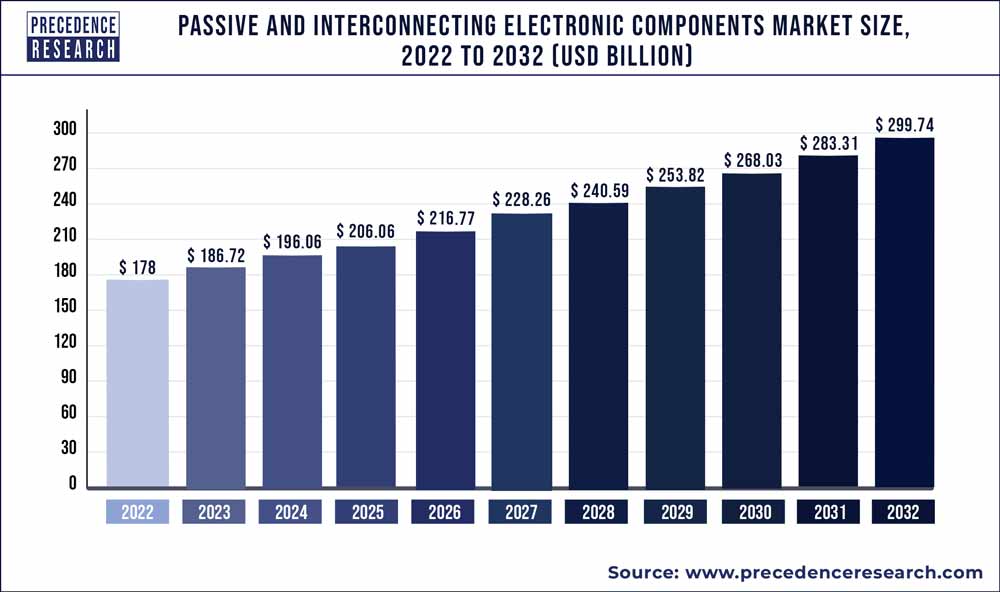

The passive and interconnecting electronic components market size is poised to grow by $ 273.9 billion by 2030 from $ 184.62 Billion in 2022, exhibiting a CAGR of 5.6% during the forecast period 2022-2030.

Passive and interconnecting electronic components are used as essential parts of electronic devices, such as smartphones, computers, electrical home appliances, and gaming consoles. They are considered the backbone of computers, consumer electronics, telecommunications, and many other industries. It includes sockets, connectors, printed circuit boards, relays, switches, and many others.

Get a Sample: https://www.precedenceresearch.com/sample/1372

Crucial factors accountable for market growth are:

- Rapid surge in demand for consumer electronics products will trigger the market growth.

- The increase in demand for 5G network services.

- The integration of internet of things (IoT) and automation with the Passive And Interconnecting Electronic Components.

- Government initiative to encourage the development of robust 5G network infrastructure.

Regional Snapshots

The Asia Pacific region leads the Passive And Interconnecting Electronic Components Market contributing a revenue share of more than USD 97.1 billion in 2020 and is estimated to grow significantly during the forecast period due to the presence of major market players investing heavily for the development of the Passive And Interconnecting Electronic Components market. For instance, On 15th April 2021, Samsung Electro-Mechanics developed the world's first ultra-small, high-capacity MLCC new product with the best performance, and is now establishing itself as the industry leader in the high added-value IT MLCC market. MLCC is a key component in electronic devices that regulates the steady flow of electric current within the circuit, and it's crucial for products like smartphones, household appliances, and automobiles.

Market Dynamics

Driver

The rise in demand for the deployment of 5G network services across the world is a major factor that is estimated to drive the growth of the Passive And Interconnecting Electronic Components. Also, the integration of automation with the electronics components is yet another factor that fosters the market growth. For instance, On 16th September 2021, The new TCO Series high-temperature, automotive-grade polymer chip capacitors, which are rated for operating temperatures up to 150°C at category voltage and meet AEC-Q200 Stress Test Qualification for Passive Components requirements, have been released by AVX Corporation, a leading manufacturer and supplier of advanced electronic components and interconnect, sensor, control, and antenna solutions.

Restraint

The major restraining factor that will negatively impact the growth of the Passive And Interconnecting Electronic Components Market includes drop in the global commodity prices and the surge in complexity of the passive and interconnecting electronic components in order to ensure high functionality.

Opportunity

The desire for availing the remote communication facilities and the implementation of the 5G network infrastructure across the globe are the factors that is expected to find huge growth opportunities which will trigger the market growth.

Challenges

The increase in complexity of the passive and interconnecting electronic components in order to provide high functionality is the major challenge encountered by the passive and interconnecting electronic components market that is anticipated to hinder the market growth.

Report Highlights

- The capacitor passive segment accounted for more than 36% revenue share in 2020.

- The consumer electronics application segment of the Passive And Interconnecting Electronic Components Market is estimated to lead the market with a market share of more than41% in 2020.

- By Geography, Asia Pacific is expected to lead the market contributing a revenue share of more than USD 97.1 billion in 2021 owing the presence of major market players in the region.

Recent Developments

- On 14th July 2021, A new 3-D interactive connectivity application has been released by AVX Corporation, a major manufacturer and provider of innovative electronic components and interconnect, sensor, control, and antenna systems. The new 3-D interactive interconnect application, which is available on the AVX website and can be accessed via computer, tablet, or smartphone, gives users several intuitive ways to access a comprehensive and visually engaging suite of product information for an extensive selection of its proven portfolio of board-to-board, wire-to-board, and wire-to-wire connectors, including application examples spanning seven market segments; interactive, animated, and annunciated, 3-D product renderings; and relevant product pages, datasheets, and catalogs.

- On 26th October 2021, The ADL3225VM inductors from TDK Corporation are now available for use in automobile Power over Coax (PoC) systems. These inductors, which have dimensions of 3.2 x 2.5 x 2.5 mm (L x W x H), are a tiny alternative for designers wanting to minimise vehicle weight as manufacturers add more sensors and cameras to accommodate expanding automotive and advanced driver-assistance systems (ADAS) applications.

- On 21st September 2021, Fujitsu Components has introduced a line of USB dongles to complement its existing IoT products. The FWM8BLZ09x USB dongles, which have built-in Massive network connectivity, are a simple and cost-effective solution to add Wirepas Massive Mesh Anchor or Tag functionality to any equipment with a USB port. They can also provide Massive Mesh Sink functionality to any existing gateway that runs Wirepas software.

- On 29th June 2021, Fujitsu Components America, Inc. has introduced a new mesh network and multi-sensor unit family with built-in Wirepas Massive network connectivity and long battery life. The nodes make dense, large-scale network installations possible for a variety of industrial monitoring IoT applications in offices, factories, warehouses, hospitals, and schools, among other places.

- On 15th September 2021, Reality AI and Fujitsu Component Limited have established a partnership to provide Fujitsu Component's contactless vibration sensor to manufacturing and industrial applications. Reality AI's RealityCheck AD for industrial anomaly detection will be demonstrated live at the forthcoming Sensors Converge Expo in San Jose, CA, from September 21 to 23.

Companies Mentioned:

By Component

- Passive

- Resistors

- Capacitors

- Inductors

- Transformers

- Diode

- Interconnecting

- PCB

- Connectors/Sockets

- Switches

- Relays

- Others

By Application

- Consumer Electronics

- Mobile Phones

- Personal Computers

- Home Appliances

- Audio and Video Systems

- Storage Devices

- Others

- IT & Telecommunication

- Telecom Equipment

- Networking Devices

- Automotive

- Driver Assistance Systems

- Infotainment Systems

- Others

- Industrial

- Mechatronics and robotics,

- Power Electronics

- Photo Voltaic Systems

- Others

- Aerospace & Defense

- Aircraft systems

- Military Radars

- Others

- Healthcare

- Medical Imaging Equipment

- Consumer Medical Devices

- Others

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

About Us

Precedence Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

0 Comments