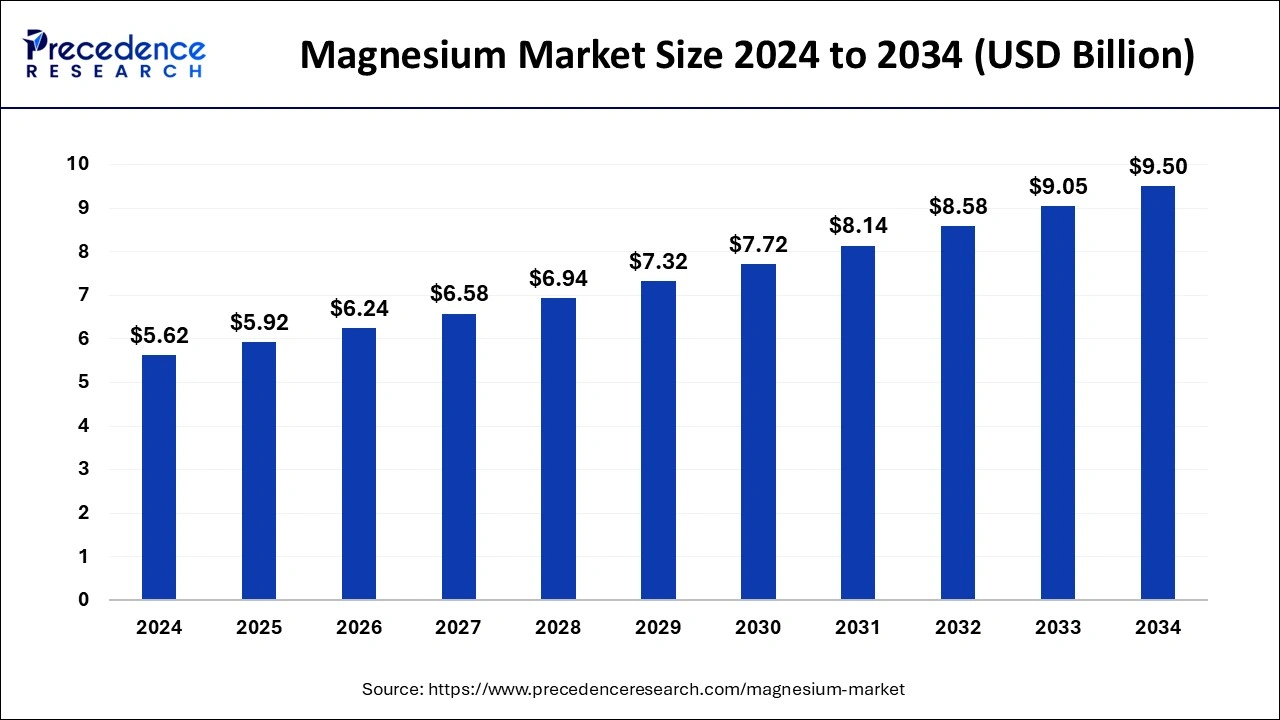

The global magnesium market size was estimated at USD 5.33 billion in 2023 and is anticipated to hitaround USD 9.05 billion by 2033, growing at a CAGR of 5.44% from 2024 to 2033.

Key Takeaways

- Asia Pacific dominated the market with the largest market share of 35% in 2023.

- Europe is projected to witness significant growth in the market over the estimated period.

- By application, the aluminum alloying segment dominated the market in 2023

- By application, the die casting segment is anticipated to witness substantial growth during the forecast period.

The global magnesium market is a vital component of various industries, including automotive, aerospace, electronics, and healthcare. Magnesium, known for its lightweight, high-strength properties, is extensively used in manufacturing alloys, die-casting components, and structural materials. The market for magnesium is influenced by factors such as industrial demand, technological advancements, regulatory policies, and macroeconomic trends. As industries seek lightweight and sustainable materials to improve efficiency and reduce emissions, the demand for magnesium continues to grow, driving innovation and investment in the global magnesium market.

Get a Sample: https://www.precedenceresearch.com/sample/4047

Growth Factors:

Several key factors are driving the growth of the global magnesium market. Firstly, the automotive industry's shift towards lightweight materials to improve fuel efficiency and meet stringent emissions standards has led to increased demand for magnesium alloys in vehicle components such as engine blocks, transmission cases, and structural parts. Additionally, advancements in magnesium production technologies, including recycling processes and alloy development, have expanded the applications and capabilities of magnesium, further driving market growth. Moreover, the aerospace industry's demand for lightweight materials with high strength-to-weight ratios has created opportunities for magnesium-based materials in aircraft manufacturing, contributing to the overall growth of the magnesium market.

Region Insights:

The global magnesium market exhibits regional variations in terms of production, consumption, and market dynamics. China dominates the global magnesium market, accounting for a significant share of both production and consumption. The country's abundant magnesium reserves, coupled with its robust industrial base and manufacturing capabilities, position it as a key player in the global magnesium market. North America and Europe also contribute significantly to the magnesium market, driven by demand from industries such as automotive, aerospace, and electronics. Additionally, emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing growing demand for magnesium-based materials, driven by industrialization, urbanization, and infrastructure development.

Trends:

Several trends are shaping the evolution of the global magnesium market. One prominent trend is the increasing use of magnesium alloys in lightweighting applications across various industries, including automotive, aerospace, and consumer electronics. Manufacturers are leveraging magnesium's lightweight and high-strength properties to design and produce innovative products that offer improved performance and energy efficiency. Another notable trend is the growing adoption of magnesium-based biomedical implants and devices in healthcare applications, driven by magnesium's biocompatibility and bioresorbable properties. Moreover, advancements in magnesium production technologies, such as electrolytic processes and sustainable sourcing methods, are enabling manufacturers to reduce costs, improve efficiency, and minimize environmental impacts.

Drivers:

Several drivers are fueling the demand for magnesium worldwide. Firstly, the automotive industry's emphasis on lightweighting to improve fuel economy and reduce emissions is a major driver of magnesium demand. As automakers strive to meet regulatory requirements and consumer expectations for more fuel-efficient vehicles, the use of magnesium alloys in automotive components is expected to increase significantly. Additionally, the aerospace industry's demand for lightweight materials with high strength-to-weight ratios is driving the adoption of magnesium alloys in aircraft manufacturing, particularly for structural components and interior applications. Furthermore, the electronics industry's need for lightweight, durable materials for consumer electronics, smartphones, and portable devices is creating opportunities for magnesium-based materials in electronics manufacturing.

Opportunities:

The global magnesium market presents numerous opportunities for stakeholders across the value chain. Magnesium producers have the opportunity to invest in research and development to improve production processes, develop new alloys, and expand applications in high-growth industries such as automotive, aerospace, and healthcare. Automotive manufacturers can leverage magnesium's lightweight properties to design and produce fuel-efficient vehicles with reduced emissions and improved performance. Aerospace companies have the opportunity to explore magnesium alloys for lightweighting initiatives in aircraft manufacturing, offering cost-effective solutions for reducing fuel consumption and carbon emissions. Moreover, advancements in magnesium-based biomedical materials present opportunities for healthcare companies to develop innovative medical devices, implants, and therapeutic treatments.

Challenges:

Despite the promising growth prospects, the global magnesium market faces several challenges that could impact its growth trajectory. One of the primary challenges is the volatility of magnesium prices, which are influenced by factors such as supply-demand dynamics, currency fluctuations, and macroeconomic trends. Fluctuations in magnesium prices can affect production costs and profit margins for manufacturers, posing challenges for market players. Additionally, environmental concerns related to magnesium production processes, such as energy consumption, emissions, and waste management, pose challenges for sustainability and regulatory compliance. Furthermore, competition from alternative materials and alloys, such as aluminum, steel, and composite materials, presents challenges for magnesium market penetration in certain applications and industries. Addressing these challenges will require collaboration among stakeholders to develop sustainable solutions, optimize production processes, and enhance the competitiveness of magnesium-based materials in the global market.

Recent Developments

- In February 2023, Western Magnesium Corporation announced its plan to build a new production facility for magnesium metal with an initial annual capacity of 25,000 metric tons and a new research and development center in Nevada. With the help of this new production facility, the company aims to serve automotive, aerospace, airline, eco-friendly technology companies, and defense contractors through this expansion.

- In July 2022, Chongqing Boao Magnesium-Aluminum Metal Manufacturing Co. Ltd (a wholly owned subsidiary of RSM Group/ Nanjing Yunhai Special Metals Co. Ltd) announced the completion of a high-performance magnesium-aluminum alloy and deep processing project (Phase II project) located in Pingshan Industrial Park, Chongqing City. The new production facilities could have various workshops, including a magnesium particle production workshop with a 7,200 tons/year capacity.

- In January 2022, VSMPO-AVISMA Corporation (VSMPO) announced the extension of a long-term agreement with Barnes Aerospace (Barnes) until December 2026, with an approximate value of $35M. Under the amended contract, VSMPO intends to provide Barnes with an agreed-upon range of alloys and sizes of titanium mill products to support their commercial aircraft manufacturing programs.

- In April 2022, Western Magnesium Corporation announced a non-brokered private placement of USD 3,000,000 in principal amount of unsecured convertible notes.

Magnesium Market Companies

- U.S. Magnesium LLC

- Mag Specialties Inc.

- RIMA Group

- China Magnesium Corporation Ltd.

- Taiyuan Tongxiangyuan Fine Material Co., Ltd.

- POSCO Magnesium Corporation

- Norsk Hydro ASA

- Dead Sea Magnesium Ltd.

- Wenxi YinGuang Magnesium Industry (Group) Co., Ltd.

- Yinguang Magnesium Industry (Group) Co., Ltd.

- Shanxi Wenxi Hongfu Magnesium Co., Ltd.

- Taiyuan Yiwei Magnesium Co., Ltd.

- Shanxi Credit Magnesium Co., Ltd.

- Shanxi Fugu Tianyu Mineral Industry Co., Ltd.

- Shanxi Xinghua Magnesium Co., Ltd.

- Shanxi Yinguang Huasheng Magnesium Co., Ltd.

- Solikamsk Magnesium Works OAO (SMW)

- Timminco Limited

- Ningxia Hui-Ye Magnesium Marketing Group Co., Ltd.

- JSC Magnezit Group

Segments Covered in the Report

By Application

- Aluminum Alloying

- Die casting

- Desulfurization

- Metal Reduction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments