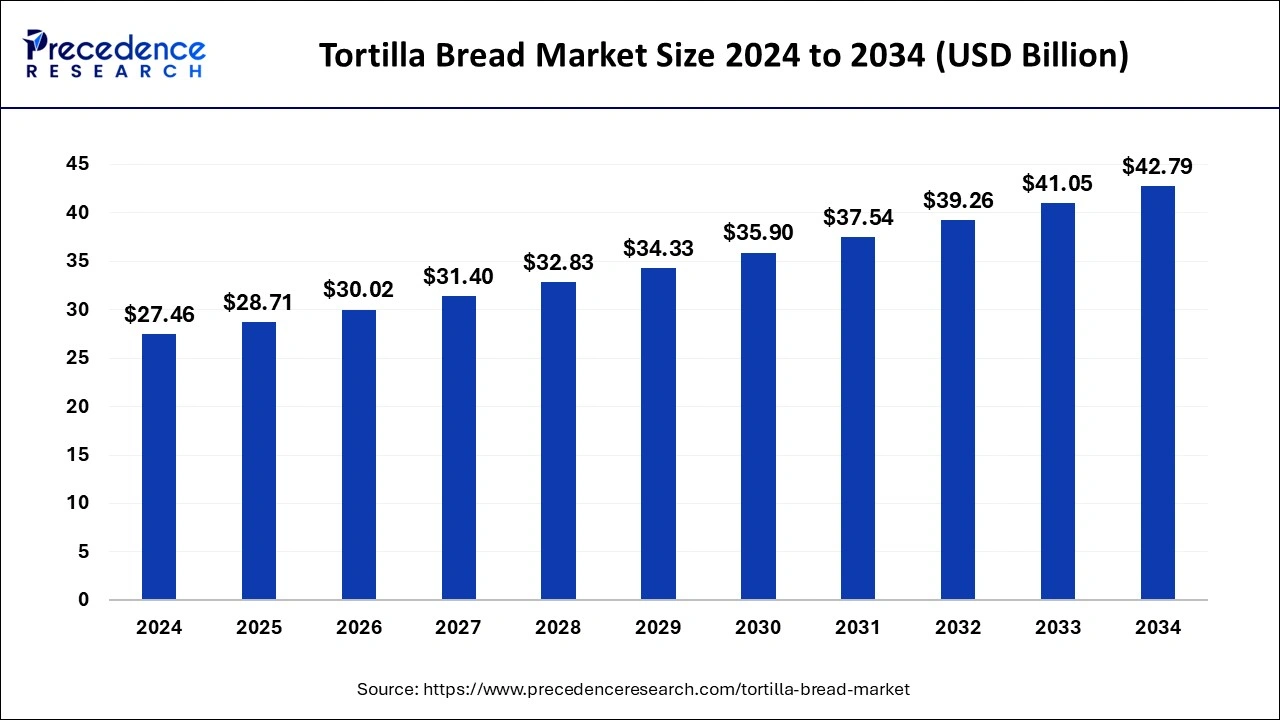

The global tortilla bread market size was evaluated at USD 26.26 billion in 2023 and is predicted to reach around USD 41.05 billion by 2033, growing at a CAGR of 4.57% from 2024 to 2033.

Key Takeaways

- North America has generated more than 42% of market share in 2023.

- By ingredients, the corn segment has contributed more than 52% of market share in 2023.

- By processing type, the fresh segment has recorded the maximum market share of 63% 2023.

- By product type, the tortilla chips segment dominated the market with the biggest market share of 36% in 2023.

- By distribution channel, the hypermarket/supermarket distribution segment has held a major market share of 37% in 202

The Tortilla Bread Market has witnessed significant growth in recent years, driven by changing consumer preferences, increasing adoption of ethnic cuisines, and the expanding global fast food industry. Tortilla bread, a staple in Mexican and Latin American cuisine, has gained popularity worldwide due to its versatility, convenience, and health benefits. This market encompasses various types of tortilla bread, including corn tortillas, flour tortillas, and specialty varieties like whole wheat and gluten-free options. The market is characterized by a diverse range of products catering to different dietary preferences and culinary traditions. With the growing demand for authentic ethnic foods and the rising popularity of wraps, tacos, and quesadillas, the tortilla bread market is poised for continued expansion in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/4018

Growth Factors:

Several factors are driving the growth of the tortilla bread market. Firstly, the increasing globalization and cultural exchange have led to greater awareness and appreciation of ethnic cuisines, including Mexican and Latin American food. This has resulted in a surge in demand for tortilla bread outside its traditional markets. Additionally, the rising popularity of healthy eating habits and the shift towards plant-based diets have contributed to the growing consumption of tortilla bread, which is often perceived as a healthier alternative to traditional bread products. Moreover, the convenience factor associated with tortilla bread, which can be easily used to make sandwiches, wraps, and snacks, has further fueled its demand among busy urban consumers.

Region Insights:

The tortilla bread market exhibits regional variations influenced by factors such as cultural preferences, culinary traditions, and availability of ingredients. In North America, particularly in the United States and Mexico, tortilla bread holds a prominent position in everyday cuisine, with corn tortillas being a staple in Mexican dishes like tacos and enchiladas. The market in Europe is witnessing steady growth, driven by the increasing popularity of Tex-Mex cuisine and the growing Hispanic population in countries like Spain and the United Kingdom. In Asia-Pacific, the market is still nascent but is experiencing rapid expansion due to the rising adoption of international cuisines and the growing presence of fast-food chains offering Mexican-inspired menu items.

Tortilla Bread Market Dynamics

Drivers:

Several key drivers are propelling the growth of the tortilla bread market. Firstly, the expanding global fast food industry, coupled with the proliferation of quick-service restaurants and food delivery services, has significantly boosted the demand for tortilla-based products. Moreover, the increasing consumer preference for convenient, ready-to-eat foods has fueled the popularity of tortilla bread, which serves as a versatile base for a wide range of dishes. Additionally, the growing focus on product innovation and the introduction of new flavors and varieties, such as organic and gluten-free options, have attracted a broader consumer base, including health-conscious and allergen-sensitive individuals.

Opportunities:

The tortilla bread market presents several opportunities for growth and innovation. One notable opportunity lies in expanding product offerings to cater to diverse dietary preferences and cultural tastes. Manufacturers can explore the development of specialty tortilla bread made from alternative grains like quinoa, amaranth, or ancient grains, targeting health-conscious consumers seeking nutritious and flavorful options. Furthermore, there is potential for market expansion in emerging economies where the adoption of Western food trends is on the rise, presenting opportunities for local and international players to tap into new consumer markets.

Challenges:

Despite the promising growth prospects, the tortilla bread market faces certain challenges that need to be addressed. One significant challenge is the competition from other bread products and alternative wraps, such as pita bread, naan, and lettuce wraps, which offer similar convenience and versatility. Additionally, the increasing cost of raw materials, including corn and wheat, could affect profit margins for manufacturers, especially amid fluctuating commodity prices and supply chain disruptions. Moreover, maintaining product quality and consistency while meeting regulatory standards and consumer expectations poses a challenge for market players, requiring continuous investment in research and development and quality control measures.

Recent Developments

- In March 2024, Tortilla Restaurants unveiled an enticing offer for evening diners: a £10 evening meal deal complete with a choice of burritos, tacos, naked burritos, or salads, accompanied by a side of sweetcorn ribs in sour cream, tortilla chips and salsa, or queso fundido.

- In October 2023, Doritos unveiled Doritos Dinamita, a fiery addition to its lineup, tailored specifically for the Indian market. These rolled tortilla chips come in two bold flavors: Fiery Lime and Chilli and Sizzlin’ Hot. Accompanied by a sizzling campaign, Doritos aims to ignite taste buds with its spicy offerings.

Tortilla Bread Market Companies

- Grupo Bimbo SAB de CV

- General Mills

- Aranda's Tortilla Company Inc.

- Ole Mexican Foods Inc

- Easy Foods Inc.

- Gruma SAB de CV

- PepsiCo Inc.

- La Tortilla Factory

- Catallia Mexican Foods

- Tyson Foods Inc.

- Azteca Foods Inc.

Segments Covered in The Report

By Ingredients

- Wheat

- Corn

By Processing Type

- Fresh

- Frozen

By Product Type

- Tortilla Chips

- Taco Shells

- Tostadas

- Flour Tortillas

- Corn Tortillas

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments