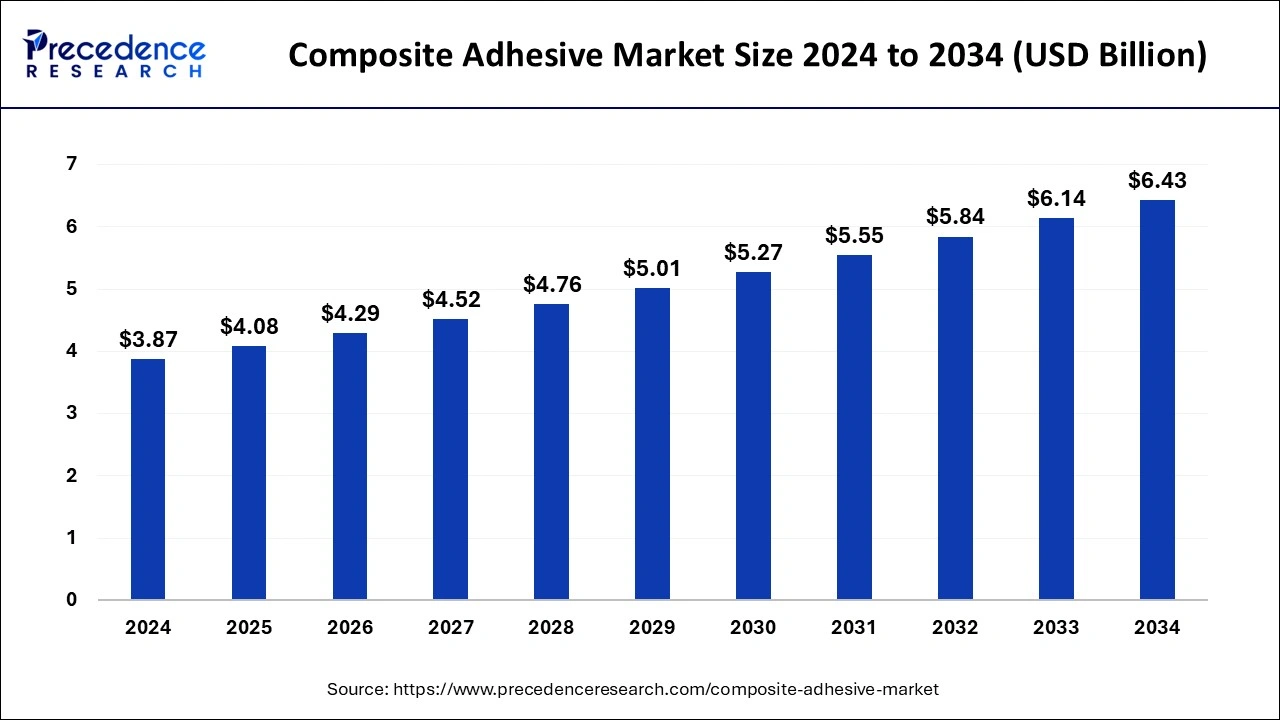

The global composite adhesive market size accounted for USD 3.68 billion in 2023 and is anticipated to hit around USD 6.14 billion by 2033, growing at a CAGR of 5.26% from 2024 to 2033.

Key Takeaways

- Asia-Pacific dominated the market with the largest market share of 49% in 2023.

- North America is expected to be the fastest-growing region over the projected period.

- By product, the epoxy segment has contributed more than 37% of market share in 2023.

- By product, the polyurethane segment is expected to witness significant growth over the forecast period.

- By application, the aerospace and defense segment has held the largest market share of 19% in 2023.

- The automotive segment is likely to grow significantly in the upcoming years.

The composite adhesive market is witnessing substantial growth owing to the increasing demand for lightweight materials in various industries such as automotive, aerospace, construction, and wind energy. Composite adhesives are specifically designed to bond composite materials, including carbon fiber, fiberglass, and others, offering superior strength, durability, and weight reduction compared to traditional mechanical fastening methods. The market is characterized by the development of advanced adhesive technologies, stringent regulations promoting sustainability, and the rising adoption of composites in lightweight applications.

Growth Factors:

Several factors contribute to the growth of the composite adhesive market. One significant factor is the shift towards lightweight materials driven by the need for fuel efficiency and emission reduction in the automotive and aerospace sectors. Composite adhesives play a crucial role in bonding lightweight materials, enabling manufacturers to achieve weight savings while maintaining structural integrity. Additionally, advancements in adhesive formulations, such as epoxies, polyurethanes, and acrylics, enhance bonding strength and performance, further driving market growth. Furthermore, increasing investments in research and development activities aimed at improving adhesive properties and compatibility with different substrates propel market expansion.

Region Insights:

The composite adhesive market exhibits significant regional variation influenced by factors such as industrialization, infrastructure development, and regulatory frameworks. North America and Europe dominate the market, attributed to the presence of major automotive and aerospace industries, stringent regulations promoting lightweight materials, and extensive R&D activities. Asia-Pacific emerges as a rapidly growing region driven by the burgeoning automotive and construction sectors, particularly in countries like China and India. The region's expanding manufacturing base, coupled with increasing investments in infrastructure development, fuels the demand for composite adhesives.

Drivers:

Several drivers propel the growth of the composite adhesive market. The automotive industry's transition towards electric vehicles (EVs) and lightweight materials to meet stringent emission norms and enhance energy efficiency creates a substantial demand for composite adhesives. Additionally, the aerospace sector's focus on reducing aircraft weight to improve fuel efficiency and performance drives the adoption of composite materials and associated adhesives. Moreover, the construction industry's emphasis on sustainable and energy-efficient building solutions amplifies the use of composite adhesives for bonding lightweight materials in structural applications.

Opportunities:

The composite adhesive market presents several opportunities for expansion and innovation. With the increasing emphasis on sustainability and environmental conservation, there is growing demand for bio-based and eco-friendly adhesive formulations derived from renewable sources. Manufacturers can capitalize on this trend by investing in research and development of green adhesives with comparable performance characteristics to conventional counterparts. Additionally, the burgeoning wind energy sector offers significant growth opportunities for composite adhesives used in the fabrication of wind turbine blades, driven by the global shift towards renewable energy sources.

Challenges: Despite the promising growth prospects, the composite adhesive market faces certain challenges that warrant attention. One of the primary challenges is the high initial cost associated with advanced adhesive formulations and technologies, which may hinder their widespread adoption, particularly in cost-sensitive industries. Moreover, ensuring consistent bond quality and durability across diverse substrates and operating conditions remains a challenge for adhesive manufacturers. Additionally, regulatory compliance and certification requirements for adhesive products necessitate rigorous testing and validation procedures, adding complexity and cost to the manufacturing process.

Recent Developments

- In February 2023, Henkel AG & Co. KGaA announced a collaboration with the International Centre for Industrial Transformation’s participation program. The business’s adhesive technologies business department wants to employ INCIT’s tools and frameworks to accelerate its processes’ digital transformation by joining INCIT’s partner network.

- In March 2022, 3M, a diversified technology business, introduced their new Scotch-Weld Multi-Material Composite Urethane Adhesive DP6310NS. This glue is intended to attach a variety of composite components and has good impact resistance and durability.

- In February 2022, Arkema completed its acquisition of Ashland's Performance Adhesives division. Structural adhesives are among the products available in this area. The acquisition was worth USD 1.65 billion. The acquisition bolstered Arkema's Adhesive Solutions sector and was in line with the company's objective of becoming a pure specialty material provider by 2024.

Composite Adhesive Market Companies

- 3M

- Bostik

- Dow

- Henkel AG & Co. KGaA

- H.B. Fuller

- Huntsman International LLC.

- Illinois Tool Works Inc.

- Permabond LLC

- Parker Hannifin Corp

- Sika AG

Segments Covered in the Report

By Product

- Acrylic

- Epoxy

- Polyurethane

- Cyanoacrylate

- Others

By Applications

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Construction & Infrastructure

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments