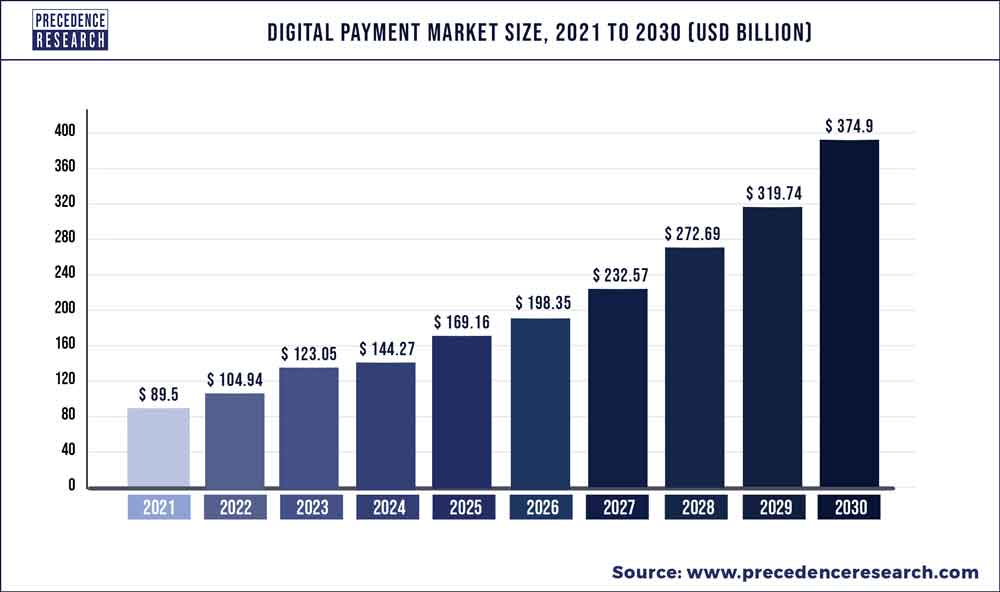

According to the research report, the global digitalpayment market size is expected to touch USD 374.9 Billion by 2030, from USD 89.5 Billion in 2021, growing with a significant CAGR of 17.25% from 2022 to 2030.

The digital payment market report offers a

comprehensive study of the current state expected at the major drivers, market

strategies, and key vendors’ growth. The report presents energetic visions to

conclude and study the market size, market hopes, and competitive surroundings.

The research also focuses on the important achievements of the market, research

& development, and regional growth of the leading competitors operating in

the market. The current trends of the global digital payment market in

conjunction with the geographical landscape of this vertical have also been

included in this report.

The report

offers intricate dynamics about different aspects of the global digital payment

market, which aids companies operating in the market in making strategic

development decisions. The study also elaborates on significant changes that

are highly anticipated to configure growth of the global digital payment market

during the forecast period. It also includes a key indicator assessment that

highlights growth prospects of this market and estimates statistics related to

growth of the market in terms of value (US$ Mn) and volume (tons).

Sample Link https://www.precedenceresearch.com/sample/2137

| Report Coverage | Details |

| Market Size in 2022 | USD 104.94 Billion |

| Market Size by 2030 | USD 374.9 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 17.25% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Component, Deployment Type, Organization Size, Industry Vertical, and Geography |

This study covers a detailed segmentation

of the global digital payment market, along with key information and a

competition outlook. The report mentions company profiles of players that are

currently dominating the global digital payment market, wherein various

developments, expansions, and winning strategies practiced and implemented by

leading players have been presented in detail.

Key Players

- PayPal

- Fiserv

- FIS

- Global Payments

- Mastercard

- Square

- ACI Worldwide

- JPMorgan Chase

- Apple Inc.

- 2Checkout now Verifone

- OpenWay Group

Market Segmentation

- Solutions

- Payment Gateway Solutions

- Payment Processing Solutions

- Payment Wallet Solutions

- Payment Security and Fraud Management Solutions

- Point of Sale (POS) Solutions

- Services

- Professional Services

- Consulting

- Implementation

- Support and Maintenance

- Managed Services

- Professional Services

By Deployment Type

- On-premises

- Cloud

By Organization Size

- Small and Medium-sized Enterprises

- Large Enterprises

By Industry Vertical

- BFSI

- Retail and Ecommerce

- Healthcare

- Travel and Hospitality

- Transportation and Logistics

- Media and Entertainment

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Research Methodology

The research methodology adopted by

analysts for compiling the global digital payment market report is based on

detailed primary as well as secondary research. With the help of in-depth

insights of the market-affiliated information that is obtained and legitimated

by market-admissible resources, analysts have offered riveting observations and

authentic forecasts for the global market.

During the primary research phase, analysts

interviewed market stakeholders, investors, brand managers, vice presidents,

and sales and marketing managers. Based on data obtained through interviews of

genuine resources, analysts have emphasized the changing scenario of the global

market.

For secondary research, analysts

scrutinized numerous annual report publications, white papers, market association

publications, and company websites to obtain the necessary understanding of the

global digital payment market.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Payment Market

5.1. COVID-19 Landscape: Digital Payment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Payment Market, By Component

8.1. Digital Payment Market, by Component, 2022-2030

8.1.1. Solutions

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Digital Payment Market, By Deployment Type

9.1. Digital Payment Market, by Deployment Type, 2022-2030

9.1.1. On-premises

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Digital Payment Market, By Organization Size

10.1. Digital Payment Market, by Organization Size, 2022-2030

10.1.1. Small and Medium-sized Enterprises

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Large Enterprises

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Digital Payment Market, By Industry Vertical

11.1. Digital Payment Market, by Industry Vertical, 2022-2030

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Retail and Ecommerce

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Healthcare

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Travel and Hospitality

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Transportation and Logistics

11.1.5.1. Market Revenue and Forecast (2017-2030)

11.1.5. Media and Entertainment

11.1.5.1. Market Revenue and Forecast (2017-2030)

11.1.5. Other

11.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Digital Payment Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.1.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.2.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.2.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.3.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.3.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.4.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.4.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.5.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.5.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Deployment Type (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Organization Size (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Industry Vertical (2017-2030)

Chapter 13. Company Profiles

13.1. PayPal

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Fiserv

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. FIS

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Global Payments

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Mastercard

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Square

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. ACI Worldwide

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. JPMorgan Chase

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Apple Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. 2Checkout now Verifone

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1

774 402 6168

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com

0 Comments