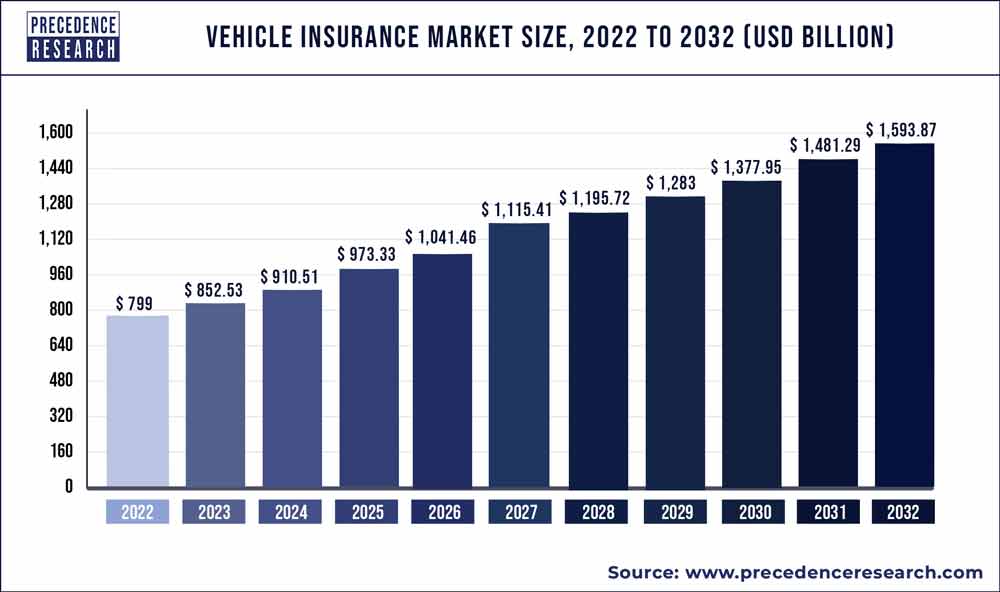

The vehicle insurance market would grow at a CAGR of 7.38% over the predicted time frame. The market is expected to increase in value from US$ 848.34 Bn in 2022 to US$ 1500 Bn in 2030.

The on vehicle

insurance Market, which provides a business strategy, research &

development activities, concise outline of the market valuation, valuable

insights pertaining to market share, size, supply chain analysis, competitive

landscape and regional proliferation of this industry.

Download

Free Sample@ https://www.precedenceresearch.com/sample/1757

Report Scope of the Vehicle Insurance Market

| Report Coverage | Details |

| Market Size by 2030 | USD 1500 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 7.38% |

| Largest Market | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Coverage, Application, Distribution Channel, Vehicle Type, Geography |

A recent

report provides crucial insights along with application based and forecast

information in the Global Vehicle insurance Market. The report provides a

comprehensive analysis of key factors that are expected to drive the growth of

this market. This study also provides a detailed overview of the opportunities

along with the current trends observed in the Vehicle insurance market.

A

quantitative analysis of the industry is compiled for a period of 10 years in

order to assist players to grow in the market. Insights on specific revenue

figures generated are also given in the report, along with projected revenue at

the end of the forecast period.

Companies

and Manufacturers Covered

The study

covers key players operating in the market along with prime schemes and

strategies implemented by each player to hold high positions in the industry.

Such a tough vendor landscape provides a competitive outlook of the industry,

consequently existing as a key insight. These insights were thoroughly analysed

and prime business strategies and products that offer high revenue generation

capacities were identified. Key players of the global Vehicle insurance market

are included as given below:

Vehicle insurance Market Key Players

- PEOPLE’S INSURANCE COMPANY OF CHINA

- ALLSTATE INSURANCE COMPANY

- CHINA PACIFIC INSURANCE CO.

- ALLIANZ

- STATE FARM MUTUAL

- TOKIO MARINE GROUP

- AUTOMOBILE INSURANCE

- GEICO

- PING AN INSURANCE (GROUP) COMPANY OF CHINA, LTD.

- ADMIRAL GROUP PLC

- BERKSHIRE HATHAWAY INC.

Market Segments

- Third Party Liability

- Comprehensive

By Application

- Personal Vehicle

- Commercial Vehicle

By Distribution Channel

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

By Vehicle Type

- New Vehicles

- Used Vehicles

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Report Objectives

- To define, describe, and forecast the global vehicle

insurance market based on product, and region

- To provide detailed information regarding the major

factors influencing the growth of the market (drivers, opportunities, and

industry-specific challenges)

- To strategically analyze micromarkets1 with respect to

individual growth trends, future prospects, and contributions to the total

market

- To analyze opportunities in the market for stakeholders

and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to

four main regions—North America,

Europe, Asia Pacific and the Rest of the World (RoW)2

- To strategically profile key players and comprehensively

analyze their product portfolios, market shares, and core competencies3

- To track and analyze competitive developments such as

acquisitions, expansions, new product launches, and partnerships in the vehicle

insurance market

Table of Content

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Vehicle Insurance Market

5.1. COVID-19 Landscape: Vehicle Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Vehicle Insurance Market, By Coverage

8.1. Vehicle Insurance Market, by Coverage Type, 2022-2030

8.1.1. Third Party Liability

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Comprehensive

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Vehicle Insurance Market, By Distribution Channel

9.1. Vehicle Insurance Market, by Distribution Channel, 2022-2030

9.1.1. Insurance Agents/Brokers

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Direct Response

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Banks

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Vehicle Insurance Market, By Application Type

10.1. Vehicle Insurance Market, by Application Type, 2022-2030

10.1.1. Personal Vehicle

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Commercial Vehicle

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Vehicle Insurance Market, By Vehicle Type

11.1. Vehicle Insurance Market, by Additive Type, 2022-2030

11.1.1. New Vehicles

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Used Vehicles

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Vehicle Insurance Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.1.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.1.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.1.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.2.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.5.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Coverage (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Vehicle Type(2017-2030)

Chapter 13. Company Profiles

13.1. PEOPLE’S INSURANCE COMPANY OF CHINA

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. ALLSTATE INSURANCE COMPANY

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. CHINA PACIFIC INSURANCE CO.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. ALLIANZ

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. STATE FARM MUTUAL

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. TOKIO MARINE GROUP

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. AUTOMOBILE INSURANCE

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. GEICO

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. PING AN INSURANCE (GROUP) COMPANY OF CHINA, LTD.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 774 402 6168

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com

0 Comments