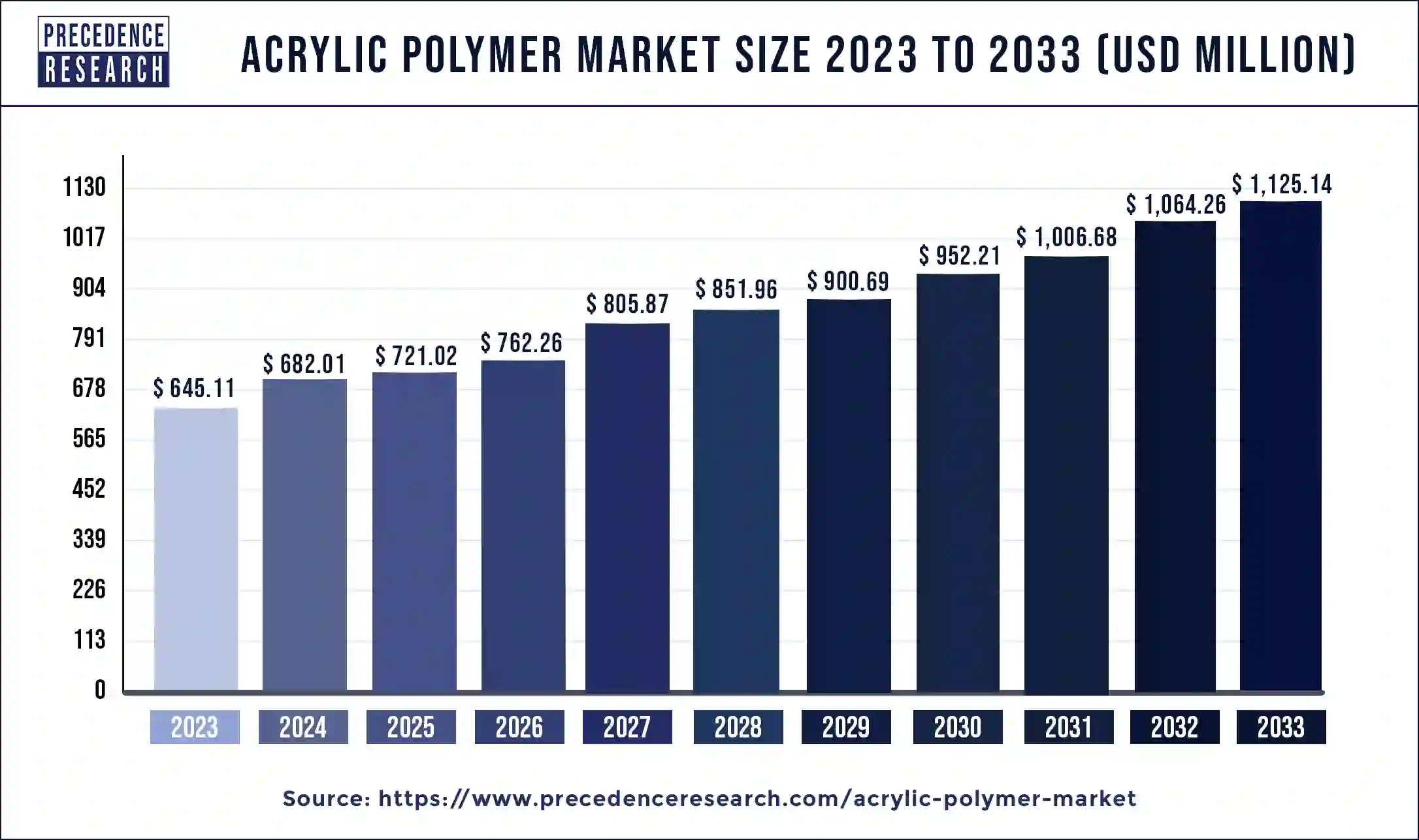

The global acrylic polymer market size reached USD 645.11 million in 2023 and is projected to reach around USD 1,125.14 million by 2033, growing at a CAGR of 5.72% from 2024 to 2033.

Key Takeaways

- North America dominated the market share in 2023.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2024 and 2033.

- By type, the polymethyl methacrylate segment held the largest market share 22% in 2023.

- By type, the polyvinyl acetate segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By solution type, the water-borne segment generated the biggest market share 28% in 2023.

- By solution type, the solvent-borne segment is expected to expand at the fastest CAGR over the projected period.

- By application, the cosmetics segment has held a major market share of 31% in 2023.

- By application, the paints & coatings segment is expected to expand at the fastest CAGR over the projected period.

The acrylic polymer market is witnessing steady growth globally, driven by its versatile applications across various industries such as paints and coatings, adhesives, textiles, and construction. Acrylic polymers, derived from acrylic acid or its derivatives, offer excellent durability, weather resistance, and versatility, making them indispensable in numerous end-use sectors. With increasing demand for eco-friendly and sustainable materials, coupled with advancements in polymerization technologies, the acrylic polymer market is poised for further expansion in the foreseeable future.

Get a Sample: https://www.precedenceresearch.com/sample/3978

Growth Factors:

Several factors contribute to the growth of the acrylic polymer market. One significant driver is the burgeoning construction industry worldwide, particularly in emerging economies. Acrylic polymers find extensive use in construction applications such as paints, coatings, sealants, and adhesives due to their excellent bonding properties, UV resistance, and durability. Rapid urbanization, infrastructure development projects, and increasing disposable incomes drive the demand for acrylic-based construction materials, fueling market growth.

Moreover, the automotive sector represents another key growth driver for the acrylic polymer market. Acrylic-based coatings and finishes are preferred for automotive refinishing applications due to their superior gloss retention, scratch resistance, and color stability. With the rising production and sales of automobiles globally, particularly in developing regions, the demand for acrylic polymers in automotive coatings is expected to escalate, contributing to market expansion.

Furthermore, the increasing adoption of water-based acrylic polymers over solvent-based alternatives aligns with growing environmental concerns and regulatory restrictions on volatile organic compound (VOC) emissions. Water-based acrylic polymers offer eco-friendly solutions with lower VOC content, making them favored choices for paints, coatings, and adhesives across various industries. This shift towards sustainable materials drives the market demand for acrylic polymers and fosters innovation in environmentally friendly formulations.

Region Insights:

The acrylic polymer market exhibits a global presence, with key regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America and Europe represent mature markets for acrylic polymers, characterized by established infrastructure, stringent environmental regulations, and a robust manufacturing base. These regions witness steady demand for acrylic-based products in construction, automotive, and industrial applications.

In contrast, Asia-Pacific emerges as the fastest-growing market for acrylic polymers, fueled by rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Southeast Asian nations. The region's burgeoning construction sector, coupled with increasing automotive production and consumer goods manufacturing, drives substantial demand for acrylic-based materials. Additionally, favorable government policies, foreign investments, and technological advancements in polymer manufacturing contribute to market growth in Asia-Pacific.

Latin America and the Middle East and Africa regions also present growth opportunities for the acrylic polymer market, driven by expanding construction activities, infrastructure projects, and automotive manufacturing. Increasing investments in commercial and residential construction, coupled with rising disposable incomes, propel the demand for acrylic-based coatings, sealants, and adhesives in these regions. Moreover, the presence of untapped markets and growing awareness of sustainable materials further stimulate market growth potential.

Acrylic Polymer Market Dynamics

Drivers:

Several factors drive the demand for acrylic polymers and propel market growth. One primary driver is the growing preference for acrylic-based products in the paints and coatings industry. Acrylic polymers offer superior performance characteristics such as excellent adhesion, color retention, and weather resistance, making them ideal for architectural coatings, automotive finishes, and industrial coatings. The expanding construction and automotive sectors, coupled with increasing renovation and refurbishment activities, fuel the demand for acrylic-based coatings worldwide.

Furthermore, the versatility of acrylic polymers extends beyond coatings to adhesive applications. Acrylic adhesives exhibit high bond strength, fast curing times, and resistance to temperature extremes, making them suitable for diverse bonding applications in construction, packaging, and automotive assembly. The demand for acrylic adhesives is driven by the need for lightweight, durable, and high-performance bonding solutions across various industries, contributing to market growth.

Additionally, the shift towards sustainable and eco-friendly materials fosters the adoption of acrylic polymers in water-based formulations. Water-based acrylic coatings and adhesives offer low VOC emissions, reduced environmental impact, and compliance with stringent regulatory standards, driving their adoption in green building projects, automotive refinishing, and consumer goods manufacturing. Increasing consumer awareness of environmental sustainability and regulatory pressures on VOC emissions accelerate the market demand for water-based acrylic polymers.

Opportunities:

The acrylic polymer market presents numerous opportunities for innovation and market expansion. One significant opportunity lies in the development of bio-based acrylic polymers derived from renewable feedstocks such as plant-derived sugars or biomass. Bio-based acrylic polymers offer sustainability advantages, reduced carbon footprint, and enhanced biodegradability compared to petroleum-based counterparts, aligning with the growing demand for eco-friendly materials in various industries.

Moreover, technological advancements in polymerization processes and formulation techniques enable the development of high-performance acrylic polymers with tailored properties and functionalities. By leveraging advancements in polymer chemistry, researchers can design acrylic polymers with enhanced adhesion, flexibility, and chemical resistance, expanding their applications in specialized coatings, adhesives, and functional materials.

Furthermore, the integration of acrylic polymers into advanced composites and nanocomposites opens up new avenues for lightweight, high-strength materials with tailored mechanical properties. Acrylic-based composites find applications in aerospace, automotive, and construction sectors, offering opportunities for lightweighting, fuel efficiency, and structural performance enhancements.

Additionally, strategic partnerships, collaborations, and mergers and acquisitions present opportunities for market players to expand their product portfolios, geographic reach, and technological capabilities. By forging alliances with raw material suppliers, end-users, and research institutions, companies can access new markets, accelerate product development, and capitalize on emerging trends in the acrylic polymer market.

Challenges:

Despite the favorable growth prospects, the acrylic polymer market faces several challenges that could hinder its expansion. One such challenge is the volatility of raw material prices, particularly for key feedstocks such as acrylic acid and methacrylate monomers. Fluctuations in crude oil prices, supply chain disruptions, and geopolitical tensions impact raw material availability and pricing, posing challenges for acrylic polymer manufacturers in managing production costs and pricing strategies.

Moreover, regulatory compliance and environmental concerns surrounding the use of acrylic polymers present challenges for market players. Stringent regulations on VOC emissions, hazardous chemicals, and waste disposal necessitate compliance with safety standards and environmental regulations throughout the product lifecycle. Companies must invest in sustainable manufacturing practices, waste management systems, and product stewardship initiatives to mitigate regulatory risks and maintain market competitiveness.

Furthermore, competition from alternative materials and substitutes poses challenges for the acrylic polymer market. Emerging technologies such as graphene-based coatings, bio-based polymers, and advanced ceramics offer alternatives to acrylic-based materials in certain applications, posing competitive threats to traditional acrylic polymer products. Market players must differentiate their offerings through product innovation, performance enhancements, and value-added services to withstand competitive pressures and maintain market relevance.

Additionally, the COVID-19 pandemic has disrupted global supply chains, manufacturing operations, and end-user demand, impacting the acrylic polymer market's growth trajectory. Supply chain disruptions, labor shortages, and fluctuating demand patterns pose challenges for market players in meeting customer requirements and sustaining business operations amidst economic uncertainties. However, the gradual recovery of end-user industries and increasing investments in infrastructure projects offer opportunities for market recovery and growth in the post-pandemic period.

Recent Developments

- On February 9, 2023, Roehm, a chemical company based in Germany, unveiled two acrylic-based copolymer compounds, Cyrolite GP-20 and MD zk6, during the 2023 MD&M West trade show. Designed for injection molding and extrusion processes, these compounds demonstrated an outstanding combination of properties ideal for medical device applications.

Acrylic Polymer Market Companies

- BASF SE

- Dow Chemical Company

- Arkema SA

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- LG Chem Ltd.

- Solvay SA

- Formosa Plastics Corporation

- Kuraray Co., Ltd.

- Nippon Shokubai Co., Ltd.

- DIC Corporation

- Celanese Corporation

- Mitsui Chemicals, Inc.

- Saudi Basic Industries Corporation (SABIC)

Segments Covered in the Report

By Type

- Polymethyl Methacrylate

- Sodium Polyacrylate

- Polyvinyl Acetate

- Polyacrylamide

- Others

By Solution Type

- Water-Borne

- Solvent-Borne

By Application

- Dentistry

- Cosmetics

- Paints & Coatings

- Cleaning

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

0 Comments