportunities for market expansion and diversification.

Challenges:

Despite the promising growth prospects, the atrial fibrillation devices market faces several challenges that could impede market growth. One such challenge is the high cost associated with AF devices and procedures, which may limit patient access, particularly in low- and middle-income countries with limited healthcare budgets and reimbursement support.

Moreover, regulatory challenges related to the approval and commercialization of AF devices pose a significant barrier to market entry for manufacturers. The complex regulatory landscape, varying approval requirements across different regions, and stringent clinical trial standards can delay the market introduction of new devices and increase development costs.

Additionally, the limited efficacy of existing treatment options for certain patient populations, such as those with persistent or longstanding persistent atrial fibrillation, presents a clinical challenge. Developing more effective therapies for these patient subsets remains a priority for researchers and industry stakeholders.

Recent Developments

- In November 2023, Medtronic introduced a heart implant to reduce the lifetime risk of stroke in patients with atrial fibrillation and improve the quality of life for patients undergoing open cardiac surgery.

- In January 2022, AliveCor, Inc. and Voluntis, a leading Aptar Pharma firm in digital therapies, have partnered to provide advanced management of atrial fibrillation for cancer patients.

Atrial Fibrillation Devices Market Companies

- Abbott Laboratories

- Johnson & Johnson

- Atricure Inc

- Microport Scientific Corporation

- Boston Scientific Corporation

- St. Jude Medical, Inc

- Medtronic Plc

- Koninklijke Philips N.V.

- Siemens AG

Segments Covered in the Report

By Product

- EP Ablation Catheters

- EP Diagnostic Catheters

- Mapping and Recording Systems

- Cardiac Monitors or Implantable Loop Recorder

- Access Devices

- Intracardiac Echocardiography (ICE)

- Left Atrial Appendage (LAA) Closure Devices

By End-use

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments