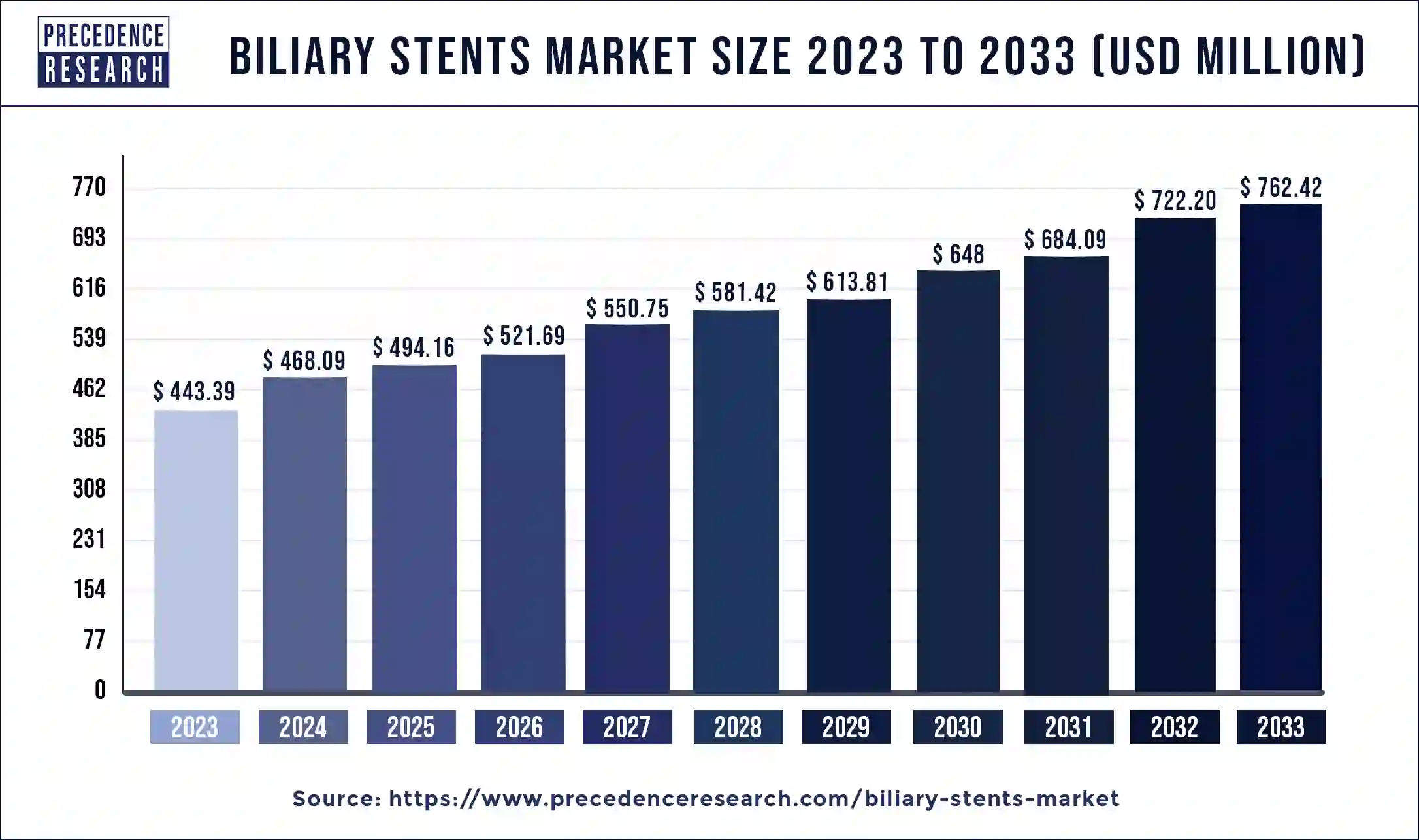

The global biliary stents market size reached USD 443.39 million in 2023 and is estimated to surpass around USD 762.42 million by 2033, at a CAGR of 5.57% from 2024 to 2033.

Key Takeaways

- North America captured the most significant share of the biliary stents market.

- By product type, the metal segment has held the largest market share in 2023.

- By application, the gallstone segment has held the largest segment of the biliary stents market.

- By end use, the hospital segment held the dominating position in the market in 2023.

The biliary stents market refers to the medical devices used for the treatment of various biliary tract disorders, including biliary strictures, bile duct obstructions, and other related conditions. Biliary stents are tubular structures typically made of metal or plastic that are inserted into the bile duct to maintain its patency and facilitate the drainage of bile from the liver to the small intestine. These stents play a crucial role in relieving symptoms, improving quality of life, and preventing complications associated with biliary tract diseases.

Get a Sample: https://www.precedenceresearch.com/sample/3931

Growth Factors:

Several factors contribute to the growth of the biliary stents market. Firstly, the rising prevalence of biliary disorders, including gallstones, biliary strictures, and pancreatic cancer, is driving the demand for biliary stents. With an aging population and changing lifestyle factors such as obesity and unhealthy dietary habits, the incidence of these conditions is expected to increase, thereby fueling market growth. Additionally, advancements in stent technology, such as the development of self-expanding metallic stents and bioresorbable stents, have improved the efficacy and safety of biliary stent placement, further boosting market expansion.

Moreover, the increasing adoption of minimally invasive procedures, such as endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC), for biliary intervention is driving the demand for biliary stents. These procedures offer advantages such as reduced postoperative complications, shorter hospital stays, and faster recovery times, leading to greater patient acceptance and utilization of biliary stents. Furthermore, the growing awareness about the importance of early diagnosis and treatment of biliary diseases among both healthcare professionals and patients is expected to drive market growth in the coming years.

Region Insights

The biliary stents market is segmented into various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America dominates the global biliary stents market owing to factors such as high healthcare expenditure, well-established healthcare infrastructure, and a large patient population with biliary disorders. The presence of major market players, technological advancements, and favorable reimbursement policies further contribute to the growth of the biliary stents market in this region.

Europe is also a significant market for biliary stents, driven by increasing healthcare awareness, rising prevalence of biliary diseases, and favorable government initiatives supporting healthcare infrastructure development. The Asia-Pacific region is expected to witness rapid growth in the biliary stents market due to improving healthcare infrastructure, growing healthcare expenditure, and increasing awareness about advanced treatment options among healthcare professionals and patients.

Biliary Stents Market Dynamics

Drivers:

Several drivers are propelling the growth of the biliary stents market. One of the primary drivers is the increasing incidence of biliary disorders such as gallstones, biliary strictures, and pancreatic cancer. Factors such as aging population, sedentary lifestyles, and dietary habits contribute to the rising prevalence of these conditions, thereby driving the demand for biliary stents.

Moreover, technological advancements in stent design and materials have led to the development of more effective and durable biliary stents, enhancing their therapeutic outcomes and patient satisfaction. The introduction of self-expanding metallic stents, drug-eluting stents, and bioresorbable stents has revolutionized biliary intervention procedures, leading to increased adoption and demand for biliary stents.

The growing preference for minimally invasive procedures for biliary intervention, such as ERCP and PTC, is another significant driver of market growth. These procedures offer advantages such as reduced postoperative complications, shorter recovery times, and improved patient outcomes, leading to greater acceptance and utilization of biliary stents.

Furthermore, favorable reimbursement policies for biliary interventions, increasing healthcare expenditure, and rising awareness about the importance of early diagnosis and treatment of biliary diseases are expected to drive market growth in the forecast period.

Restraints:

Despite the growth drivers, the biliary stents market faces several restraints that may hinder its growth. One of the primary restraints is the risk of complications associated with biliary stent placement, including stent migration, stent occlusion, infection, and tissue ingrowth. These complications can lead to additional procedures, hospitalizations, and increased healthcare costs, thereby limiting market growth.

Moreover, the availability of alternative treatment options for biliary disorders, such as surgical intervention and medication, poses a challenge to the adoption of biliary stents. Surgical procedures such as laparoscopic cholecystectomy and bile duct resection offer definitive treatment for certain biliary conditions and may be preferred over stent placement in some cases.

Additionally, the high cost of biliary stent placement procedures, especially in developing regions with limited healthcare resources, may restrict market growth. Limited access to advanced healthcare facilities, inadequate reimbursement policies, and lack of trained healthcare professionals for biliary interventions further contribute to market restraints in these regions.

Opportunities:

Despite the restraints, the biliary stents market presents several opportunities for growth and expansion. One of the key opportunities lies in the development of innovative stent designs and materials to improve stent performance, durability, and biocompatibility. Research and development efforts focused on enhancing stent deployment techniques, reducing complications, and prolonging stent patency are expected to drive market growth.

Moreover, expanding indications for biliary stent placement, such as in benign biliary strictures, postoperative biliary leaks, and palliative care for advanced biliary malignancies, present significant growth opportunities for market players. Clinical trials evaluating the efficacy and safety of biliary stents in novel indications and patient populations are likely to expand the market landscape and drive adoption in new therapeutic areas.

Furthermore, increasing investments in healthcare infrastructure, particularly in emerging markets, and initiatives aimed at improving access to healthcare services are expected to create favorable market conditions for biliary stents. The growing emphasis on early diagnosis and intervention for biliary diseases, coupled with rising healthcare expenditure and improving healthcare awareness, will further drive market growth in the forecast period.

Recent Developments

- In January 2024, Olympus concluded the acquisition of Taewoong Medical Co. Ltd., a leading Korean gastrointestinal stent company.

- In October 2022, Cordis, a global frontrunner in the innovation and production of interventional cardiovascular and endovascular technologies, revealed its acquisition of MedAlliance, a Switzerland-based firm renowned for pioneering drug-eluting balloons.

- In June 2022, Boston Scientific announced its agreement to acquire a majority stake in M.I.Tech Co. Ltd. from Synergy Innovation Co. Ltd.

Biliary Stents Market Companies

- Boston Scientific

- Cook Group

- ENDO-FLEX GmbH

- Olympus Corporation

- B Braun Melsungen

- CONMED Corporation

- M.I Tech

- Becton, Dickinson & Company

- Medtronic plc

- Cardinal Health

- Merit Medical System

Segments Covered in the Report

By Type

- Metal

- Polymer

- Plastic

By Application

- Biliopancreatic Leakages

- Pancreatic Cancer

- Benign Biliary Structures

- Gallstones

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

0 Comments