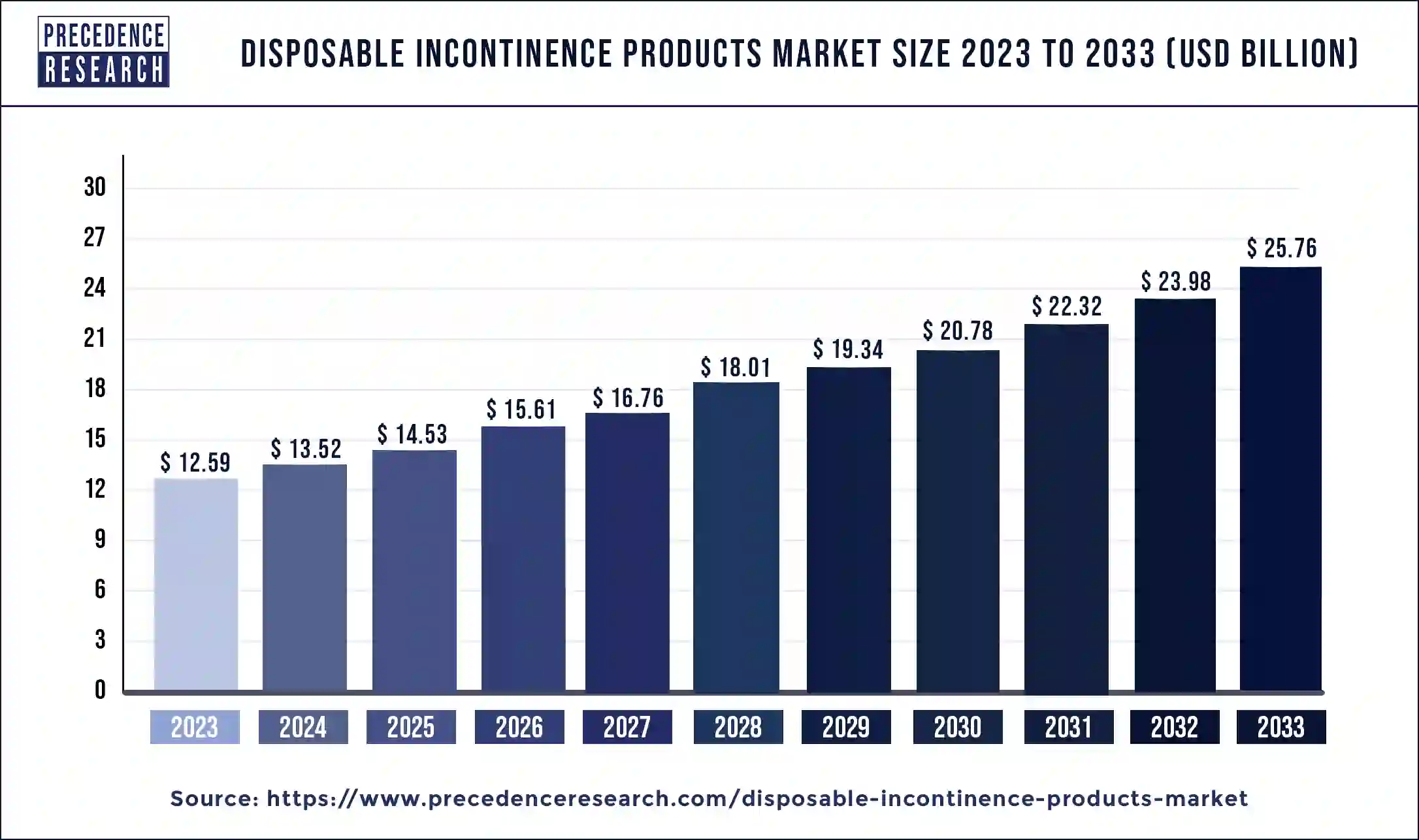

The global disposable incontinence products market size surpassed USD 12.59 billion in 2023 and is anticipated to hit USD 25.76 billion by 2033, expanding at a CAGR of 7.42% from 2024 to 2033.

Key Takeaways

- Europe dominated the market with the largest share of 35% in 2023.

- By product, the protective incontinence garments segment has held the largest market share of 85% in 2023.

- By application, the fecal incontinence segment has contributed more than 25% of market share in 2023.

- By incontinence type, the mixed segment dominated the market with the largest share in 2023.

- By disease, the chronic disease segment has accounted for more than 26% of the market share in 2023.

- By material, the cotton fabrics segment dominated the market's largest revenue share in 2023.

- By gender, the female segment dominated the disposable incontinence products market in 2023.

- By age, the 60 to 79 years segment dominated the market in 2023.

- By distribution channel, the retail stores segment dominated the market in 2023.

- By end-use, the ambulatory surgical centers segment held the largest share of the market in 2023.

The disposable incontinence products market is experiencing rapid growth due to the rising prevalence of urinary and fecal incontinence, particularly among the elderly population. Disposable incontinence products, including adult diapers, pads, and protective underwear, offer convenience, comfort, and dignity to individuals managing incontinence-related issues. With increasing awareness about the importance of maintaining hygiene and quality of life, the demand for disposable incontinence products is expected to continue to surge globally.

Get a Sample: https://www.precedenceresearch.com/sample/3980

Growth Factors:

Several factors contribute to the growth of the disposable incontinence products market. One key driver is the aging population worldwide, coupled with a higher prevalence of chronic diseases and conditions that contribute to incontinence, such as obesity, diabetes, and neurological disorders. As the elderly population grows, the demand for effective and discreet incontinence management solutions increases, driving market expansion.

Moreover, changing lifestyles and cultural norms contribute to increased acceptance and adoption of disposable incontinence products. The stigma associated with incontinence is gradually diminishing, leading to greater openness in seeking and using incontinence management products. Additionally, improvements in product design, materials, and absorbency technologies enhance the performance and comfort of disposable incontinence products, further driving market growth.

Furthermore, the expansion of e-commerce platforms and direct-to-consumer distribution channels provides greater accessibility and convenience for individuals seeking incontinence products. Online retail platforms offer a wide range of disposable incontinence products, along with discreet packaging and home delivery options, catering to the privacy and convenience preferences of consumers. This accessibility and convenience contribute to market growth by reaching a broader customer base and reducing barriers to product acquisition.

Region Insights:

The disposable incontinence products market exhibits significant regional variation, with North America, Europe, Asia-Pacific, and other regions representing key market segments. North America dominates the market, driven by a large elderly population, high healthcare expenditures, and favorable reimbursement policies for incontinence products. The region's robust healthcare infrastructure and awareness campaigns contribute to high market penetration and product adoption.

In Europe, increasing aging demographics and government initiatives to improve incontinence management drive market growth. Countries such as Germany, the UK, and France have well-established reimbursement schemes for incontinence products, supporting market expansion. Moreover, the presence of prominent manufacturers and innovative product offerings further strengthens Europe's position in the disposable incontinence products market.

Asia-Pacific emerges as a rapidly growing market for disposable incontinence products, fueled by aging populations, increasing healthcare expenditures, and improving awareness about incontinence management. Countries such as Japan, China, and South Korea witness significant market growth due to changing demographics and lifestyle factors. Moreover, the expansion of retail distribution channels and online platforms enhances product accessibility and drives market expansion across the region.

Disposable Incontinence Products Market Dynamics

Drivers:

Several factors drive the adoption of disposable incontinence products globally. One primary driver is the increasing prevalence of urinary and fecal incontinence, particularly among aging populations and individuals with chronic health conditions. Incontinence negatively impacts quality of life and social well-being, driving individuals to seek effective management solutions such as disposable incontinence products to maintain dignity and independence.

Moreover, advancements in product technology and design contribute to improved performance, comfort, and discretion of disposable incontinence products. Innovations such as superabsorbent materials, odor control mechanisms, and breathable fabrics enhance product efficacy and user satisfaction, driving market adoption. Additionally, the availability of a wide range of product options tailored to different levels of incontinence and user preferences further accelerates market growth.

Furthermore, increasing healthcare expenditures and government initiatives to improve incontinence management drive market expansion. Reimbursement policies for incontinence products in developed countries and the inclusion of incontinence management in healthcare coverage plans increase affordability and accessibility for consumers. Moreover, awareness campaigns and educational programs aimed at reducing stigma and promoting early intervention contribute to greater acceptance and adoption of disposable incontinence products.

Opportunities:

The disposable incontinence products market presents numerous opportunities for innovation and expansion. One significant opportunity lies in the development of eco-friendly and sustainable incontinence products to address growing environmental concerns. Biodegradable materials, compostable packaging, and recycling initiatives offer environmentally conscious alternatives to traditional disposable incontinence products, catering to eco-conscious consumers and regulatory preferences.

Moreover, expanding market reach into emerging economies and underserved regions presents growth opportunities for disposable incontinence product manufacturers. Rising healthcare expenditures, improving healthcare infrastructure, and increasing awareness about incontinence management in countries such as Brazil, India, and South Africa create new market opportunities. Strategic partnerships, distribution agreements, and localized product offerings can facilitate market entry and drive adoption in emerging markets.

Furthermore, the integration of technology-enabled solutions such as smart sensors and connected wearables presents opportunities for enhancing the functionality and usability of disposable incontinence products. Smart incontinence products equipped with sensors for moisture detection, urinary volume monitoring, and leakage alerts offer real-time insights and personalized care solutions for users and caregivers. These technological innovations not only improve user experience but also enable remote monitoring and telehealth interventions, driving market differentiation and value proposition.

Challenges:

Despite the promising growth prospects, the disposable incontinence products market faces several challenges that could impact its trajectory. One such challenge is the cost sensitivity of consumers, particularly in developing economies and among low-income populations. Disposable incontinence products can impose a financial burden on individuals with limited financial resources, leading to affordability issues and barriers to product adoption. Cost-effective product options and government subsidies may help address affordability challenges and expand market access.

Additionally, regulatory requirements and quality standards pose challenges for manufacturers in ensuring product safety, efficacy, and compliance. Regulatory frameworks governing the manufacturing, labeling, and marketing of disposable incontinence products vary across regions, requiring manufacturers to navigate complex regulatory landscapes and obtain necessary certifications and approvals. Non-compliance with regulatory standards can result in market entry barriers and reputational risks for manufacturers.

Moreover, the stigma associated with incontinence remains a significant barrier to product acceptance and adoption, particularly in conservative cultures and communities. Addressing misconceptions, promoting awareness, and providing education about incontinence management are essential for reducing stigma and improving product acceptance. Moreover, designing products with discreet packaging, odor control features, and user-friendly designs can enhance user confidence and comfort, mitigating stigma-related concerns.

Recent Developments

- In September 2022, Attindas Hygiene Partners proudly presents its cutting-edge, new adults disposable incontinence underwear line in North America. The latest product, which is invisible beneath clothes and offers 100% leak-free protection, uses Maxi Comfort ultrasonic bonding tech to create a more elastic material that can fit a variety of body shapes. The product comes in three skin-friendly, cottony-soft colors for both men and women.

Disposable Incontinence Products Market Companies

- Essity AB

- Kimberly-Clark Corporation

- Coloplast Ltd.

- Unicharm Corporation

- Paul Hartmann AG

- Ontex

- First Quality Enterprises

- Medline Industries Inc.

Segments Covered in the Report

By Product

- Protective Incontinence Garments

- Disposable Adult Diaper

- Disposable Protective Underwear

- Cloth Adult Diaper

- Disposable Pads and Liners

- Male Guards

- Bladder Control Pads

- Incontinence Liners

- Belted and Beltless Under Garments

- Disposable Under Pads

- Urine Bag

- Leg Urine Bag

- Bedside Urine Bag

- Urinary Catheter

- Indwelling (Foley) Catheter

- Intermittent Catheter

- External Catheter

By Application

- Urine Incontinence

- Fecal Incontinence

- Dual Incontinence

By Incontinence Type

- Stress

- Urge

- Mixed

- Others

By Disease

- Feminine Health

- Pregnancy and Childbirth

- Menopause

- Hysterectomy

- Others

- Chronic Disease

- Benign Prostatic Hyperplasia

- Bladder Cancer

- Mental Disorders

- Others

By Material

- Plastic

- Cotton Fabrics

- Super Absorbents

- Latex

- Others

By Gender

- Male

- Female

By Age

- Below 20 years

- 20 to 39 years

- 40 to 59 years

- 60 to 79 years

- 80+ years

By Distribution Channel

- Retail Stores

- E-commerce

By End-use

- Hospital

- Ambulatory Surgical Centers

- Nursing Facilities

- Long term Care Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments