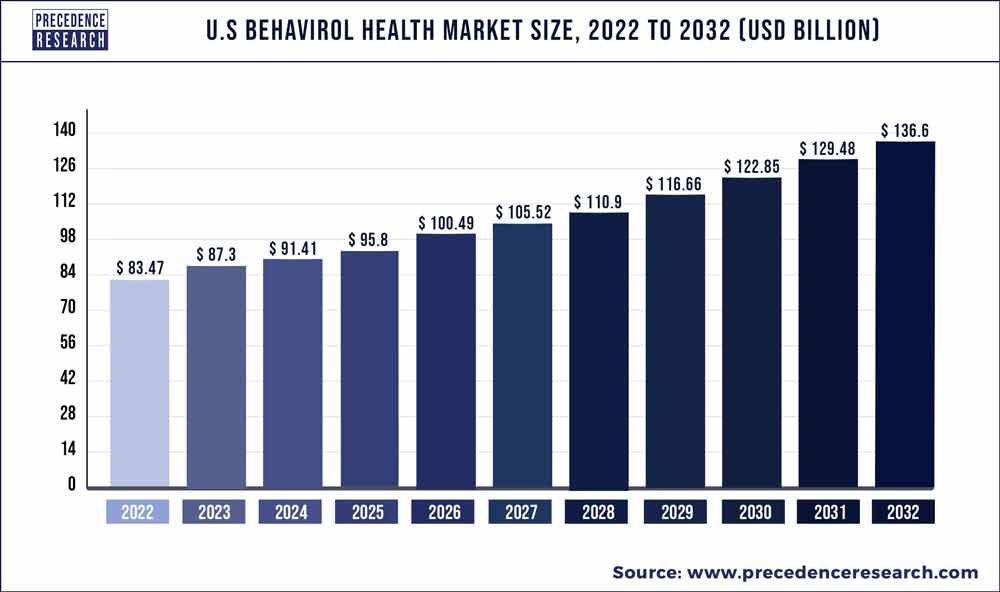

According to the research report, the global U.S.behavioral health market size is expected to touch USD 132.4 Billion by 2027, from USD 90.5 Billion in 2020, growing with a significant CAGR of 5.3% from 2021 to 2027.

The U.S. behavioral health report offers a

comprehensive study of the current state expected at the major drivers, market

strategies, and key vendors’ growth. The report presents energetic visions to

conclude and study the market size, market hopes, and competitive surroundings.

The research also focuses on the important achievements of the market, research

& development, and regional growth of the leading competitors operating in

the market. The current trends of the global U.S. behavioral health in

conjunction with the geographical landscape of this vertical have also been

included in this report.

The report offers intricate dynamics about

different aspects of the global U.S. behavioral health market, which aids

companies operating in the market in making strategic development decisions.

The study also elaborates on significant changes that are highly anticipated to

configure growth of the global U.S. behavioral health during the forecast

period. It also includes a key indicator assessment that highlights growth

prospects of this market and estimates statistics related to growth of the

market in terms of value (US$ Mn) and volume (tons).

Sample Link @ https://www.precedenceresearch.com/sample/1320

This study covers a detailed segmentation of the global U.S. behavioral health market, along with key information and a competition outlook. The report mentions company profiles of players that are currently dominating the global U.S. behavioral health market, wherein various developments, expansions, and winning strategies practiced and implemented by leading players have been presented in detail.

Market Segmentation

- Home-Based Treatment Services

- Outpatient counseling

- Emergency mental health services

- Inpatient hospital treatment

- Intensive care management

By Disorder

- Bipolar Disorder

- Anxiety Disorder

- Depression

- Post-Traumatic Stress Disorder

- Eating Disorder

- Substance Abuse Disorder

- Others

By End User

- Outpatient Clinics

- Hospitals

- Rehabilitation Centers

- Homecare Setting

Research Methodology

The research methodology adopted by

analysts for compiling the global U.S. behavioral health report is based on

detailed primary as well as secondary research. With the help of in-depth

insights of the market-affiliated information that is obtained and legitimated

by market-admissible resources, analysts have offered riveting observations and

authentic forecasts for the global market.

During the primary research phase, analysts

interviewed market stakeholders, investors, brand managers, vice presidents,

and sales and marketing managers. Based on data obtained through interviews of

genuine resources, analysts have emphasized the changing scenario of the global

market.

For secondary research, analysts

scrutinized numerous annual report publications, white papers, market

association publications, and company websites to obtain the necessary understanding

of the global U.S. behavioral health market.

TABLE OF CONTENT

Chapter 1 Introduction

1.1 Research Objective

1.2 Scope of the Study

Chapter 2 Research Methodology

2.1 Research Process

2.2 Market Research Process

2.3 Market Research Approach

2.4 Data Sources

2.5 Assumptions & Limitations

Chapter 3 Executive Summary

3.1 US behavioral health market snapshot

Chapter 4 Market Variables and Scope

4.1 Introduction of behavioral health

4.2 Classification and Scope

Chapter 5 COVID-19 Impact on US Behavioral Health Market

5.1 COVID-19 Landscape: US behavioral health industry impact

5.2 Mental disorder and substance disorder prevalence during COVID-19 pandemic

5.2.1 Young adults

5.2.2 Adults experiencing job loss or income insecurity

5.2.3 Parents and children

5.2.4 Communities of color

5.2.5 Essential workers

5.3 Policy responses

5.4 Behavioral health outlook

Chapter 6 US Behavioral Health Market Dynamics & Trends

6.1 US behavioral health market dynamics

6.1.1 Market drivers

6.1.1.1 Rise of digital behavioral health to drive the market

6.1.1.1.1 Trends in digital behavioral health marketspace

6.1.2 Market restraint

6.1.2.1 Lack of coverage and inadequate reimbursement to restrain the market growth

6.1.3 Market opportunity

6.1.3.1 Payer-based strategy to provide opportunities for market growth

6.2 Reimbursement & regulatory scenario

6.2.1 Laws and regulations

6.2.1.1 SUPPORT Act

6.2.1.2 21st Century Cures

6.2.1.3 Comprehensive Addiction and Recovery Act (CARA)

6.2.1.4 Affordable Care Act (ACA)

6.2.1.5 Tribal Law and Order Act (TLOA)

6.2.1.6 Mental Health Parity and Addiction Equity Act

6.2.1.7 Americans with Disabilities Act (ADA)

6.2.1.8 Sober Truth on Preventing (STOP) Underage Drinking Act

6.2.1.9 Garrett Lee Smith Memorial Act

6.2.1.10 Children’s Health Act

6.2.1.11 Charitable Choice

6.2.1.12 Emergency Response

6.2.1.13 Protection and Advocacy for Individuals with Mental Illness Program

6.2.1.14 Synar Amendment and Tobacco Regulation for Substance Abuse Prevention and Treatment Block Grants

6.2.1.15 Federal Workplace Drug Testing

6.2.1.16 Opioid Drug Treatment

6.2.1.17 Patient Record Confidentiality

6.2.1.18 Other Federal Regulations Related to SAMHSA

6.2.2 Coverage

6.2.3 Reimbursement

6.2.3.1 TRICARE Inpatient Mental Health Per Diem Payment System

6.2.3.2 PHP rates

6.3 Role of telehealth in behavioral health

6.3.1 Background

6.3.2 Benefits

6.3.2.1 Provider experience

6.3.2.2 Client experience

6.3.2.3 Population health

6.3.2.4 Costs

6.3.2.5 Health equity and telehealth

6.3.3 Implementation of telehealth

6.3.4 Barriers to telehealth

6.3.5 Future of telehealth

6.3.6 Example of telehealth implementation

6.3.6.1 Eastern Shore Mobile Care Collaborative (ESMCC)

6.3.6.1.1 Client population

6.3.6.1.2 Forms of telehealth

6.3.6.1.3 Services offered through telehealth modalities

6.3.6.1.4 Findings and outcome

6.3.6.1.5 Lessons learned

6.3.6.2 Citywide Case Management Program

6.3.6.2.1 Client population

6.3.6.2.2 Forms of telehealth

6.3.6.2.3 Services offered through telehealth modalities

6.3.6.2.4 Findings and outcome

6.3.6.2.5 Lessons learned

6.4 Porter’s five forces analysis

Chapter 7 US Behavioral Health Market, By Services

7.1 US behavioral health market, by service, 2020 & 2027

7.1.1 US behavioral health pre-COVID-19 market size and estimations, by service, 2016-2027

7.1.2 US behavioral health post-COVID-19 market size and estimations, by service, 2021-2027

7.2 Home-based treatment services

7.3 Outpatient counseling

7.4 Emergency mental health services

7.5 Inpatient hospital treatment

7.6 Intensive care management

Chapter 8 US Behavioral Health Market, By Disorder

8.1 US behavioral health market, by disorder, 2020 & 2027

8.1.1 US behavioral health pre-COVID-19 market size and estimations, by disorder, 2016-2027

8.1.2 US behavioral health post-COVID-19 market size and estimations, by disorder, 2016-2027

8.2 Bipolar disorder

8.3 Anxiety & depression disorder

8.4 Post-traumatic stress disorder (PTSD)

8.5 Eating disorder

8.6 Substance abuse disorder

8.7 Other disorders

Chapter 9 US Behavioral Health Market, By End-user

9.1 US behavioral health market, by end-user, 2020 & 2027

9.1.1 US behavioral health pre-COVID-19 market size and estimations, by end-user, 2016-2027

9.1.2 US behavioral health post-COVID-19 market size and estimations, by end-user, 2016-2027

9.2 Outpatient clinics

9.3 Hospitals

9.4 Rehabilitation centers

9.5 Homecare settings

Chapter 10 US Behavioral Health Market, By Payer

10.1 US behavioral health market, by payer, 2020 & 2027

10.1.1 US behavioral health pre-COVID-19 market size and estimations, by payer, 2016-2027

10.1.2 US behavioral health post-COVID-19 market size and estimations, by payer, 2016-2027

10.2 Medicare & Medicaid

10.3 Self-pay

10.4 Private insurance & others

Chapter 11 Competitive Landscape

11.1 Company market share/positioning analysis, 2020

11.2 Strategies adopted by key players, 2019-2021 (YTD)

Chapter 12 Company Profiles

12.1 Acadia Healthcare

12.1.1 Company overview

12.1.2 Business outline

12.1.3 Services offered

12.1.4 Financial performance

12.1.5 Recent initiatives

12.2 Promises Behavioral Health (Elements Behavioral Health)

12.2.1 Company overview

12.2.2 Business outline

12.2.3 Services offered

12.2.4 Recent initiatives

12.3 Epic Health Services (Aveanna Healthcare)

12.3.1 Company overview

12.3.2 Business outline

12.3.3 Services offered

12.4 Universal Health Services

12.4.1 Company overview

12.4.2 Business outline

12.4.3 Product line

12.4.4 Financial performance

12.4.5 Recent initiatives

12.5 Behavioral Health Group, Inc.

12.5.1 Company overview

12.5.2 Business outline

12.5.3 Product line

12.5.4 Recent initiatives

12.6 IBH Population Health Solutions

12.6.1 Company overview

12.6.2 Business outline

12.6.3 Service offering

12.6.4 Recent initiatives

12.7 CuraLinc Healthcare

12.7.1 Company overview

12.7.2 Business outline

12.7.3 Service offering

12.8 North Range Behavioral Health

12.8.1 Company overview

12.8.2 Business outline

12.8.3 Services offered

12.8.4 Recent initiatives

12.9 Ardent Health Services

12.9.1 Company overview

12.9.2 Business outline

12.9.3 Services offered

12.9.4 Financial performance

12.9.5 Recent initiatives

12.10 CRC Health Group

12.10.1 Business outline

12.11 List of other companies

12.11.1 National mental health organizations

12.11.2 Behavioral health technology start-up companies

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1

774 402 6168

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com

0 Comments