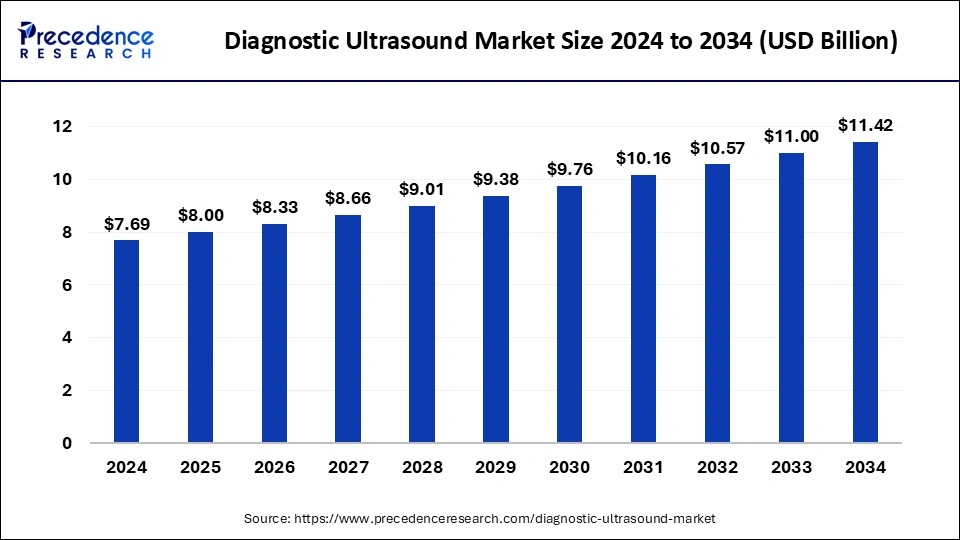

The global diagnostic ultrasound market size reached USD 7.39 billion in 2023 and is projected to hit around USD 11 billion by 2033, growing at a CAGR of 4.06% from 2024 to 2033.

Key Takeaways

- North America has held the largest market share of 32% in 2023.

- By technology, the 2D segment has accounted the largest market share of 37% in 2023.

- By portability, in 2023, the trolley segment has captured the biggest market share of 66% in 2023.

- By application, the obstetrics/gynecology segment held a significant share in 2023.

- By end use, the maternity centers segment holds the largest share of the market.

The diagnostic ultrasound market is a crucial segment within the broader medical imaging industry, offering non-invasive imaging solutions for various medical conditions. Ultrasound technology utilizes high-frequency sound waves to produce real-time images of internal organs, tissues, and blood flow, aiding in the diagnosis and monitoring of diseases and conditions. This overview delves into the growth factors, regional insights, drivers, restraints, and opportunities shaping the diagnostic ultrasound market globally.

Get a Sample: https://www.precedenceresearch.com/sample/3961

Growth Factors:

The diagnostic ultrasound market is experiencing robust growth driven by several factors. Technological advancements have led to the development of portable and handheld ultrasound devices, expanding access to imaging services in remote and underserved areas. Additionally, the growing prevalence of chronic diseases such as cardiovascular disorders, cancer, and musculoskeletal conditions necessitates frequent diagnostic imaging, driving demand for ultrasound services.

Furthermore, the increasing adoption of point-of-care ultrasound (POCUS) in emergency medicine, critical care, and primary care settings contributes to market growth. POCUS offers real-time imaging capabilities at the patient's bedside, facilitating rapid diagnosis and treatment decision-making. Moreover, the rising geriatric population worldwide, coupled with the growing demand for prenatal and obstetric ultrasound services, further fuels market expansion.

Region Insight

The diagnostic ultrasound market exhibits regional variations influenced by factors such as healthcare infrastructure, regulatory environment, reimbursement policies, and demographic trends. North America dominates the market, driven by advanced healthcare facilities, high healthcare spending, and strong demand for imaging services. Europe follows closely, characterized by well-established healthcare systems and increasing adoption of advanced ultrasound technologies.

Asia-Pacific emerges as a lucrative market with rapid urbanization, expanding healthcare infrastructure, and growing medical tourism. Emerging economies such as China, India, and Brazil present significant growth opportunities fueled by rising disposable incomes, increasing healthcare expenditure, and government initiatives to improve healthcare accessibility and affordability. Meanwhile, the Middle East and Africa show growing demand for diagnostic imaging services driven by population growth and rising disease burden.

Diagnostic Ultrasound Market Dynamics

Drivers:

Several drivers propel the growth of the diagnostic ultrasound market globally. Technological innovations, such as 3D and 4D ultrasound imaging, enhanced Doppler imaging, and artificial intelligence (AI) algorithms for image interpretation, enhance diagnostic accuracy and efficiency, driving adoption rates. Moreover, the versatility of ultrasound technology across various medical specialties, including cardiology, obstetrics, gynecology, and musculoskeletal imaging, expands its applications and market potential.

Additionally, the shift towards value-based healthcare models incentivizes healthcare providers to invest in cost-effective and efficient diagnostic solutions such as ultrasound. The growing focus on preventive medicine and early disease detection underscores the importance of diagnostic imaging modalities like ultrasound in improving patient outcomes and reducing healthcare costs. Furthermore, strategic collaborations between medical device manufacturers, healthcare providers, and research institutions drive innovation and market expansion.

Restraints:

Despite the promising growth prospects, the diagnostic ultrasound market faces certain restraints and challenges. High upfront costs associated with ultrasound equipment acquisition and maintenance pose barriers to adoption, particularly in resource-constrained settings. Moreover, the lack of skilled healthcare professionals trained in ultrasound imaging techniques limits its widespread use and hampers market growth.

Regulatory hurdles and reimbursement challenges in some regions impede market penetration and hinder investment in advanced ultrasound technologies. Additionally, concerns regarding the safety and efficacy of ultrasound imaging, particularly in pregnant women and fetuses, raise ethical and regulatory concerns, affecting market adoption rates. Furthermore, competition from alternative imaging modalities such as magnetic resonance imaging (MRI) and computed tomography (CT) poses challenges for the ultrasound market.

Opportunities:

Despite the challenges, the diagnostic ultrasound market presents ample opportunities for growth and innovation. Continued technological advancements, including miniaturization, wireless connectivity, and cloud-based image storage and analysis, enhance the portability and functionality of ultrasound devices, opening new avenues for market expansion. Moreover, the increasing focus on telemedicine and remote healthcare delivery amid the COVID-19 pandemic accelerates the adoption of tele-ultrasound solutions, enabling remote consultations and diagnosis.

Furthermore, expanding applications of ultrasound technology beyond traditional medical settings, such as veterinary medicine, sports medicine, and industrial inspections, diversify revenue streams and broaden market opportunities. Strategic partnerships with healthcare providers, government agencies, and non-profit organizations facilitate market access and support initiatives to address healthcare disparities and improve access to diagnostic imaging services in underserved communities.

Recent Developments

- In January 2024, Canon Medical Systems and Olympus revealed a business alliance concerning Endoscopic Ultrasound Systems.

- In February 2024, IBA acquired Radcal Corporation to enhance its Medical Imaging Quality Assurance offering and bolster its presence in the U.S.

- In February 2023, GE HealthCare announced its acquisition of Caption Health, broadening its ultrasound capabilities to support new users through FDA-cleared, AI-powered image guidance.

- In June 2023, UltraSight and EchoNous partnered to facilitate more accessible cardiac ultrasound for patients.

- In February 2023, Leader Healthcare entered into a strategic partnership with Hisense Medical to redefine ultrasound imaging at Arab Health 2023.

Diagnostic Ultrasound Market Companies

- Canon Medical Systems

- FujiFilm

- GE Healthcare

- Hitachi

- Kalamed

- Samsung Electronics

- Koninklijke Philips

- TELEMED Medical Systems

- Siemens Healthcare

- Toshiba Medical Systems

Segments Covered in the Report

By Technology

- 2D

- 3D and 4D

- Doppler

By Portability

- Trolley

- Compact/Handheld

By Application

- General Imaging

- Cardiology

- Obstetrics/Gynecology

- Others

By End-use

- Hospitals

- Maternity Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments