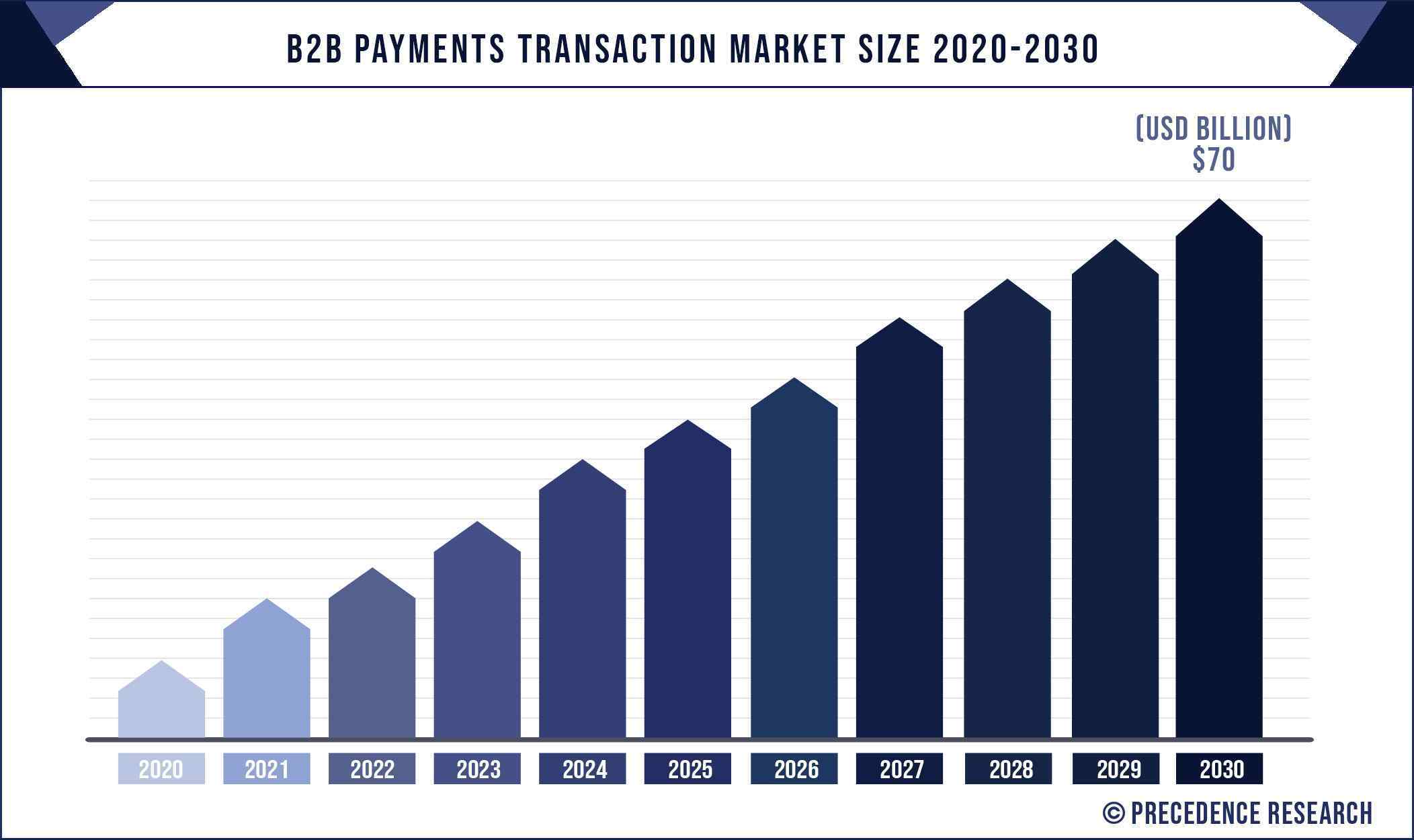

According to the research report, the global B2BPayments Transaction market size is expected to touch USD 70 Billion by 2030, from USD 868.02 Billion in 2020, growing with a significant CAGR of 10.7% from 2021 to 2030.

The B2B Payments Transaction report offers

a comprehensive study of the current state expected at the major drivers,

market strategies, and key vendors’ growth. The report presents energetic

visions to conclude and study the market size, market hopes, and competitive

surroundings. The research also focuses on the important achievements of the

market, research & development, and regional growth of the leading

competitors operating in the market. The current trends of the global B2B

Payments Transaction in conjunction with the geographical landscape of this

vertical have also been included in this report.

The report offers intricate dynamics about

different aspects of the global B2B Payments Transaction market, which aids

companies operating in the market in making strategic development decisions.

The study also elaborates on significant changes that are highly anticipated to

configure growth of the global B2B Payments Transaction during the forecast

period. It also includes a key indicator assessment that highlights growth

prospects of this market and estimates statistics related to growth of the

market in terms of value (US$ Mn) and volume (tons).

Sample

Link @ https://www.precedenceresearch.com/sample/1274

| Report Highlights | Details |

| Market Size | USD 70 Billion by 2030 |

| Growth Rate | CAGR of 10.7% from 2021 to 2030 |

| Base year | 2020 |

| Historic Data | 2017 to 2020 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Payment Type, Enterprise Size, Payment Mode, Industry Vertical |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, South America |

This study covers a detailed segmentation

of the global B2B Payments Transaction market, along with key information and a

competition outlook. The report mentions company profiles of players that are

currently dominating the global B2B Payments Transaction market, wherein

various developments, expansions, and winning strategies practiced and

implemented by leading players have been presented in detail.

Key Players

- American Express

- Bank of America Corporation

- Capital One

- Mastercard

- Citigroup Inc.

- TransferWise Ltd.

- Payoneer Inc.

- PayPal Holdings Inc.

- Square Inc.

- Visa Inc.

Market Segmentation

- Domestic Payments

- Cross-Border Payments

By Enterprise Size

- Large Enterprises

- Small and Medium Sized Enterprises

By Payment Mode

- Traditional

- Digital

By Industry Vertical

- BFSI

- Manufacturing

- Metals & Mining

- IT & Telecom

- Energy & Utilities

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Research Methodology

The research methodology adopted by

analysts for compiling the global B2B Payments Transaction report is based on

detailed primary as well as secondary research. With the help of in-depth

insights of the market-affiliated information that is obtained and legitimated

by market-admissible resources, analysts have offered riveting observations and

authentic forecasts for the global market.

During the primary research phase, analysts

interviewed market stakeholders, investors, brand managers, vice presidents,

and sales and marketing managers. Based on data obtained through interviews of

genuine resources, analysts have emphasized the changing scenario of the global

market.

For secondary research, analysts

scrutinized numerous annual report publications, white papers, market

association publications, and company websites to obtain the necessary

understanding of the global B2B Payments Transaction market.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global B2B Payments Transaction Market, By Payment

7.1. B2B Payments Transaction Market, by Payment Type, 2021-2030

7.1.1. Product Offering

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Cross-Border Payments

7.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global B2B Payments Transaction Market, By Enterprise Size

8.1. B2B Payments Transaction Market, by Enterprise Size, 2021-2030

8.1.1. Large Enterprises

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Small Enterprises

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Medium Enterprises

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global B2B Payments Transaction Market, By Payment Mode Type

9.1. B2B Payments Transaction Market, by Payment Mode Type, 2021-2030

9.1.1. Traditional

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Digital

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global B2B Payments Transaction Market, By Industry Vertical Type

10.1. B2B Payments Transaction Market, by Industry Vertical Type, 2021-2030

10.1.1. BFSI

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Manufacturing

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Metals & Mining

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. IT & Telecom

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Energy & Utilities

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global B2B Payments Transaction Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Payment (2017-2030)

11.1.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.1.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.1.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Payment (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.1.5.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Payment (2017-2030)

11.1.6.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.1.6.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.1.6.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Payment (2017-2030)

11.2.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.2.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.2.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Payment (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.2.5.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Payment (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.2.6.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Payment (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.2.7.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Payment (2017-2030)

11.2.8.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.2.8.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.2.8.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Payment (2017-2030)

11.3.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.3.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.3.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Payment (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.3.5.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Payment (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.3.6.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Payment (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.3.7.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Payment (2017-2030)

11.3.8.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.3.8.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.3.8.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Payment (2017-2030)

11.4.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.4.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.4.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Payment (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.4.5.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Payment (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.4.6.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Payment (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.4.7.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Payment (2017-2030)

11.4.8.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.4.8.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.4.8.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Payment (2017-2030)

11.5.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.5.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.5.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Payment (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.5.5.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Payment (2017-2030)

11.5.6.2. Market Revenue and Forecast, by Enterprise Size (2017-2030)

11.5.6.3. Market Revenue and Forecast, by Payment Mode Type (2017-2030)

11.5.6.4. Market Revenue and Forecast, by Industry Vertical Type (2017-2030)

Chapter 12. Company Profiles

12.1. American Express

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bank of America Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Capital One

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Mastercard

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Citigroup Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. TransferWise Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Payoneer Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. PayPal Holdings Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Square Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Visa Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1

774 402 6168

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com

0 Comments