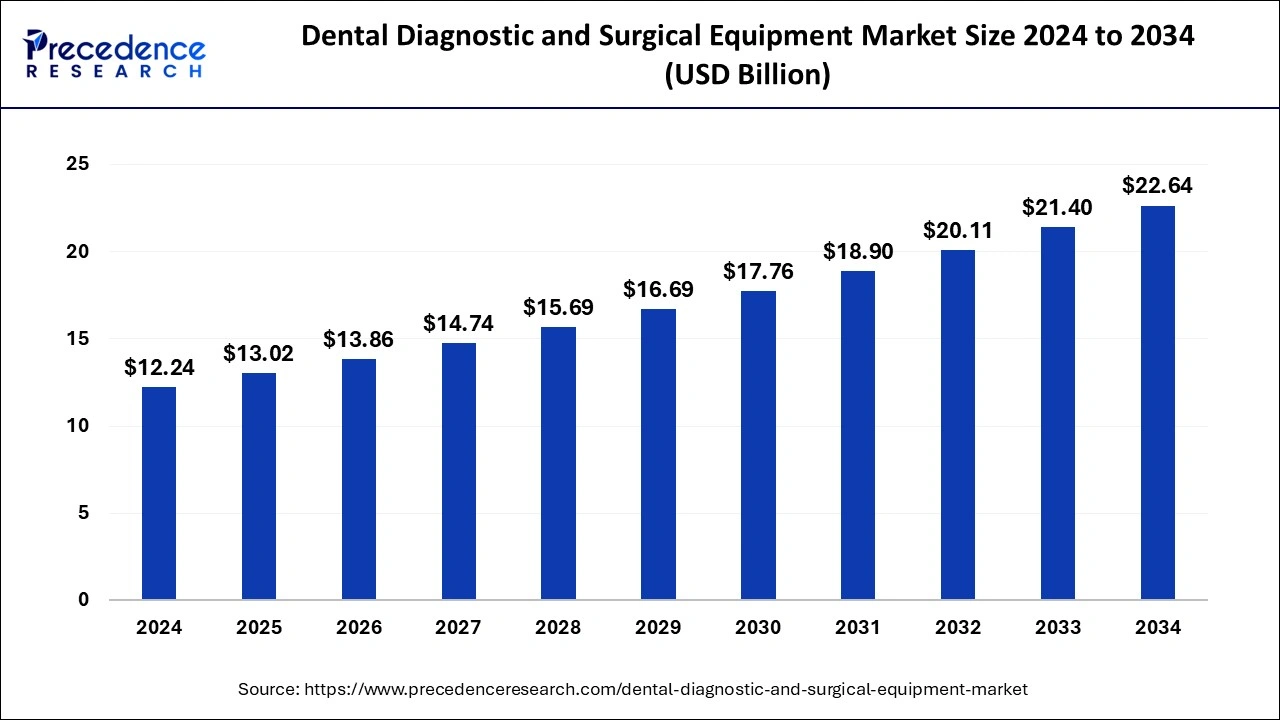

The global dental diagnostic and surgical equipment market size was estimated at USD 11.50 billion in 2023 and is projected to hit around USD 21.40 billion by 2033, growing at a CAGR of 6.40% from 2024 to 2033.

Dental Diagnostic and Surgical Equipment Market Key Takeaways

- The North America dental diagnostic and surgical equipment market size was estimated at USD 4.83 billion in 2023 and is expected to surpass around USD 8.99 billion by 2033.

- North America dominated the global dental diagnostic and surgical equipment market with a 42% revenue share in 2023.

- By product, the dental surgical equipment segment has captured 53% in 2023.

- By product, the dental diagnostic equipment segment is expected to witness the fastest growth during the forecast period.

- By end use, the solo practices segment dominated the market in 2023.

- By end use, the DSO/group practices segment is projected to witness the fastest growth over the forecast period.

The dental diagnostic and surgical equipment market encompasses a range of tools and devices used in the field of dentistry for diagnostic, therapeutic, and surgical purposes. This includes equipment such as dental drills, imaging devices, laser systems, and other dental instruments. These tools are crucial for dental professionals to provide accurate diagnoses and perform effective treatments for a variety of dental issues.

Get a Sample: https://www.precedenceresearch.com/sample/4114

Growth Factors

The market for dental diagnostic and surgical equipment is experiencing growth due to several key factors. Increasing awareness of oral health and its importance to overall well-being is driving demand for dental services. Additionally, technological advancements in dental equipment, such as the development of digital imaging and laser technologies, have improved diagnostic accuracy and treatment outcomes. The aging population and rising incidence of dental issues such as cavities and periodontal disease also contribute to market growth.

Region Insights

The dental diagnostic and surgical equipment market is geographically diverse. North America leads the market due to its advanced healthcare infrastructure, high adoption of innovative dental technologies, and a well-established dental care industry. Europe follows closely, with a focus on preventive dental care and an aging population. The Asia-Pacific region is experiencing significant growth, driven by rising healthcare expenditure, increasing awareness of dental care, and a growing middle-class population with greater access to dental services.

Drivers

The key drivers of the dental diagnostic and surgical equipment market include the adoption of advanced technologies, such as digital imaging and 3D printing, which enhance the precision and efficiency of dental treatments. Additionally, the demand for minimally invasive procedures and cosmetic dentistry is fueling the market. Regulatory support and reimbursement policies that favor advanced dental procedures also play a role in market growth.

Opportunities

Opportunities in the market include the potential for further technological innovation, such as the integration of artificial intelligence (AI) in diagnostic tools and the development of advanced materials for dental implants and prosthetics. Emerging markets offer opportunities for expansion as dental care awareness and access increase. Collaboration between dental equipment manufacturers and dental practitioners can lead to the development of more efficient and user-friendly tools.

Challenges

The market faces challenges such as high costs associated with advanced dental equipment, which may limit adoption, especially in emerging economies. Additionally, there are regulatory hurdles and compliance requirements that manufacturers must navigate to bring new products to market. The need for continuous training and education for dental professionals to use new technologies effectively can also pose a challenge.

Dental Diagnostic and Surgical Equipment Market Recent Developments

- In August 2023, Dentylec, an Israeli tech company, announced its launch of transformative solutions with the potential to revolutionize dental diagnostics. Dentylec will provide clearer insights into patients’ oral health and have a positive impact on it. Diagnostic technologies will be integrated with artificial intelligence to provide a clear and comprehensive view of patient’s oral health.

- In November 2023, DEXIS, a leading company in dental imaging technologies, announced a demonstration of its new technologies: DEXIS OP 3D LX and DEXassist Solution. The company claimed that both of these technologies would be extremely beneficial in the dental diagnostic market.

Dental Diagnostic and Surgical Equipment Market Companies

- Danaher Corporation

- KaVo Kerr

- Biolase Technologies

- Zolar Dental Laser

- 3M Company

- Ivoclar Vivadent AG

- American Medicals

- Henry Schein

- Midmark Diagnostic Group

Segments Covered in the Report

By Product

- Dental Diagnostic Equipment

- CAD/CAM Systems

- Instrument Delivery Systems

- Extra Oral Radiology Equipment

- Intra Oral Radiology Equipment

- Cone Beam Computed Tomography (CBCT)

- Dental Surgical Equipment

- Dental Laser

- Dental Handpieces

- Dental Forceps & Pliers

- Curettes and Scalers

- Dental Probes

- Dental Burs

- Electrosurgical Equipment

- Others

By End-use

- Solo Practices

- DSO/Group Practices

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments