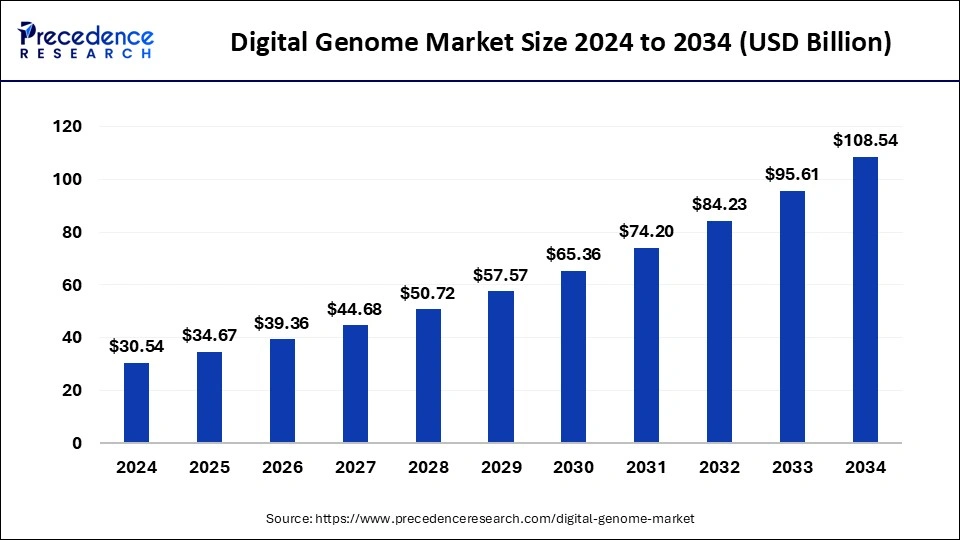

The global digital genome market size reached USD 42.23 billion in 2023 and is expected to hit around USD 109.74 billion by 2033, growing at a CAGR of 10.20% from 2024 to 2033.

Key Points

- North America held the largest share of the market in 2023.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By product, the sequencing and analyzer instruments segment dominated the market in 2023.

- By product, the DNA/RNA analysis kits segment is observed to witness the fastest rate of expansion during the forecast period.

- By application, the microbiology segment accounted for the largest market share in 2023.

- By end-user, the academic research institutes segment dominated the market in 2023.

The Digital Genome Market is a burgeoning sector within the broader biotechnology and healthcare industries, characterized by the utilization of advanced technologies to sequence, analyze, and interpret genetic information. This market encompasses a wide array of applications, including but not limited to personalized medicine, genetic testing, drug discovery, and agricultural biotechnology. At its core, the digital genome concept represents the digitization of genetic information, enabling efficient storage, analysis, and sharing of genomic data across various domains.

Get a Sample: https://www.precedenceresearch.com/sample/3963

Growth Factors:

Several key factors contribute to the growth of the digital genome market. Firstly, advancements in sequencing technologies, such as next-generation sequencing (NGS), have significantly reduced the cost and time required for genome sequencing, making it more accessible to researchers, clinicians, and consumers. Additionally, increasing awareness about the potential of genomic information to revolutionize healthcare and personalized medicine is driving demand for genomic testing and analysis services. Moreover, the growing prevalence of chronic diseases, coupled with the rising adoption of precision medicine approaches, is fueling the need for comprehensive genomic profiling to tailor treatment strategies to individual patients.

Region Insights:

The digital genome market exhibits a global presence, with significant activity observed across various regions. North America, particularly the United States, holds a dominant position in the market, driven by the presence of leading biotechnology and pharmaceutical companies, well-established healthcare infrastructure, and substantial investments in genomic research and development. Europe follows closely, with countries like the United Kingdom, Germany, and France contributing significantly to market growth. The Asia-Pacific region is also emerging as a lucrative market, propelled by rapid advancements in healthcare technology, increasing government initiatives to promote genomics research, and a growing focus on precision medicine initiatives in countries like China, Japan, and India.

Digital Genome Market Dynamics

Drivers:

Several drivers propel the growth of the digital genome market. Firstly, the expanding applications of genomic data in healthcare, agriculture, and other sectors are driving demand for advanced genomic analysis solutions. Furthermore, the growing trend towards precision medicine, wherein treatments are tailored to individual genetic profiles, is creating a substantial demand for genomic testing and interpretation services. Additionally, the increasing prevalence of genetic disorders and chronic diseases is amplifying the need for accurate and comprehensive genomic sequencing for early diagnosis and personalized treatment approaches.

Opportunities:

The digital genome market presents numerous opportunities for stakeholders across the value chain. For technology providers, there is immense potential in developing innovative sequencing platforms, bioinformatics tools, and data analysis software to enhance the efficiency and accuracy of genomic analysis. Moreover, partnerships and collaborations between biotechnology companies, healthcare providers, and research institutions can facilitate the development of novel therapies and diagnostics based on genomic insights. Additionally, the integration of artificial intelligence and machine learning algorithms into genomic analysis workflows holds promise for unlocking new discoveries and improving clinical outcomes.

Challenges:

Despite the promising growth prospects, the digital genome market faces several challenges. One of the primary hurdles is the ethical and regulatory complexities surrounding the collection, storage, and use of genomic data, particularly concerning privacy concerns and data security issues. Moreover, the high cost of genomic sequencing and analysis technologies limits access to these services, especially in resource-constrained settings. Additionally, the interpretation of genomic data poses challenges due to the vast amount of information generated and the need for robust bioinformatics tools and expertise to derive meaningful insights. Furthermore, ensuring interoperability and standardization of genomic data formats across different platforms remains a significant challenge for seamless data sharing and integration in research and clinical settings.

Recent Developments

- In February 2024, the government of Telangana announced the Rs 2000 crore investment for the expansion of the Genome Valley Project in Hyderabad. The Chief Minister of Telangana Revanth Reddy announced the government is promoting the 300-acre second phase for the project expansion stated in the inauguration of the BioAsia 2024 meet in Hyderabad.

- In February 2024, Bio-Rad Laboratories, Inc. a leading player in clinical diagnostic products, and life science research announced the launch of the Vericheck ddPCR Replication Competent AAV Kit and Vericheck ddPCR™ Replication Competent Lentivirus Kit. The launch is the cost-effective solution of replication-competent adeno-associated virus (RCAAV), and replication-competent lentivirus (RCL), supports the safer production of gene therapies and cells.

- In February 2024, Veracyte, Inc. a leading player in cancer diagnostics announced the completion of a partnership with C2i Genomics, Inc., with the addition of whole-genome minimal residual disease (MRD) capabilities in its diagnostic platform and increasing the company's ability to serve patients in the cancer care continuum.

Digital Genome Market Companies

- Illumina, Inc.

- PerkinElmer, Inc.

- Pacific Biosciences of California, Inc.

- Thermo Fisher Scientific Inc.

- Oxford Nanopore Technologies Limited

- Nanostring Technologies, Inc.

- IBM Corporation

- Google LLC

- Amazon.com, Inc.

- Desktop Genetics Ltd.

- Ancestry.com LLC.

Segments Covered in the Report

By Product

- Sequencing And Analyzer Instruments

- DNA/RNA Analysis Kits

- Sequencing Chips

- Sequencing and Analyzing Software

- Sample Preparation Instruments

By Application

- Microbiology

- Biological

- Clinical

- Industrial

- Reproductive and Genetic Transplantation

- Livestock and Agriculture

- Forensic Research and Development

By End-user

- Academic Research Institutes

- Diagnostics and Forensic Labs

- Hospitals

- Bio-pharmaceutical Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments