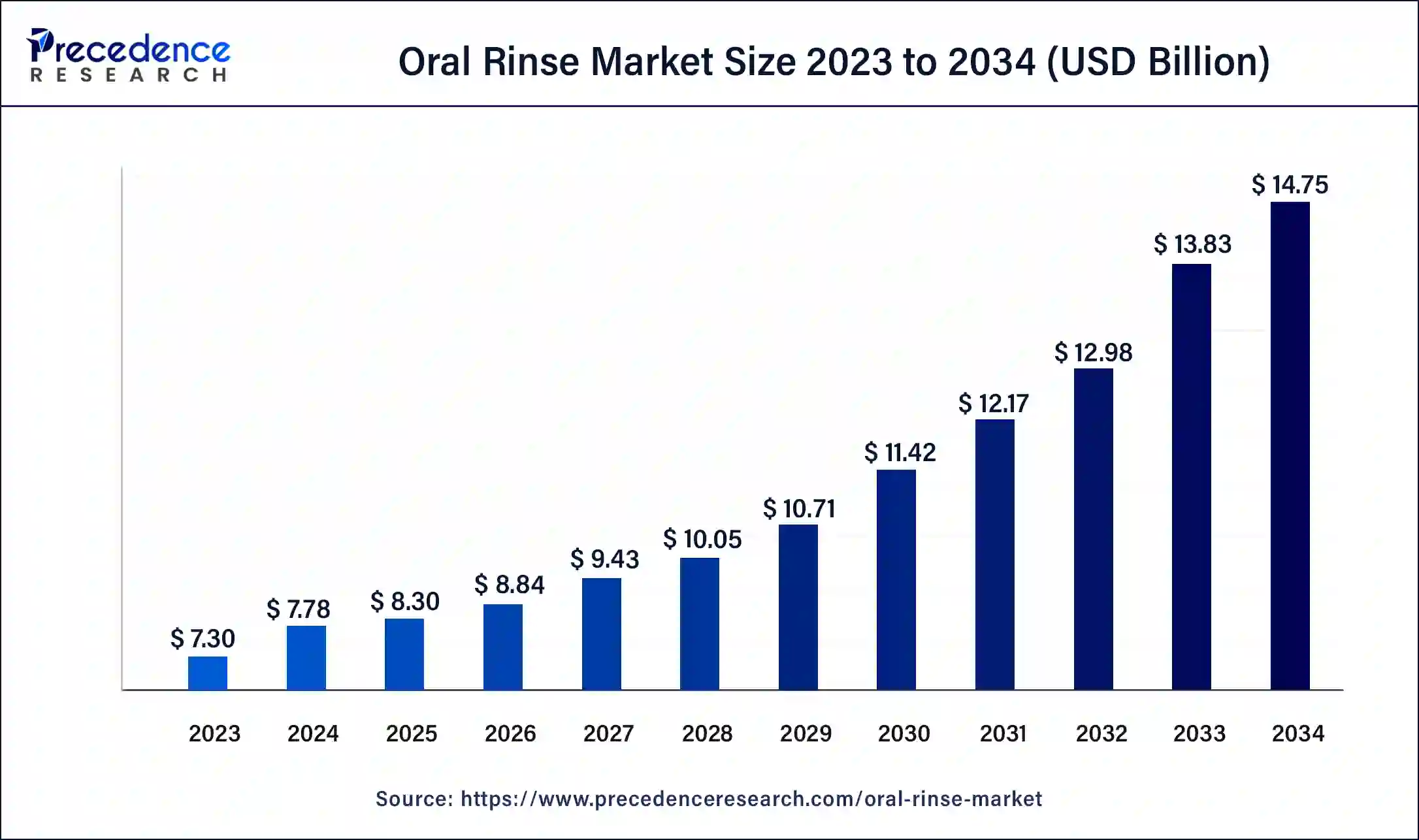

The global oral rinse market size was estimated at USD 7.30 billion in 2023 and is anticipated to grow around USD 13.70 billion by 2033, growing at a CAGR of 6.49% from 2024 to 2033.

Key Points

- North America dominated the oral rinse market by region, in 2023 and hit 31% revenue share.

- Asia Pacific is expected to grow at the highest CAGR in the market by region during the forecast period.

- The antiseptic mouthwash segment dominated the market by product in 2023 and accounted for 33% revenue share.

- The periodontitis segment dominated the market by indication in 2023 and has held a 32% revenue share.

- The online store segment has dominated the market by distribution channel in 2023 and has accounted for 45% of revenue share.

The oral rinse market encompasses products designed to maintain oral hygiene, including mouthwashes and rinses that help reduce plaque, prevent gingivitis, freshen breath, and provide other benefits. These products can be found in various formulations, such as alcohol-based, alcohol-free, fluoride, and herbal. The market serves a wide range of consumers, including those with specific oral health concerns such as dry mouth, bad breath, and gum disease.

Get a Sample: https://www.precedenceresearch.com/sample/4098

Growth Factors

The oral rinse market is growing due to increasing awareness of oral hygiene and its impact on overall health. Rising incidences of dental issues such as cavities and gingivitis also drive demand for oral rinses. Technological advancements have led to new product formulations that cater to different consumer preferences, such as alcohol-free and natural options. Additionally, marketing campaigns by major players and endorsements from dental professionals further fuel market growth.

Region Insights

North America leads the oral rinse market due to high consumer awareness of oral health, extensive product availability, and the presence of major market players. Europe follows, driven by a strong focus on oral hygiene and preventative dental care. In the Asia-Pacific region, rapid urbanization and increasing disposable income are driving market growth, along with growing awareness of oral health. Emerging markets in Latin America and the Middle East and Africa also present growth opportunities as awareness of oral hygiene increases.

Drivers

Key drivers of the oral rinse market include an increase in oral health awareness, supported by educational campaigns and recommendations from dental professionals. The rise in dental issues such as cavities and gum disease has led consumers to seek additional oral care products. Product innovations, such as natural and herbal formulations, appeal to health-conscious consumers. The convenience and ease of use of oral rinses also make them popular among busy consumers.

Opportunities

There is significant potential for growth in emerging markets where awareness of oral health is on the rise. Companies can capitalize on the trend towards natural and organic products by offering herbal or plant-based oral rinses. Developing products that cater to specific needs, such as sensitivity or dry mouth, can also open new market segments. Collaborations with dental professionals and influencers can enhance market penetration and brand trust.

Challenges

The oral rinse market faces challenges such as increasing competition from other oral care products like toothpaste and dental floss. Regulatory constraints and the need to comply with safety and efficacy standards can also pose hurdles for new entrants. Additionally, the presence of alcohol in some oral rinses may deter certain consumers, necessitating the development of alternative formulations. Addressing these challenges will be key to maintaining market growth.

Recent Developments

- In April 2024, Sensodyne announced the launch of alcohol-free mouthwash for sensitive teeth, namely ‘Sensodyne Complete Protection+ Mouthwash.’ The mouthwash is formulated to complement daily brushing, offering additional protection for oral health.

- In February 2024, Oral health company OraBio announced the general availability of performance Oral Rinse. This new product, described as an all-natural liquid anesthetic, aims to provide dental professionals with a convenient, efficient, and effective solution for alleviating and managing patient pain both within and outside their offices, according to a press release from the company.

- In January 2024, Dr. Dento announced the launch of a new product range for oral health. Dr. Dento has produced an innovative range of electric toothbrushes, toothpaste, and mouthwash that are GMP-Certified and combine cutting-edge technology with natural ingredients like NHap, Coconut Extract, Theobromine, Amaranth Solution, Papain Enzyme, Hyaluronic Acid, and Aloe Vera to deliver comprehensive oral health combined with the nourishing effects of Vitamin C and Vitamin E.

- In March 2023, TheraBreath announced the launch of an anti-cavity oral rinse for kids, which is formulated to strengthen teeth and prevent cavities. TheraBreath for Kids mouthwash is vegan, gluten-free, and free of parabens and alcohol. The rinse, which is for kids aged six and older, is available in stores and online in different flavors, including wacky watermelon, grapes galore, and strawberry splash.

Oral Rinse Market Companies

- Colgate-Palmolive Company

- Johnson & Johnson

- GlaxoSmithKline

- Unilever

- TheraBreath

- Proctor & Gamble

- Biotène

- Himalaya Wellness Company

- Amway

- Dabur

- Lion

Segment Covered in the Report

By Product

- Antiseptic Mouthwash

- Cosmetic Mouthwash

- Natural Mouthwash

- Fluoride Mouthwash

By Indication

- Periodontitis

- Mouth Ulcers

- Gingivitis

- Dry Mouth

By Distribution Channel

- Retail Stores

- Pharmacies

- Online Stores

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments